Actually we're not going to make it. We played very aggressive but on the short side and had our asses handed to us trying to get from $26,000 on Thanksgiving to $50,000 in 60 days. Did we learn a valuable lesson here? No – it was kind of fun and we didn't do too badly but we did come close to giving up our early gains (we had jumped to $29,957 in cash by Dec 16th and $30,737 on Jan 3rd) as we were forced to press our virtual bets against an ever-rising market.

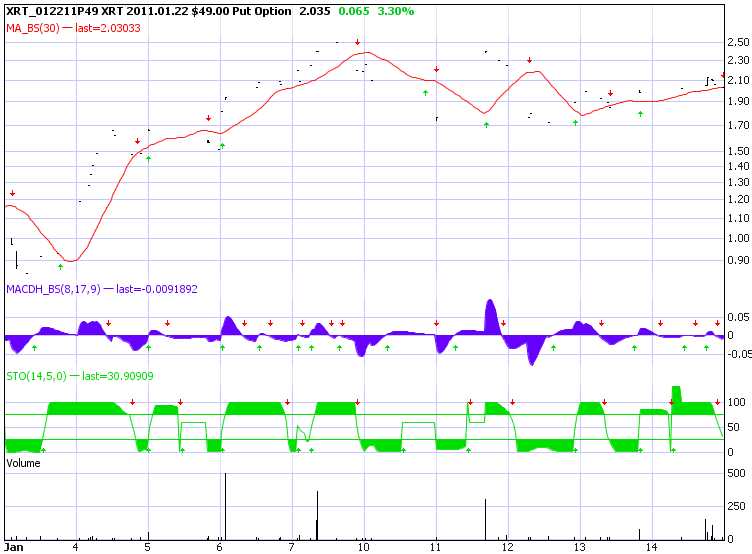

Back on the 3rd we had $30,737 in virtual cash against and unrealized loss of $4,810. All the moves since then (originally from daily Member Chat) are detailed under the main $1050P post in our Virtual Portfolio Tab but the short story is we killed the XRT Jan $46 puts even on the 4th and, that turned out to be a bit early as they flew all the way to $2.50 and, even now, are $2.03 but it doesn't pay to have regrets – but it does pay to review your actions to see if you could have timed things a bit better!

That's the purpose of tracking these virtual portfolios – hopefully, we learn something along the way. Keep in mind we were losing big time on the XRTs on the 3rd and the call in that morning's alert was to roll the 10 Jan $46 puts, which we had bought for $1 and were down to .30 so we rolled them to the $49 puts for .80 more and then Doubled down at $1 for an average entry of $1.40 when the puts were down to $1. Why do we do that? By rolling up to a higher position, we increase our delta so that the pullback, if it ever does come, gives us more bang for our buck. So spending .80 to roll up $3 in strike made a significant difference in the delta and put us in a position where we still could win at a net $1.80 entry. But the $49 put was only $1 and needed a huge move in XRT to get us even so, logically, doubling down at $1 and bringing the average entry on 20 down to $1.40 meant we had a far better chance of getting our .40 back.

I often say, this is both the pain and joy of fundamental trading. We KNEW from our PSW survey and from the retail reports we were seeing, that the sector was not going to live up to the hype. However, just because we KNOW something doesn't mean the rest of the World does and, as Lord Keynes famously said: "The markets can remain irrational longer than you can remain solvent." He knew this from experience – having lost a fortune in his own market speculations at one point.

As I commented on the 3rd in the Morning Alert, we were watching reports from SONC, FDO, RT and SRZ to get some idea of direction. Our foodies did OK but both FDO and SRZ were nightmares. Because we were behind and ran our commitment up from the original 5 Jan $44 puts at .80 ($400) to (through a series of rolls and doubles) 20 Jan $49 puts at $1.40 ($5,600), we were THRILLED just to get our money back (actually it was $1.50 for a $200 profit). The trade had gone very wrong from day one and once you get to an over-allotment on a position (20%) – you can no longer afford to take chances.

