Just 24 hours before the World is scheduled to end and here we are?

I don't want to make fun of religion but I do think it's a little funny to see so many people taking this May 21st thing seriously. Oct 28th, 1992 was one scheduled date, then 1993 and 1994 but then people gave up until now as far as I know but Harold Camping has made enough of a media campaign with his May 21st prediction that my kids (9 &11) are talking about it in school and two different people who interviewed me yesterday asked me what I thought about it.

Come on people, even if the Rapture comes this weekend, there will still be Billions of sinners left on earth so LVS and WYNN should be a big buy and, of course, all the classic "sin" stocks like TAP, SAM, DEO, STZ, MO, PM, LO, BTI, PLA, RICK and KKD – lots of good things to invest in if we're still here on Monday. Of course, if nothing does happen tomorrow, then we have our own past sins to pay for and maybe it will be time to face up to them.

The World is awash in debt after 20 years of partying like it's 1999 and, of course, it's not just the debt but the unfunded obligations that have been taken on by most of the World Governments to take care of the aging baby boomers as they move out of their productive years and into retirement. This is not a complicated thing – we have known it was happening since the term "baby boomer" was first coined in the 1980s (in "Great Expectations: America and the Baby Boom Generation") and defined those of us who were born between 1946 and 1964 and 2011 is the first year of retirement for the first 5% of that group.

You can (and people have) construct all sorts of doomsday scenarios for what will happen to the US and other countries as our population ages. Dennis Gartman recently observed that "There are more Depends being sold in Japan than diapers" and, while this may seem like a simple witticism, consider the fact that Japanese automation firm Super Faiths has developed a series of recycling machines that turn adult diapers into fuel for biomass boilers and stoves. It's not a joke – it's a business opportunity! Production of adult diapers in Japan topped 5 billion units in 2009, up 7% from 2008 among the World's longest-lived people – given the boomer bell-curve in population plus the increased longevity of the Japanese people, we can expect that kind of growth to continue for a while.

You can (and people have) construct all sorts of doomsday scenarios for what will happen to the US and other countries as our population ages. Dennis Gartman recently observed that "There are more Depends being sold in Japan than diapers" and, while this may seem like a simple witticism, consider the fact that Japanese automation firm Super Faiths has developed a series of recycling machines that turn adult diapers into fuel for biomass boilers and stoves. It's not a joke – it's a business opportunity! Production of adult diapers in Japan topped 5 billion units in 2009, up 7% from 2008 among the World's longest-lived people – given the boomer bell-curve in population plus the increased longevity of the Japanese people, we can expect that kind of growth to continue for a while.

What may be funny in Japan will become serious in the US where we are "lucky" to rank 36th in life expectancy with men averaging 75.6 vs. 78 in Japan (Europe is around 77) BUT, even in the US, newborns have a life expectancy of 80.8 while a Japanese baby can expect to live to be 86.1 (due to that evil national medical care). When Social Security began in 1935, the average American only lived to be 59.12 – how's that for a scam? To be fair, a person who was 20 and made it past the dangers of childhood disease was expected to live to 66.02, so at least they would collect for a year and almost a week. By the end of the baby boom, in 1964, the average American was expected to live to be 67.94 with a 20-year old expected to make it to 70.25.

So, already in 1964, trouble was brewing with the SS actuarial tables and they did raise the rates to compensate for it. Unfortunately, in 2011, the first year the boomers are retiring, a newborn is now expected to live 75.6 years and a person who IS 65 has, in theory 15.9 years to go! In 1935, there were only 120M people in America, in 1965 there were 190M (15M per decade), 260M in 1990 (28M per decade) and 310M in 2010 (25M per decade) so our percentage of population growth is dropping off sharply as the bulk of our population moves towards retirement.

Unfortunately, the "lock box" of the Social Security trust fund was raided in the past decade to the point where Geithner announced last week that the system will exhaust all it's assets by 2036. Now a 65 year-old boomer today is expected to live 15.9 more years (sorry if you are 80 and reading this) and that's almost 2,027 so not too much to worry about if you are 65-70 now but, as we move through those boomers – this situation is NOT going to go away and if we are, in fact, all still here next week – we should probably start to address this problem. Keep in mind that this obligation, which we will fail on halfway through the Boomers retirement cycle, is not even included in our debt calculations.

