Courtesy of Jr. Deputy Accountant

Are Wisconsin protests a harbinger of doom for muni bonds? John Carney seems to think so.

While muni bond holders in Wisconsin shouldn’t have much to worry about in the weeks and months ahead, there are greater fools out there (like California debt-holders) who should be sweating right about now.

Martin J. Bennett argues via California Progess Report that California public employees aren’t the problem:

According to the California Budget Project (CBP), [California has] the second lowest ratio of state workers per 10,000 residents in the nation. In addition, more than 70,000 public sector jobs have been eliminated in California since the crash of 2008, and public sector job loss is proportionately greater in California than in most other states.

Does the CBP calculate that number counting California’s 2.5 million illegal immigrants or whatever official number it is we’re using today? (It’s supposed to be somewhere around 7% of California’s entire population) Perhaps a large reason why illegal immigrants are not demonized in the state is because it can be really convenient to add them in to prove our statistical points, especially when defending not only the large number of public employees in California but the large lifetime benefits they reap for being such.

Anyway, how many there are doesn’t matter. It comes down to the political choices lawmakers in broke states will make when it comes to paying the bills and keeping their promises. What’s scarier, an angry mob of teachers or a bunch of hedge fund guys ticked off at you?

But a victory by the unions in Wisconsin could embolden state workers in states with far worse finances. Politicians worried about similar revolts might consider it better politics to force muni bond holders to accept haircuts. After all, hedge fund and mutual fund managers are not likely to fill the streets of the state capital or win the sympathy of members of the state legislatures.

Much of the bullish case for munis depends on the belief that states and localities will behave rationally and predictably when it comes to their debt payments. In Wisconsin, however, we’re seeing these assumptions fall apart. Political risk is alive and well.

Better politics? I doubt politicians have the ability to adopt a fuck or be fuckedposition when it comes to staying a step ahead of Wall Street financial engineers who are banking on their failure.

See also WSJ, January 14, 2011:

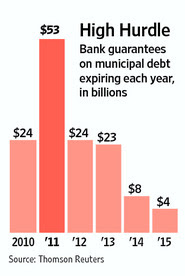

The rollover rush stems from the credit crisis that roiled the U.S. in 2008. Municipalities had issued so-called auction-rate securities, instruments whose rates reset at weekly auctions. Amid the credit crunch, buyers at these auctions vanished.

Many municipalities scrambled to convert the debt into other instruments, including variable-rate demand obligations, which are long-term bonds with interest rates that reset periodically. For a fee, big banks guaranteed many of these deals.

These so-called letters of credit from banks typically only last two or three years, leaving municipalities to refinance the deals or obtain a new guarantee. The issuers expected to easily renew the letters of credit.

But many of these letters of credit have become much more expensive and scarce, state officials say, leaving them with little choice but to try to refinance at a time when the broader muni market is under pressure.

How many times do we have to go over this before we admit that politics can no longer fix this mess and must be removed for us to get anywhere?

Or let’s go back to kindergarten and make this simpler. Remember when some kid in your class came to school with lice and the school nurse would end up sending you home with a letter that your parents had to search through your head for the nasty little bugs? And if they found them, your head would be soaked in chemicals, your sheets and blankets boiled in the laundry and your stuffed animals and toys wrapped up in trash bags and tossed.

The infestation is rampant. You with me?

And why is no one pointing out that unions are supposed to be for the people against the corporation, not for the people against the people.

As Sic Ibid said via WC Varones in June 2010:

Now, a regular union’s purpose is to protect its members from the ownership of the company they work for. That’s fine and dandy. But let’s ask ourselves; who are the Public Employee Unions protecting their members from? Who "owns" the U.S. government (all obvious jokes aside here)? The citizens of America, is the answer! Public Employee Unions are protecting their members from the citizens, from us! So every time the Public Employee Unions demand fulfillment of unreasonable pension promises despite a state being tens of billions of dollars in debt, they are acting in a way that is totally contrary to the interest of the people, who in theory, own and run their government and are supposed to be able to make their own laws (via our representatives).

See you on the breadline, comrades.