Running the position up to 20 Jan $49 puts at $1.40 put us up to $5,600 and that position was already down .40 ($1,600), which was a 5% loss on our $30K virtual portfolio. At most, we were willing to let it go to .65, which would have been a devastating 10% loss and HAD WE NOT BEEN WELL AHEAD AND PLAYING AGGRESSIVELY TO DOUBLE UP IN A SHORT TIME-FRAME – we never should have exceeded the max position loss of $1,000, which is 20% of a 20% ($5,000 of a $25,000 virtual portfolio) full position allocation. Make sure you read our Strategy Section as well as the lined article on scaling in and comments because that's what this exercise is all about!

Another very important thing I want to point out here is that we are now, 6 weeks later, at the EXACT spot on the S&P (1,293) that the channel we were tracking in the November 27th article predicted (see chart there). Also in that post, we discussed that our 3 most important Fibonacci levels are: 38.2%, 50% and 61.8% – 1,293 is that 61.8% line off the 2008-2009 consolidation at 800 and boy did they try to jam into that one on Friday!

The actual Fib number would be 1,294.40 (I'm not very good at adjusting the lines on charts but I am good at math!) and the high of the day on Friday was the S&P's close of 1,293.24 so the big, giant breakout for the S&P is going to be next week. We have stayed bearish in the 1050P because, with our very aggressive goal and short time-frame, we had a much better chance of doubling up on a pullback than we did of getting a gigantic rally but, as you may have noticed, a gigantic rally is just what we have gotten so far.

When the market goes against you, sticking with unhedged positions like these is kind of like surfing – we roll and adjust to try to stay on top of the wave that goes against us and we hope that it breaks before we wipe out so we can get a good ride down. We added $200 closing out the XRT's with a whopping .10 profit and that brought our virtual total up to $30,937 and we already knew the market was kicking our ass on the 3rd so our remaining moves were mainly about trying to get out from under $4,000 worth of unrealized losses from our remaining 3 positions.

We caught a big break on the USO Jan $41 puts on the 4th as well and got out of all 40 of those at $3, which was a nice .50 gain and that added $2,000 to our total ($32,937) and, more importantly, put cash back in the virtual portfolio which left us able to adjust our other positions. A big mistake people make in a virtual portfolio is not taking winners off the table as they try to "make up for" the losers. Notice that what we do here is try to turn each position into a winner, one by one, and we're happy to get back to cash around even on recovered positions – as that cash then lets us make adjustments on positions that "haven't won yet."

We caught a big break on the USO Jan $41 puts on the 4th as well and got out of all 40 of those at $3, which was a nice .50 gain and that added $2,000 to our total ($32,937) and, more importantly, put cash back in the virtual portfolio which left us able to adjust our other positions. A big mistake people make in a virtual portfolio is not taking winners off the table as they try to "make up for" the losers. Notice that what we do here is try to turn each position into a winner, one by one, and we're happy to get back to cash around even on recovered positions – as that cash then lets us make adjustments on positions that "haven't won yet."

This is a core tenant of the Strategy Option Sage and I advocate and you can read all about that in our Education Section or, if you want to brush up on your trading basics, Sage waives the $2,995 sign-up fee at Market Tamer for our Members and also gives a free two-week look at his $149/month training site. If you are a fast reader – that's a hell of a deal! .

On Wednesday, the 5th, at 12:57, my comment to Members was:

We’re unfortunately back to Monday’s highs, where we pressed those bets in the 1050P but the logic is the same – we are taking a last stand here and a lot happier about it now that we booked a profit on USO and got out even on XRT so we actually could even stand to press them some more now that USO isn’t weighing so heavily on us. At the moment – best to watch and wait to see what they can make stick. Certainly by Friday we’ll want to throw in the towel if things don’t improve (for us, not the market).

Oil/Mampcs – Yes, they must get those 310Mb worth of contracts out of Feb by expiration day (21st) so they have 12 sessions to dump 280Mb of oil into the longer contracts and Feb is already pretty full. Hopefully oil gets back to $92 and we can jump back in on USO puts. Dollar down to 80.35 so they may be able to pull it off.