Unfortunately, the "lock box" of the Social Security trust fund was raided in the past decade to the point where Geithner announced last week that the system will exhaust all it's assets by 2036. Now a 65 year-old boomer today is expected to live 15.9 more years (sorry if you are 80 and reading this) and that's almost 2,027 so not too much to worry about if you are 65-70 now but, as we move through those boomers – this situation is NOT going to go away and if we are, in fact, all still here next week – we should probably start to address this problem. Keep in mind that this obligation, which we will fail on halfway through the Boomers retirement cycle, is not even included in our debt calculations.

The reason Portugal, Ireland, Italy, Greece and Spain have a debt crisis is because they can't print their own money to cover their debts. The US, Japan and the EU can just keep writing checks that are backed by nothing more than the signature of that nation's central banker. In fact, I just went to look at what a Dollar bill does promise us in writing and it's NOTHING – just that "This note is legal tender for all debts, public and private." What the Hell does that mean?

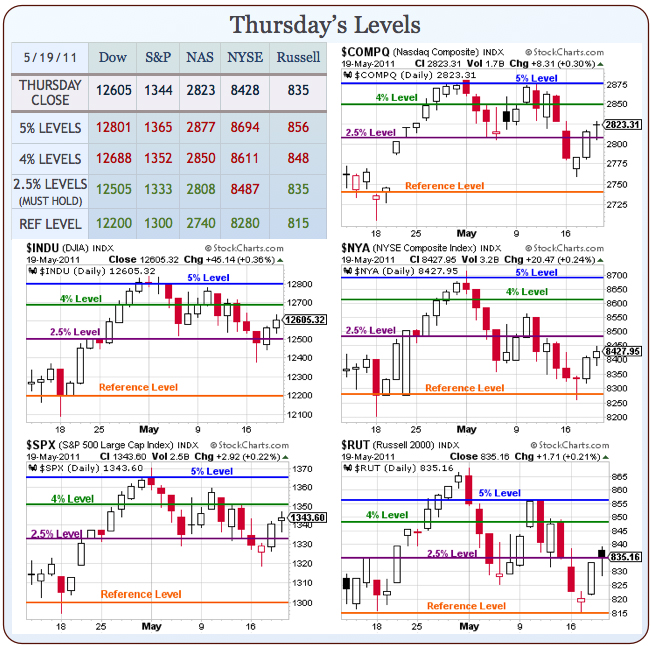

Oops, shouldn't say Hell what with judgement day tomorrow and all… Anyway, not too much going on, which is why I was rambling this morning. It's option expiration day and we expect to flat-line more or less along our 2.5% lines but we're still expecting the commodity bubble to burst and we're short on both gold ($1,500) and oil ($100 now, was $99 but we rolled). And waiting for that other shoe to drop. In this morning's Member chat they were foolish enough to run oil back to $100 – giving us another nice entry in our futures shorts.

It's all about which way we break now. $98.50 is our goal for oil but we can break that if the Dollar can get back over 75.75, which is the top of the narrow 0.50 range we've been watching. Clearly, our joke of a Government isn't likely to do anything right but Europe and Japan are so full of potential black swans that we are now on the lookout for a Frankenswan event – where multiple black swans get together and terrorize the global village!

Other than that, it will be business as usual in the markets as long as they can keep the dollar down and commodities up. That allows "them" to extend and pretend that everything is OK and, as I pointed out yesterday, that makes those of us in the top 10% happy as we are the speculator class so, if the markets are happy – we are happy because, contrary to what they tell poor people – money does, in fact, buy you a great deal of happiness…

Most likely we will be short(er) going into the weekend because the chance of things going horribly wrong are greater when the markets are closed. When the markets are open, the Bots can clean things up very nicely but, as I said, if they lose control of the Dollar – most likely through a failure in the Euro – then look out below. That 2.5% line on the Russell is key today at 835 – below that and bullishness is a fool's bet. 2,808 needs to hold on the Nasdaq too but Gap, Aeropostale and Ann Taylor all reported poor outlook (great for our XRT shorts) so all is not well in retail land.

Have a nice weekend (or at least a nice Friday night, after that – who know?),

– Phil