Greater Fool theory being tested again…..Courtesy of Mish

Proving that extreme sentiment can always get more extreme, inquiring minds are focused on the LinkedIn IPO that soared from $45 to as high as $122.70 in a single day.

Please consider LinkedIn stock soars in IPO

LinkedIn’s stock (LNKD +126.40%) soared more than 140% to $108.25, valuing the company at roughly $10 billion, as the professional-networking site began trading on the New York Stock Exchange.

Propelled by robust demand leading up to its initial public offering, LinkedIn’s IPO priced at $45 a share, at the top end of a recently raised range of $42 to $45 a share. Previously, the IPO pricing range had been $32 to $35.

The Mountain View, Calif.–based company is seen as the first in what could be a wave of social-networking IPOs, which could soon include Facebook and Groupon

LinkedIn announced in March that it reached 100 million members, with more than half of its members based outside the United States. The company said it was seeing its fastest growth in Brazil, Mexico, India and France.

100 Million Members – OK – What about Income?

LinkedIn boasts 100 million members. I am one of them. But what is a member worth? More importantly what kind of income does LinkedIn have, and what will the growth in income be?

Reality Lenses takes up that question in IPO Mania — LinkedIn up 100% in 2 hours

So now, the market cap is in the $9-10 billion while company generated $9 million last year, and is hoping to generate $15 million this year. This means we have a price earnings ratio of about 950 and a forward PER of 650? Is my calculation completely wrong? Or are we back in the twilight zone?

Based on revenues Henry Blodget says Sorry, LinkedIn’s IPO Is NOT Proof Of A New Tech Bubble

LinkedIn is an established company. It generated nearly $250 million of revenue last year, and it should do more than $400 million this year. It has three strong revenue streams: consumer premium subscriptions, corporate recruiting subscriptions, and advertising. It earns money. And it has a huge growth opportunity. These reasons and others are why many institutional investors are lining up to buy the stock.

That’s about 10-times this year’s projected revenue.

Is 10-times revenue a high multiple? Sure it’s a high multiple. But it’s also a multiple that, depending on LinkedIn’s growth over the next couple of years, could be well-deserved.

Is This a Bubble?

In a video in the above link, Blodget went on to say "LinkedIn is a profession product. You do not go there because your friends and family are there?"

OK, it’s a profession product. What are the earnings? What are the expected earnings? Will the expected earnings pan out?

Betting on Social Networking

A Seeking Alpha Post by Albert Babayev in January 2011 called Betting on Social Networking discusses revenue and earnings.

Facebook, at the latest valuation of $50 billion, is valued at 25x its 2010 revenue and almost 105x earnings (Apple (AAPL) is 22x earnings). To get to the same earnings multiple as Apple, Facebook would have to quadruple its revenues and increase profits by 500%.

The current model values LinkedIn at 11x current revenue and 56x earnings. Such betting on growth would most likely require Facebook and LinkedIn to introduce additional and unproven layers of paid content to its users.

Currently, investors on SecondMarket.com have an Ask price on the LinkedIn stock at $25/share, or $2.625 billion, which would create a 16% increase in a 6 month period. As LinkedIn continues to introduce new premium channels, my forward estimated price target for LinkedIn is $27.50, which is a 28% increase over its current price.

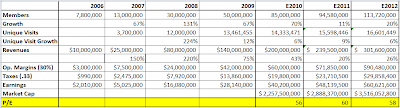

LinkedIn Table of Earnings, Subscribers, Revenue

click on table to expand

The above table with thanks to Albert Babayev.

Assuming the earning’s estimate is accurate we can calculate a PE ratio by dividing $10 billion by $48.139 million. I calculate not 950 but 208.

Regardless looking at expected growth that may not happen, I would call this a bubble. That does not constitute a tech bubble but it sure looks like a bubble in the price of LinkedIn.

Buying LinkedIn at $122 is a bet on the Greater Fool Theory, nothing more, nothing less.