Wheeeee – this is fun!

It's always fun when the market does what you predict it's going to do. Last Wednesday I said we were going to see a pattern in the indexes that was going to look like the "M" in the McDonald's arches and Stock World Weekly did a nice job of illustrating it this weekend, which I put up in yesterday's post as well. At no point did we change our mind but we did change direction as we bounced around within a fairly tight intra-day trading range but our macro picture remains intact and now those patterns are looking very obvious on the charts.

In last Thursday's post, I had mentioned: "those Ms are going to look dangerously sloppy (more bearish) if they can’t at least round out the top today" and that's where we are now, with sloppy M's that may not even hold our reference levels, which were our old breakout levels that we had hoped would support the broader rally.

Of course we didn't have much adjusting to do (which is why we're just having fun with day trades) while we wait for the pattern to complete because it was the Wednesday before that, on May 4th, when I called the bottom on the Dollar and, therefore , a top on the market.

Right in the main post (which is Emailed to Report-level Members and above at 8:30 every weekday) I suggested the TZA June $37/42 bull call spread at $1. This one is going very well as TZA is already at $36.65 and the spread is at $1.35, up 35% in 2 weeks – now THAT's a hedge! Our offset to that was to sell the weekly RUT $825 puts at $1.15 and they did, as expected, expire worthless that Friday which made the whole trade a free ride with a .15 credit and up 1,000% so far. Notice how that's a great cover because if the RUT went up, for sure we keep the $1.15 and we have a free hedge but if it went down but held our levels (it did) we still get a free hedge and, if it went down and exceeded our expected range, then we have $5 coming to us from the spread to help pay for a roll.

Other hedges we took that day in Member chat were GLD Aug $135 puts at $1.45, those are just $1.65 so far (up 14%) so still playable. It's too late for the SQQQ June $22/25 bull call spread, which we picked up at $1.15 but those are already 100% in the money at $1.80, up 56% but those were offset with WFR May $11 puts at .45 (now .30) or the PFE May $21 puts at .75 (now .20) to lower the basis. SQQQ was also a straight play with the May $23 calls at .80 on the 6th, now $2.30 – up 187% in 11 days. Hedging is easy, picking long-term upside winners is the tricky part!

Our other go-to hedge is EDZ, as we felt the commodity sell-off would hit the overbought emerging markets. Just last Thursday, we were still adding EDZ hedges, with the July $16/20 bull call spread at $1.60, now $2.20 (up 25%) but offset with the sale of PCLN May $545 calls at $1.60, now .20, for a net spread of .20 that's up 1,100%. On 5/6 our cover had been similar, with the June $17/20 bull call spread at $1.15, selling the PBR Jan $25 puts for .90, which are still .90 but the spread is $1.56, up 35% so far but EDZ is at $19.43 so it's $2.43 in the money and time is on our side.

Our other go-to hedge is EDZ, as we felt the commodity sell-off would hit the overbought emerging markets. Just last Thursday, we were still adding EDZ hedges, with the July $16/20 bull call spread at $1.60, now $2.20 (up 25%) but offset with the sale of PCLN May $545 calls at $1.60, now .20, for a net spread of .20 that's up 1,100%. On 5/6 our cover had been similar, with the June $17/20 bull call spread at $1.15, selling the PBR Jan $25 puts for .90, which are still .90 but the spread is $1.56, up 35% so far but EDZ is at $19.43 so it's $2.43 in the money and time is on our side.

