This is fun, right?

This is fun, right?

We had a nice opportunity to buy the F'ing dip yesterday as well as an interesting opportunity to test the prudishness of the hundreds or web sites that syndicate my articles as I saw every possible variation of "F'ing" popping up in titles that were pinged back to me. Social mores aside the move was so well telegraphed that we were able to take a non-greedy exit on our QID position – leaving us, thankfully, with just the DIA shorts in our $10,000 Virtual Portfolio. That means, we are going to be able to start our brand new $25,000-$100,000 Virtual Portfolio right on schedule next week.

We began "Turning $10,000 into $50,000 by January 21st" on June 11th and we're not done yet but we're well over $30,000 – even looking at our wrong-way (so far) short bet on the Dow. We could have killed that one yesterday as well but, as today's title says – we just have to give the old Alpha 2 a chance to fully play out as we would just hate ourselves if we get get that 500-point drop in the Dow right after we bail on the shorts as that would be our $50K right there!

So up only 200% or so in 7 months is a failure but, to be fair, we did take a couple of months off as I didn't like the market enough in October and November and we already had $26,000 so it didn't seem worth risking 260% to make another 100%. In the final month, we decided to "go for it" but it was a messy way to make another 20% as our overall premise – that a drop was "right around the corner" simply did not pan out.

Frankly, looking back at the original 5 picks makes me want to cry as we could have just left those on the table and gone on vacation! They were:

- 10,000 YRCW at .21 (we doubled down at .11), now $3.76, up $35,500 (a Bazillion percent, I think but there was a reverse split…)

- 20 C Dec $3/4 bull call spreads at .62, closed at $1, up $760 (up 61%)

- 20 short C Dec $4 puts at $1.08, close at $0, up $2,160 (up 100%)

- 20 TASR Jan $5/7.50 bull call spreads for .35, now $0, down $700 (down 100%)

- 10 short TASR Jan $5 puts at $1.30, now .35, up $950 (up 73%)

- 10 BP Jan $30/34 bull call spreads at $2.20, now $4, up $1,800 (up 81%)

- 20 FAS Jan $21/29 bull call spreads at $1, now $8, up $14,000 (up 700%)

- 10 short XLF Jan $15 puts at $2, now $0, up $2,000 (up 100%)

So there's $56,470 in profits for a $66,470 total IF WE HAD JUST LEFT THE DAMNED THING ALONE! [Actually (8:30 update) I realize that the reverse split on YRCW means that it didn't go up that far on an adjusted basis – so maybe we didn't do all that badly compared to leaving it alone.] Oh well, we didn't leave it alone because when we make a lot of money early (as we did with YRCW) we take it off the table and then we hedge to protect our profits and some of our later plays were not as clever as our first set but $30,000 is nothing to be ashamed of, is it? Still, it's a very good lesson that we can take with us into the new virtual portfolio and I urge Members to go through the Virtual Portfolio tab and review all the moves we made over the past 6 months as the $25K Virtual Portfolio won't be much different at first as it's also a small virtual portfolio where we have to manage our small bets very carefully.

Aside from today being our target date to close these trades out, I mention the virtual portfolio this morning to remind our Members that we are NOT missing anything by waiting to be sure of the breakout. We waited for a nice dip and what we felt was a solid move up before initiating that $10KP and we had a rocky start as the market did take another 10% dip in late June but that was GOOD news as we hadn't over-committed and we doubled up on YRCW and pressed some other bets and by October we had $26,000 and decided we'd rather lock in those gains (the purpose of the virtual portfolio was to have a nicer Christmas than planned) than risk our gains right into holiday shopping season. Was our $10KP responsible for America's strong holiday shopping numbers???

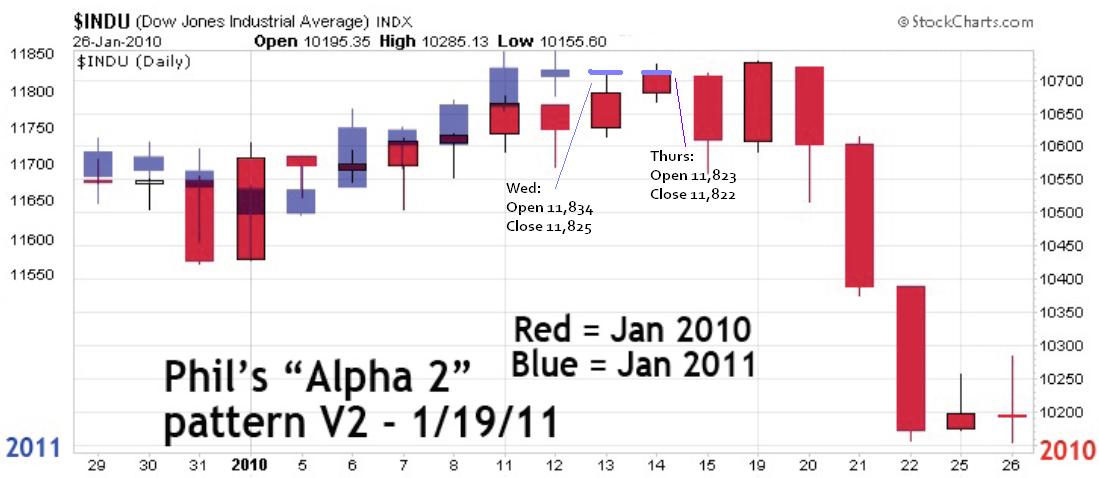

We intend to do better in 2011 than we did in 2010 and step one in hitting our $100,000 goal is BEING CAREFUL WITH OUR ENTRIES! As noted in last week's Stock World Weekly, we have been rolling along this month right in line with the TradeBot's Alpha 2 pattern that they ran last year and Elliot sent me an advanced copy of this week's newsletter where he cleaned up the chart to match out the expiration dates. I believe you will see why I still have a slight concern:

Spooky, isn't it? Don't forget, we identified this pattern on the 3rd and we targeted 11,850 on the Dow and 1,285 on the S&P as the adjusted tops of our ranges and, so far, Lloyd and da Boyz have been firing on all cylinders to paint a picture that is just as pretty as the one they painted last January, right into expiration day, when the VIX ran all the way down to 17.50 (from 30 in November) as complacency reached extreme levels. The tip-off at the time, that we were about to drop, was a sudden pop in the VIX on that Friday, back to 17.99, and by the next Tuesday we were back to 18.68 and, by Tuesday the 21st, panic was back in fashion and the VIX finished the day at 22.27 – on the way to 27 the next day. Now THAT's a sell-off!

Is it "different" this time? How much are you willing to bet on that? We're not betting much, we're cashing out the $10KP and we'll see what happens next week, confident that we KNOW that if the market goes down – we can make money and if the market goes up – we can make money but we can make so much more if we wait for the right opportunity before placing our bets.

Is it "different" this time? How much are you willing to bet on that? We're not betting much, we're cashing out the $10KP and we'll see what happens next week, confident that we KNOW that if the market goes down – we can make money and if the market goes up – we can make money but we can make so much more if we wait for the right opportunity before placing our bets.

As David Fry notes on his DIA chart, POMO does make this time different and it does seem like we are being hard-wired to buy those F'ing dips. That's OK, we can accept that if that's how we have to play it but please Lloyd, show us that you are willing to break the pattern first – then we'll be willing to step a little closer to the edge of the cliff. Forgive us, of course, if the idea of standing next to you at a cliff when we know that you might make a Dollar for pushing us over gives us the creeps – it's just that, well, we know you!

Speaking of people who are willing to sell their country out for a Dollar – GE had excellent earnings and I got my daily "WHUCK?!?" moment this morning when Obama named Jeff Immelt the head of his Economic Advisor Panel, replacing Paul Volker who quit when he realized this country is totally being controlled by Souless Corporate Interests who are embodied by none other than – Jeff Immelt.

Yes, it's the same Jeff Immelt who just signed a deal to transfer America's Avionics Technology to China's State-owned Commercial Aircraft Corp. of China who (and I mean who, not Hu, althogh it's easy to see how this is confusing) intends to go into direct competition with Boeing, who is not only a top US military supplier but our nation's largest manufacturing exporter BY A MILE – so much so that Durable Goods have to be measured ex-Aircraft to smooth out their shipping cycle.

Boeing sells $68Bn worth of airplanes per year and has over $300Bn worth of orders for the 787 backlogged. The company directly employs 157,000 employees, mainly in the USA and, as they build their planes here and tend to use American parts, they in turn employ roughly 1M more people, accounting for close to 10% of our nation's total manufacturing employees. As I mentioned when the deal first broke – the technology GE is turning over to China represents 100 years worth of advances in American avionics and, just because GE legally got their hands on the patent rights over the years – does not give them the right to put a bow around them and had them to Hu (not "who," this time I literally mean Hu).

There's a word for what GE is doing. It's right at the tip of my tongue. Oh yes, TREASON!!! Oran's Dictionary of the Law (1983) defines treason as "…[a]…citizen’s actions to help a foreign government overthrow, make war against, or seriously injure the [parent nation]." Well, the supreme court just decided that our Corporations are citizens and have the right to give politicians unlimited bribes contributions as they exercise their right to free speech. Why then do we not hold them to a citizen's standards when they clearly take actions that are against the best interests of the United States of America?

I wonder if a Paulson-like immunity from prosecution comes with Immelt's job as head of the President's Economic Counsel and I also wonder Hu benefits from having their main man firmly inserted at a desk in the White House? Surely the timing of the appointment to coincide with China's visit is not a coincidence. As an M&A consultant, I have seen this happen a million times – a company (or country, in this case) is having trouble paying it's bills and their balance sheet winds up in breech of loan covenants which prompts a visit from the President of the bank (in this case the PBOC) who wrangle some additional concessions and guarantees and, in extreme cases – the Bank asks that one of their boys be given a seat on the board so they can "keep tabs" on your progress.

That scenario is bad enough when your bank is just a bank but when you borrow money from a competitor and put yourself in that position, you may as well pack it in because you essentially just spilled blood in the shark tank. It's only a matter of time before all your thrashing around, trying to stay afloat, turns into a selachimorpha version of a piñata game.

Is this the beginning of a long and glorious partnership with our Chinese Masters or simply step 2 in the dismantling of America as Immelt Presides over the transfer of the rest of America's Intellectual Property to China so we can cut out the middle (class) man as our Global Corporations expedite their operational shifts more and more overseas. With only two years until the next election – there is the danger that the American people will wake up and demand action so, as happened during the final days of the Soviet empire – we can expect big moves like GE's partnership with China to come fast and furious over the next 24 months.

What are we doing about it? Well, as I told you yesterday, we're BUYING GE, as well as JPM and, if you can find any more loathsome Corporate bastards who have top-level access to the White House and a pocketful of Congressmen and Judges – we'll invest in them too because the first step towards working your way up the ladder in a Corporate Kleptocracy is to realize you are living in a Corporate Kleptocracy. Once you accept that – the rest is obvious…

So have a great weekend – the news doesn't matter – we'll just keep an eye on the Bots and continue to go with the flow, even if we have to hold our noses while we're riding it out.

Be careful out there,

– Phil