Gosh that was some impressive BS yesterday, wasn’t it?

Gosh that was some impressive BS yesterday, wasn’t it?

As David Fry said: "Most market veterans will tell you when markets rise on bad news that’s bullish. It’s hard to question this experience; but, Tuesday put this wisdom to the test. The news was just dreadful. The Greek situation is by no means resolved which is the slender reed bulls ascribed as a reason to rally. Frankly, all this Euro Zone troubles will continue to bob to the surface as troubles get only temporarily papered over.

What news there was featured awful Consumer Confidence data (60 vs 67 expected) which made the previous Michigan Consumer Sentiment data seemed as bogus as suggested here last week. On top of this was the double-dip in the Case-Shiller Home price data and a large drop in the Chicago PMI from 67.6 to 56.6 vs expectations on 63.

The good news from all this is just a repetition of the previous theme: “bad news is good, and good news is better”. This has dominated bullish thinking as they believe interest rates will remain low offering little competition for stocks. Naturally, another round of $7 billion in POMO Tuesday just threw gas on the fire."

So much was going right for the Nasdaq yesterday we just HAD to short it, going for the SQQQ July $24/25 bull call spread at .35 and selling the June $23 puts for .30 for net .05 on the $1 spread with a 1,900% upside if the ultra-ETF (short the Nasdaq) is over $25 at the July close. Other than that, we mostly stayed on the sidelines in shock and awe of the amazing display of bullish firepower against a background of some of the most bearish news we’ve hear all year.

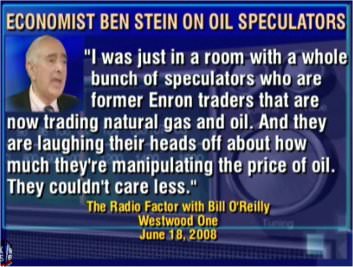

We did, of course follow through with our plan from last week, which was essentially: "If some idiot is stupid enough to pretend to want to buy oil at $103 for July delivery – we are happy to sell it to them." This comes from our fundamental concept that oil is in no way, shape or form WORTH $103 per barrel and that, even if it were, consumers can’t AFFORD $103 a barrel and, even if consumers were mindlessly throwing themselves another $2Bn a day in debt ($10Bn globally) without cutting back on fuel consumption – that the Dollar, which oil is PRICED in, is also undervalued and will correct up and kill the PRICE of oil at some point.

We did, of course follow through with our plan from last week, which was essentially: "If some idiot is stupid enough to pretend to want to buy oil at $103 for July delivery – we are happy to sell it to them." This comes from our fundamental concept that oil is in no way, shape or form WORTH $103 per barrel and that, even if it were, consumers can’t AFFORD $103 a barrel and, even if consumers were mindlessly throwing themselves another $2Bn a day in debt ($10Bn globally) without cutting back on fuel consumption – that the Dollar, which oil is PRICED in, is also undervalued and will correct up and kill the PRICE of oil at some point.

Even this morning, we got another chance to short oil at $103 and now (7am) they have crossed the $102.50 line so that’s a winner for the $103 crowd and a new entry opportunity for others on the $102.50 line on the futures if they cross below $102.50 again (nickel stops to keep risk low). This is not complicated guys – "THEY" are willing to fake a massive demand for oil but this game only works if nobody makes them pay.

When we short a barrel of oil on the futures, we MAKE THEM PAY for the barrels that they pretend they want. Right now, open interest on the NYMEX is 376,620 contracts for July delivery, which closes in three weeks on June 21st (contracts open that day must accept delivery during the month of July) and that’s 376 MILLION barrels of oil that "THEY" are currently pretending they want delivered at $103 a barrel within 2 months. That would be 40 days worth of US imports in a 30-day period all delivered to a terminal in Cushing, Oklahoma that has a 40M-barrel handling capacity for the month.

Usually, what these crooks do is to "roll" the contracts to the next month. In June they pretended to want 400M barrels but, by expiration day, all but 20M barrels worth of contracts (20,000) had been rolled or canceled. I had made a similar observation when I was interviewed in late April, as oil was $112.79 a barrel and there was "only" fake demand for 287M barrels and Goldman was fanning the flames with $200 oil calls. By May 6th those contracts fell to $94.77 and were still $95.35 on the 17th as traders desperately tried to unload their fake demand contracts into expiration.