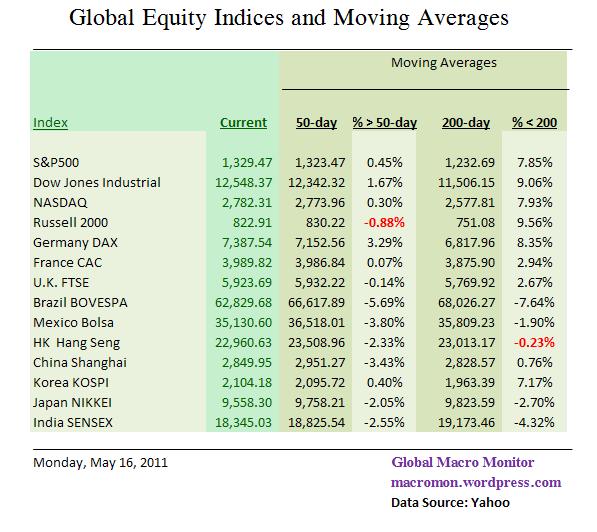

The question for today is whether or not time in on the side of global equities, which are generally failing their 50-day moving averages with the Hang Seng now joining Brazil's Bovespa, Mexico's Bolsa, India's Sensex (go EDZ!) and Japan's Nikkei as golbal indexes that have now failed their 200-day moving averages (chart by MacroMan).

"You can't ignore the World," my Grandfather used to say, "It's right below your feet." That was probably the best investment advice I ever got as my Grandpa Max would make me read the papers (more than one because you can't trust one to be right) with him every morning before we even looked at the financial pages.

To this day it amazes me how little attention American investors pay to the Global Macros but God bless CNBC and the rest of the MSM that keeps herding the sheeple back and forth into poor investments shouting "USA, USA, USA" as a substitute for proper analysis. It gives those of us in the thinking crowd a huge advantage!

Of course what happens in the US matters a lot to us but it's a Big World out there and we ignore it at our peril. Unfortunately, our own Fed and Congress seem to be ignoring as they debase the currency and act like fiscally irresponsible children, playing chicken with the debt ceiling. Our biggest loser lately has been TBT, which keeps going down instead of up but, at some point, the Fed and Treasury's Ponzi scheme will end and it will end badly. At the moment, the Fed is buying about 80% of the Treasury notes that are issued – do you really think they will stop in June and someone else will fill their place at these prices?

At the moment, the betting is that the Fed won't/can't stop and that plus the relative strength of the Dollar is keeping rates ridiculously low. TBT may end up being a dead bet – it sure was for people who thought Japan's rates would head higher at some point over the past two decades but, for now, we still like it. This dip is a fine time to take advantage of short puts like the TBT Jan $32 puts, that can be sold for $2.50 and, on the long side, I like the 2013 $30/40 bull call spread at $4.50 for net $2 on the $10 spread. That's a nice hedge against proper inflation.

I already made a call for Members this morning at 6:57 that I didn't think the pre-market rally would stick and now it's 8:40 and we're turning red. We took a short on oil at $97.50 and it's already down to $96.60 so congrats to the futures players (again) as this has been, by far, our favorite slot machine! The Dollar was 75.60 at the time, now 75.85 (up 0.2%) and that neatly erased the 0.25% pre-market pump but the Dollar will probably re-test 76 and breaking over that will not be good at all for our equity indices (or commodities).

I already made a call for Members this morning at 6:57 that I didn't think the pre-market rally would stick and now it's 8:40 and we're turning red. We took a short on oil at $97.50 and it's already down to $96.60 so congrats to the futures players (again) as this has been, by far, our favorite slot machine! The Dollar was 75.60 at the time, now 75.85 (up 0.2%) and that neatly erased the 0.25% pre-market pump but the Dollar will probably re-test 76 and breaking over that will not be good at all for our equity indices (or commodities).

Boosting the Dollar today are concerns that Greece may, indeed, need to be restructured. You may be thinking "duh" because you read us every day but this is taking most investors totally by surprise and the Euro has fallen 1% since yesterday as has the Pound – only the relative strength of the Yen (which EU investors also panic to) is keeping the Dollar from breaking over that 76 line. Bill Gross flat out called Greece, not only insolvent, but at the end of the road with no more room left to kick the can further along.

China is certainly no escape route as JP Morgan now says "Chinese economic data suggests that the risk of a “hard landing” in the world’s second-largest economy is rising." Keep in mind that in 2007 and 2008 we were constantly being told that we were going to have a "soft landing" and we know how that worked out so the fact that JPM is already calling it a hard landing should really give you pause if you have money inside the China Bubble.

