Courtesy of Surly Trader

The recent plunge in the ISM manufacturing index was the largest one month drop since 1984. Some will suggest that it’s a mere slowdown in growth which should naturally be expected in any recovery, but I believe it is indicative of all negative economic surprises as of late that have lead to a sub 3% yield on the 10 year treasury. What is even more ominous is the strong correlation between the ISM and the 1 year rolling return in the S&P 500:

An ugly drop in ISM suggests an equity correction?

The adjusted R squared of this duo is above 50%, but if you analyze the data you will find that sometimes the ISM leads, sometimes it happens at the same time, sometimes it is a bit behind. Regardless, it is a very negative reading that actually is just indicative of the other ugly economic news that continues to roll out:

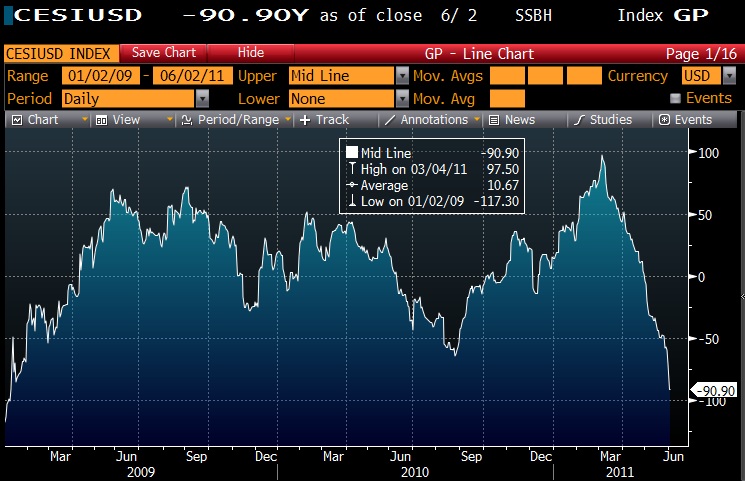

Where is the plunge protection team for economic surprises? QE3?

Bottom line: It will probably get more interesting from here before it gets boring.