Usually, what these crooks do is to "roll" the contracts to the next month. In June they pretended to want 400M barrels but, by expiration day, all but 20M barrels worth of contracts (20,000) had been rolled or canceled. I had made a similar observation when I was interviewed in late April, as oil was $112.79 a barrel and there was "only" fake demand for 287M barrels and Goldman was fanning the flames with $200 oil calls. By May 6th those contracts fell to $94.77 and were still $95.35 on the 17th as traders desperately tried to unload their fake demand contracts into expiration.

They got away with an easy roll in May and now they are getting brave again so I am going to point out that we can take them down again by offering to sell those 376M barrels of oil for $103 per barrel. You see, anyone can pretend to want 1,000 barrels of oil, the margin on the NYMEX futures is just $6,000 to control $103,000 worth of oil. By accepting the BS offers to buy 376M barrels of oil that is being made by speculative jackasses, we, the people can force the speculators to buy $39Bn worth of oil for July delivery because we won’t let them just cancel or roll – will we?

This would flood the US markets with oil for the entire summer and, more importantly, bankrupt many small speculators and, if we’re lucky, destroy one or two investment banks – simply by making them actually do what they pretend they want to do every month – which is buy 20 times more oil than anyone really wants.

This would flood the US markets with oil for the entire summer and, more importantly, bankrupt many small speculators and, if we’re lucky, destroy one or two investment banks – simply by making them actually do what they pretend they want to do every month – which is buy 20 times more oil than anyone really wants.

Is there a risk? Of course there is a risk – Lloyd Blankfein (for example but I’m sure he would never do this) could pick up the phone and pay 4 Nigerian teenagers $100,000 to fire a shoulder missile at a refinery or he could hire some Somali Pirates to take a tanker hostage (in fact, isn’t there a tanker company the the CTFC is already charging with manipulating the markets?) or he could wire $10M to any one of several OPEC nations to have the leaders or the opposition stir up a little trouble and then have his flunkies at CNBC blow it totally out of proportion.

That’s what makes oil trading so much fun – it’s all based on factors that are out of our control and half a World away so the speculators have dozens of tools available to them to manipulate the market BUT – just like the speculators – we only have to PRETEND to want to sell oil for $103 a barrel. We can also roll our sale so the real bet is that demand for oil will break long before they can sustain a price spike that will break our short position.

I have to tell you, I love this plan. Let’s use their own easy-to-manipulate system against them! It’s very simple, we just need 376,000 people to short one oil contract each and, as long as we are willing to gut out an engineered spike, we should be able to break them.

I have to tell you, I love this plan. Let’s use their own easy-to-manipulate system against them! It’s very simple, we just need 376,000 people to short one oil contract each and, as long as we are willing to gut out an engineered spike, we should be able to break them.

Oil topped out at $147 in 2008 so you’d be looking at a $43,000 paper loss but keep in mind that, at the end of 2008, oil was $35.13 a barrel and you would have a $64,000 profit at that price so this works even better if you plan to average in to sell 4 contracts: 1 at $103, 1 at $123 and 2 at $143 which, if we all actually did this with the first 376M barrels, would force them to agree to buy 1.5Bn barrels of oil for an average of $128 per barrel from us for a grand total of $192Bn. If they are willing to fake that level of demand at $143 a barrel, then we’re going to lose $60,000 ($143-128 x 4 x $1,000) but, if they break and we have 4 contracts at $128 average and oil drops back to just $80 – that’s a profit of $192,000 on 4 contracts!

Do you know who should do this? Barack Obama! The President just so happens to have 726 Million barrels of oil in the Strategic Petroleum Reserve. The Republicans want the US to sell some assets so why doesn’t the President simply offer to give the speculators what they pretend to want? The oil would still be in America, it would be delivered to Cushing and put into private storage (which is already swollen with over 1Bn additional barrels for a total of 1.78Bn barrels of petroleum stored in a country that imports just 9.4M barrels a day so that’s a 189-day supply of imports – an all-time record!) where we can offer to buy it again when the price falls below $90 for a quick $5Bn profit.