Gold isn't going to help you according to George Soros, who dumped his holdings of GLD last quarter, getting rid of 4.7M shares of GLD while the MSM herded the sheeple the other way and Soros is now reported to have dumped all 5M shares held by his fund. Dennis Gartman says the "smartest people" are getting out of commodities – I don't know if being a bit early with that call makes us smarter or dumber but it sure is fun for us to have our cash on the sidelines and able to short the commodities while all the slower "smart people" are scrambling to get out (see our "Roach Motel Theory" to explain how commodity players get trapped in their positions).

Even typical safety plays are not working as insurance companies just coming off the devastating Japan quake are now being hit with $6Bn worth of tornado losses in the South from last month and are looking at much more than that in flood damage as the mighty Mississippi overflows this week. Not to start a controversy but this is the cost of NOT dealing with global warming but it's the insurance companies that are idiots because they should be out there supporting the green side of the argument, rather than letting the polluters control all the lobbyists while the environment spins out of control. Oh well, with any luck the Earth will end as scheduled on Saturday and then the Koch brothers will get to say "I told you so."

We're still operating under the premise that Judgment Day will not be on Saturday or, if it is, that it won't have any major bearing on our current virtual portfolios. If the World does end on Saturday, it will be a nice break for HPQ, who warned yesterday that their managers should "brace yourselves for "another tough quarter." The word "another" in the leaked memo forced HPQ to move earnings up to this morning and, as inferred, earnings were not so good and HPQ is down over 5% in pre-market trading.

Two other things not worth investing in, from yesterday's news, are A) A college education – with a Pew survey finding 57% say the U.S. higher education system fails to provide students with good value for the money, and an even larger majority (75%) says college is too expensive for most Americans to afford and B) New Homes – which James Altucher blasts in: "Why I would rather shoot myself in the head than own a home," saying, for starters: "Leveraging up 400% in an illiquid investment with no diversification is a scary concept to me and should be to any rational person." That is some solid investment advice. Also read my article on the subject: "Interest Scams and How to Avoid Them – Mortgage Madness" which, if you MUST buy a home, at least shows you how to knock $100,000 off your mortgage payments.

Hopefully we do hold our reference levels on the dips. Obviously the NYSE and the RUT will be first to test but, if they break below those lines, the others are likely to follow. There's certainly no improvement in the data and we did not expect good data this week as a lot of it relates to housing which, to use the proper economic term – SUCKS!

- U.K. inflation jumps to 4.5%, up from 4% in March and above the 4.2% consensus.

- Germany's ZEW expectations index falls to 3.1 in May, vs. 7.6 in April and the historical average of 26.5.

- State Bank of India after the country's largest lender reports a 99% fall in Q4 profit.

- ICSC Retail Store Sales: -2% W/W, vs. flat last week.

- Redbook Chain Store Sales: -2.3% Y/Y vs. +4.7% last week.

- April Housing Starts: -10% to 523K vs. 585K last month (revised from 549K). Permits -4% to 551K vs. 574K (revised from 594K) last month.

- April Industrial Production: 0% vs. +0.7% (revised from +0.8%) in March. Capacity utilization 76.9% vs. 77% (revised from 77.4%) in March.

- China faces maybe its worst-ever power shortages as drought conditions hurt hydropower generation at the same time booming coal prices threaten power plant supply. Unable to raise prices to meet higher costs, power plants are trying to cut losses by operating at a lower capacity level.

- Apple (AAPL) continues to face serious iPad production problems, FBR's Craig Berger writes, likely rendering the company's internal goal of producing 40-45M iPads this year "out of reach."

We're very well positioned for this dip so let's just sit back and relax and see what sticks. Bad news aside, our plan was to complete our M pattern, consolidate into expirations on Friday and then hopefully move back up but, as I said above, the sloppy M's are a concern and if we can't hold those bases – there's another 5% down before we test any serious support!