It is down but not yet out.

It is down but not yet out.

The once mighty US dollar flops around in the mid-70s like a fish out of water, gasping for it’s last breath. Like the Emilio, the goldfish (see link), it would be very easy for the powers that be to stomp the life out of it in its weakened condition but, if someone would be so kind as to pick it up and put it back into a bowl of water (or Global Liquidity, as the case may be), it might fully recover as soon as it catches its breath.

As noted by Gold and Oil Guy, Chris Vermeulen – "Most economists are discussing the possibility of a major decline in the value of the U.S. Dollar going forward as inflationary monetary policy begins to strangle growth. While that view point may prove right over the long haul, in the short run most traders are not likely expecting the U.S. Dollar to rally."

Chris also has some lovely charts indicating that the Gold sector may be presaging a rapid decline in the price of gold and another that points out that the Russell and the Transports are clearly rolling over – something that was discussed in last night’s Phistockworld Wrap-Up Show:

Indeed Bill Gross’s comments are well worth a read and let’s not forget Mr. Ron Paul, who we discussed yesterday morning, who added yesterday: "It is important to understand the Fed’s role in creating today’s unemployment crisis, while also highlighting that high unemployment and low economic growth can persist even in the face of tremendous monetary inflation." Wow, that was the topic of Monday’s special post – how timely we are getting! Robert Reich added to our conversation last night, saying:

Corporate earnings remain strong (better-than-expected reports from UPS and Pfizer fueled Tuesday’s rally). The Fed’s continuing slush pump of money into the financial system is also lifting the animal spirits of Wall Street. Traders like nothing more than speculating with almost-free money. And tumult in the Middle East is pushing more foreign money into the relatively safe and reliable American equities market.

It’s simply wonderful, especially if you’re among the richest 1 percent of Americans who own more than half of all the shares of stock traded on Wall Street. Hey, you might feel chipper even if you’re among the next richest 9 percent, who own 40 percent.

But most Americans own a tiny sliver of the stock market, even including stocks in their 401(k) plans.

What do most Americans own? To the extent they have any significant assets at all, it’s their homes.

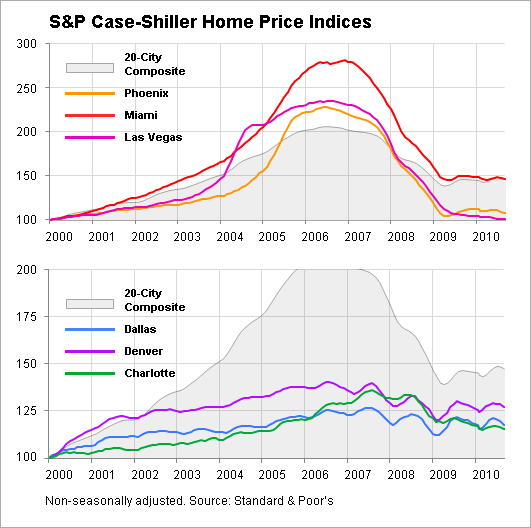

It’s year 4 of our housing downturn and home prices are still dropping. This is not at all surprising to those of us who are not in denial because we realize that homes are expensive, generally costing much more money than the average person can find under the sofa cushions. That means they have to save up if they want to buy one – even if you can demonstrate that it would save them money in the long-run (see "Interest Scams and How to Avoid Them – Mortgage Madness" for a reality check on that).

This is the part the top 1%, even the top 10% don’t get and why they think that housing will recover if the Fed just keeps giving money to banks. That is total crap! People (the ones who buy the homes) need to save up (back to Tuesday’s post now) two years of the average American’s income just to put a 20% deposit down on a new home.

This is the part the top 1%, even the top 10% don’t get and why they think that housing will recover if the Fed just keeps giving money to banks. That is total crap! People (the ones who buy the homes) need to save up (back to Tuesday’s post now) two years of the average American’s income just to put a 20% deposit down on a new home.

That’s without moving and furniture and painting and all those other little expenses that those of us who can afford them consider annoying, whereas, for the bottom 90% – they are insurmountable obstacles. The bottom 90% used to borrow deposit money from parents and other family members – now those people have no spare money either.

If anything, the banks have tightened their lending requirements and the MSM has blamed the victims of the sub-prime scam for not being smarter than Mortgage Professionals and Bankers and seeing through the contracts they were advised to accept (by people they paid professional fees to). That has taken the option of giving the working poor the ability to purchases housing with little or no deposits off the table – EVEN if the mortgage and taxes are cheaper than their current rents.

Why? Why would we do such a thing? Because the Banksters are not done stealing the homes yet. There’s a reason that cash is required at foreclosure auctions and that there is no way a poor person could get a bank to give them a blank check to go house shopping with: The game is designed to block them out. Only rich people with money can buy cheap houses, silly. What do you think this is, Russia? China? We’re Capitalists here – and that means NO POOR PEOPLE ALLOWED, right?

| The Colbert Report | Mon – Thurs 11:30pm / 10:30c | |||

| The Word – Swift Payment | ||||

|

||||

Unfortunately, we need those poor people to BUYBUYBUY the crap we sell them. Again, the problem the investing class has understanding this is that we are too far removed from the poor. And by poor, I don’t mean your maid or the guy who rakes your leaves, I mean the 50% of the working people in this country who earn less than the median $26,500 a year. Jim Cramer says they will be buying houses, Jim Cramer says they will be subscribing to NetFlix and shopping on Amazon.com with their high-speed web browsers, perhaps on their new 3-D TVs… They will eat out at Chipolte and, of course, they will BUYBUYBUY food and gasoline no matter how expensive it gets.

Does that make sense to you or, is it just remotely possible, that 50% of the people in the United States of America can’t possibly afford to live in Bullish Projection America and that the growth that is priced into the markets is, perhaps, overly optimistic? Our friend, Whitney Tilson, has finally capitulated and once again we’re feeling very lonely on the bear side of this market. I have long said I will feel comfortable being bullish long-term once we get past April without a collapse as, by then, inflation will have taken hold and we can be as aggressive as we like with little fear of a pullback.

Does that make sense to you or, is it just remotely possible, that 50% of the people in the United States of America can’t possibly afford to live in Bullish Projection America and that the growth that is priced into the markets is, perhaps, overly optimistic? Our friend, Whitney Tilson, has finally capitulated and once again we’re feeling very lonely on the bear side of this market. I have long said I will feel comfortable being bullish long-term once we get past April without a collapse as, by then, inflation will have taken hold and we can be as aggressive as we like with little fear of a pullback.

Perhaps that will make us slow to join the party but I’d rather be late than wrong because late means we can catch up, while wrong means we’re down considerably and writing books with sad little titles like "Getting Back to Even." I don’t mean to pick on Cramer but it’s amazing how many people I meet begin their questions with "Cramer says.." so he sort of embodies the mentality that led us to disaster in the last cycle and, as indicated in this chart from last year – here we are again, right at the top or the overheating commodity cycle that is driving inflation rapidly higher.

I guess we can ignore it.

But not today.