Do you know who should do this? Barack Obama! The President just so happens to have 726 Million barrels of oil in the Strategic Petroleum Reserve. The Republicans want the US to sell some assets so why doesn’t the President simply offer to give the speculators what they pretend to want? The oil would still be in America, it would be delivered to Cushing and put into private storage (which is already swollen with over 1Bn additional barrels for a total of 1.78Bn barrels of petroleum stored in a country that imports just 9.4M barrels a day so that’s a 189-day supply of imports – an all-time record!) where we can offer to buy it again when the price falls below $90 for a quick $5Bn profit.

How could the Republicans not love a plan that makes $5Bn a month selling oil? There’s no need to drill baby, drill when we already have a 6-month supply in storage that we can roll over at will (and, when you consider that Canada and Mexico supply over 5Mbd of our imports, it’s really a full-year supply of OPEC crude). If Obama is unwilling or unable to do this, then I call on our "friends" at OPEC to put their oil where their mouth is and simply sell into the speculative frenzy or even our buddy Chavez – who once offered to sell us all the oil we wanted under long-term contracts for $50 a barrel but was instead vilified by the Bush administration and targeted for overthrow. Fortunately for Chavez, the Bush administration was already busy overthrowing Saddam Hussein, who had the nerve to try to bypass the den of thieves at the NYMEX and trade oil directly (just a coincidence, I’m sure).

I spent pretty much all day yesterday warning Members not to fall for the other kind of blatant manipulation as the funds gave us a mega window-dressing day. Today I will either be a hero or a goat but, when push comes to shove – you do have to go with your gut and my gut was screaming BS at yesterday’s move from the minute we opened all the way until that ridiculous close.

I spent pretty much all day yesterday warning Members not to fall for the other kind of blatant manipulation as the funds gave us a mega window-dressing day. Today I will either be a hero or a goat but, when push comes to shove – you do have to go with your gut and my gut was screaming BS at yesterday’s move from the minute we opened all the way until that ridiculous close.

Today though, we once again have news that is so bad – it may be considered good: The ADP jobs report for May shows just 38,000 jobs added by the private sector. That is down from 190,000 jobs expected by economorons (my new term for economists) and down 78% from last month’s 177,000. The word catastrophe springs to mind as do many other words that have 4 letters and apply to our economic situation…

Of course we’ve been discussing this for weeks but the bullsh*t bullishness was so relentless that even I was concerned I was being too gosh-darned negative yesterday morning. As I mentioned, that feeling quickly passed and we doubled down on our oil shorts in yesterday’s morning Alert to Members, where we grabbed the USO June $39 puts at .50. They shot up to .60 (up 20%) by noon but we were greedy and held out for .65 or better.

It’s certainly been a wild ride in May and, as the great Yogi says: "It ain’t over ’till it’s over" but May is now officially over and it was, in fact, a down month, despite the TREMENDOUS effort that was made in the past week to keep it from being a 5% loss. Now it’s June and we’ll have a chance in this short week to see what is real and we still have our levels to watch. Holding the 2.5% lines today will be technically impressive but we only got over those levels by knocking the Dollar down to 74.50 and I’m not at all sure that low level can be sustained and that is where the whole thing begins to unravel…

Can the Dollar be held down low enough to lift the markets? Well, that all depends on how screwed up the rest of the World looks by comparison. Yesterday’s Dollar destroyer was news out of Europe that Greece is "fixed" but it’s fixed in rhetoric only as nothing has been signed or voted on and we’ve been down the road of false promises and good intentions many times before in Europe where first it was "just" Iceland, then Ireland, then Greece, then Portugal and we’re just about at the point where they are making the same soothing noises about Italy and Spain that they used to make about Greece and Portugal so I find that to be a very strange chain of logic to follow towards a relatively strong Euro.