On Thursday, our bearish premise was given some legs when reporting retailers had 14 misses against just 11 beats (leading to deep regrets on the XRT short!) on Friday we decided to risk the weekend but we didn't like the open on Monday (from a bearish perspective), the 10th and my comment from the 9:48 Alert to Members was:

I’ll be kind of surprised if we break down here. Volume is kind of low and we have easy note auctions (3 & 6 months) to celebrate today and no real new until tomorrow, which is mostly the already ignored Retail Weakness. So let’s expect 11,600 to hold along with S&P 1,260, Nas 2,675, NYSE 7,900 and RUT 775 but keep in mind that NYSE 7,935 and RUT 800 are goals for Breakout II so we continue to trend dangerously close to a 2nd (NYSE) and 3rd (Dow) red line on these little dips. When you begin to test the bottom of a range more often than the top – worry more about breaking down…

Still, it’s "Buy the F’ing Dips" until it doesn’t work anymore and AAPL is still fueling the Nasdaq all by itself and, at over 20% of the Nas, it can do that if it wants to. I like the DIA Jan $116 calls at $1.10 for an upside momentum play above Dow 11,600, with as stop below that line, maybe at $1.

The Dow never did go back below 11,600 and those calls are up 80% from the $1 entry we got at 10:15 but, unfortunately, I did not make that call officially one for the 1050P – it was just a general call to cover with the DIAs for the upside. At 10:15 we also called the bottom with a cover on the Mattress play by selling a full cover Jan $115.75 puts for $1.15 against the June $118 puts, which were $6.90 at the time. As of Friday, the June $118 puts have fallen to $5.50 while the short puts have dropped to .20. This allows us to roll up to the June $120 puts (a move I suggested on Friday) combined with the sale of the $117.75 puts at .95 to hold us over the weekend.

I'll just do a quick commercial here for balance. BALANCE IS GOOD! A couple of people have talked about losing money by being too bearish and, although we are 100% bearish in the 1050P, it's a hyper-aggressive virtual portfolio aimed at making a double in a very short period. That you can't do with balance but, even so – if we weren't playing with 200% profits from when it was $10K, even in a fun virtual portfolio I would not endorse this kind of activity!

In an actual virtual portfolio that is not just a "fun," gambling part of your account, VERY bearish should be 70% bearish and VERY bullish should be 70% bullish and otherwise, you should be 60% one way or the other. That way, even if you are VERY bearish and take and extreme loss, like the 20% loss on the June DIA puts and they were 70% of your virtual portfolio (14% loss), then the 80% gain on the long side on 24% of your virtual portfolio would make up for it (24% gain). Or, let's break this down to a $25,000 Virtual Portfolio example: Let's say that the DIA Mattress play was a double full position, taking up 40% of the virtual portfolio because we went to 20% and kept losing so we doubled down and ended up with the June $118/Jan $115.75 spread.

The net loss on that position was "just" .50 or about $1,000 on 20 spreads (an $11,500 allocation). Even if we had made only an initial entry on the DIA $116 calls at $1 to offset with a 20% of $5,000 allocation to offset our extremely bearish position – that $1,000 would have returned $800 and offset a good portion of the bullish positions losses. See, hedging is GOOD! That example is 90% bearish and it still beats the hell out of 100%, doesn't it? When we concentrate on selling premium, we make money if the market goes up, down or flat unless it goes way up or way down and, in those cases, if we are 60:40 or 40:60 – there is very little damage no matter what the market does and WE LIVE TO FIGHT ANOTHER DAY!

The net loss on that position was "just" .50 or about $1,000 on 20 spreads (an $11,500 allocation). Even if we had made only an initial entry on the DIA $116 calls at $1 to offset with a 20% of $5,000 allocation to offset our extremely bearish position – that $1,000 would have returned $800 and offset a good portion of the bullish positions losses. See, hedging is GOOD! That example is 90% bearish and it still beats the hell out of 100%, doesn't it? When we concentrate on selling premium, we make money if the market goes up, down or flat unless it goes way up or way down and, in those cases, if we are 60:40 or 40:60 – there is very little damage no matter what the market does and WE LIVE TO FIGHT ANOTHER DAY!