Australia’s GDP SHRANK 1.2% in Q1, the largest decline in 20 years INCLUDING the 2008 global collapse. China’s manufacturing grew, but at the slowest pace in 9 months at 52, with 50 being flat. In the UK, May PMI also fell to 52.1 from 54.4 and that is the UK’s weakest number in 20 months and the entire Eurozone’s PMI fell even more drastically, from 58 to 54.6 with Spain and Greece each falling into negative territory below 50! Spain’s Catalonia region reported a NEGATIVE 2.7% GDP in Q1, twice as bad as expected by economorons who study this sort of thing for a living. Paul Krugman says eurozone monetary tensions have reached the panic stage: "The water level has now dropped so far that the fuel rods are exposed. We really are in meltdown territory."

Australia’s GDP SHRANK 1.2% in Q1, the largest decline in 20 years INCLUDING the 2008 global collapse. China’s manufacturing grew, but at the slowest pace in 9 months at 52, with 50 being flat. In the UK, May PMI also fell to 52.1 from 54.4 and that is the UK’s weakest number in 20 months and the entire Eurozone’s PMI fell even more drastically, from 58 to 54.6 with Spain and Greece each falling into negative territory below 50! Spain’s Catalonia region reported a NEGATIVE 2.7% GDP in Q1, twice as bad as expected by economorons who study this sort of thing for a living. Paul Krugman says eurozone monetary tensions have reached the panic stage: "The water level has now dropped so far that the fuel rods are exposed. We really are in meltdown territory."

While Spain is pulling back money and bankrupting the provinces, China is planning a massive bailout of its local governments – shifting RMB2-3T ($308-463B) of debt off their balance sheets, and mostly onto the central government tab. Local debt is often discussed as a risk to the Chinese economy; it’s been assumed Beijing would need to step in with its cash. Now the worry can shift to central government debt.

The so-called Indignant Protests in Greece, purposely peaceful so far, get a bit rowdy as demonstrators block the exits from the Parliament building, forcing MPs to need police escorts to their cars. An appearance by composer Mikos Theodrakis, who calls the bailout a "national betrayal," drew 20,000 protesters.

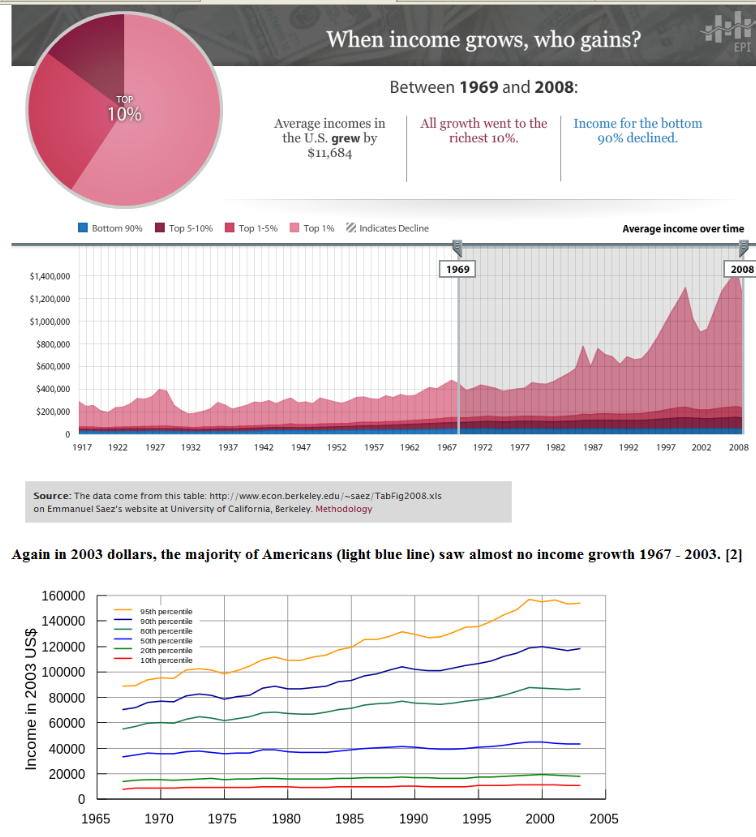

How long before the American people wake up to our own "national betrayal"? This chart series from Barry Ritholtz’s site says it all:>

click for all 22 charts