I don't know how many ways I can say this to people but making 10-20% every year for 20 years is much, much better than the outcome you would get even if you made 40% and lost 20% on alternating years. EVEN if you make 40% two years in a row (196%) and then lose 20% on the 3rd year (156.8%), you are blown out by a guy who makes 20% 3 years in a row (172%) and you are barely ahead of someone who makes 15% 3 years in a row (152%). Unless you are NEVER wrong – HEDGE!!! Even if you have NEVER been wrong – imagine that one day you might be and HEDGE!!!

Also, keep in mind we are talking about a year's performance but DURING the year, you are doing this to yourself trade by trade if your habit is "going for it" rather than following sensible strategies that are aimed at generating modest profits on a trade by trade basis. Our 2011 virtual portfolio will be a a good example of this as we try to turn $25,000 into $100,000 over the year. While that seems ambitious, we have taken $10,000 to over $30,000 in this virtual portfolio and this has been a really rough year!

Getting back to the current virtual portfolio: Tuesday the 11th we had the 20 DIA Feb $119 puts at net $5.30 ($10,600) and the 20 QID Jan $10 calls at net $1.30 ($2,600). I liked the USO Jan $39 puts at $1 again so we added 20 of those ($2,000) to the virtual portfolio in the Morning Alert. By 11:52 we took a DD at .80 for a .90 average ($3,600 for 40). We were aggressive on the oil shorts because I just could not see how "THEY" could hold the NYMEX up based on the barrel count we were tracking. My comment at 2:53 on Tuesday was:

Tomorrow we have inventories and maybe another pop up but then the sell-off should begin. They have already dropped Feb down to 226M barrels with 270M in March and 97M in April so the same 600M barrels being shuffled around but now stuffed to the gills in March. May is still 81M and it looks like June is swelling at 101M already. It is doubtful they want more than 26M in Cushing so 200Mb must get spread over those next 4 months. 8 sessions left, 200Mb to go = 25,000 contracts per session must die. Anything less than that is a problem so we’ll have to watch to see if they are on or off track this week.

Again we see the dangers of being a fundamental trader. We tend to stick to our guns while the technical guys are bailing and, if you ALSO trade technically, this can set up some very deep conflicts that make it very hard to ride out moves that go against you. In addition to that, you have idiots on TV telling you oil is going to $100 or China is increasing consumption or pirates have seized a tanker in Somalia or whatever the day's excuse is for the wriggles on the chart.

My fundamental note on the afternoon of the 11th on USO was: "Note for the 1050P. I just went over the NYMEX and I will be very surprised to lose on this one. Of course I have been very surprised before, especially with oil so it’s a matter of whether you want to risk it overnight. By doing that though, we’re pretty much committing to rolling up and out (to Feb) if it goes against us."

On Wednesday morning the market popped yet again and we decided to "go for it" by pressing our bets on the Dow, adding 20 more Feb $119 puts at $3.10 for a $4.20 average on 40 ($12,500), now tying up a good portion of the virtual portfolio. We wanted to get 1/2 back out even on those and all out for $1 on the QIDs but that never happened. The USO 40 Jan $39 puts at .90 were rolled for .62 up to the $40 puts, putting us in for net $1.52 on those ($6,080) and we were very lucky to get out Friday at $1.60 ($6,400) leaving us with $33,257 of virtual cash against (as of Wednesday) $14,300 of DIA and QID positions.

Unfortunately, we were over-committed on the Dow so we couldn't also overcommit to the USO puts when I picked them as a general selection on the morning of the 13th at $1.05. The only other changes we made for the week was buying time on our QID Jan $10s by spending another .15 to roll them to the Feb $10s and doubling down to 40 at an average $1.15 ($4,600) and, because we are now inflexible on both of those positions (as we're not going to DD to 80 of anything!) we covered with 40 short DIA Jan $117 puts sold at .95 to, as I said in the Morning Alert "hold us over the weekend." That gave us another $3,800 cash (and BALANCE!) to work with and, if next week begins like last week – I will not forget to include another upside play on the Dow in the 1050P!