Courtesy of The Automatic Earth

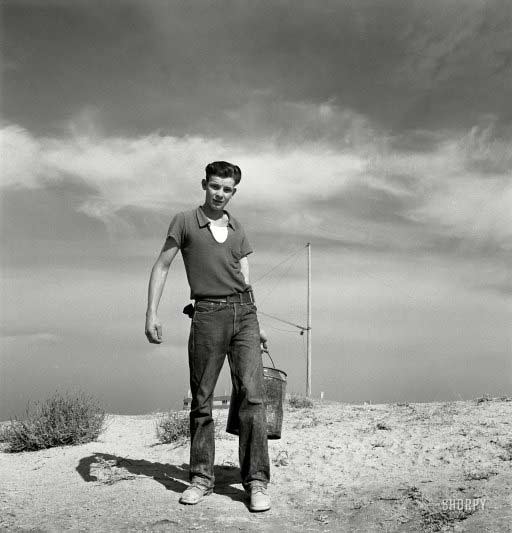

"Seventeen year old boy going to feed the pigs, Dazey farm, Homedale district, Malheur County, Oregon"

Ilargi: First, any Greek bailout plan that will (may?!) be agreed on doesn’t change anything about the country’s financial reality. Greece is unable to pay down its debt. If an IMF/ECB/EU package deal is found, that debt will simply now be owed to the "Troika". And Greece will still not be able to pay it back.

You can find comments from those involved in the negotiations that suggest Athens will be "safe“ until 2014, or even for the next 5 years, but this is nonsense. The first aid package hasn’t even been paid in full, and the deparate need for a second one has already led to the emergency talks we see now. The only thing that changes is that -much of- the debt is shifted from private investors to the public at large. An all too familiar pattern, and one that is really due for a change.

The situation at the talks, meanwhile, is becoming so opaque it’s getting harder to belive there’s not at least to some intent intentional. If Germany and France think they can get away with more procrastination, why wouldn’t they go that route? They need the euro to weaken vs the UD dollar. These are not good times to have a string currency. But again, they fail to see what the overall perception is in the marketplace. Which is that no matter what they do from here on in, their credibility is shot. For good.

On Friday, Angela Merkel was reported to have given in to French and ECB demands to not press for involuntary haircuts for private investors. Sometime over the weekend, this was denied, or half denied. Now, all of a sudden, Greece may only get half of the next tranche of Bailout 1.0, which it’s supposed to receive in July. Moreover, any decision on the topic will be delayed until July as well. By then, we’ll know if Papandreou will still be the Greek PM; he has a confidence vote coming up on Tuesday.

Papandreou’s (caviar-) socialist party holds 155 of 300 seats. 5 defections and it’s game over, both for him and for Bailout 2.0. To prevent this, he made his big party rival Venizelos Minister of Finance, to secure the support of the left wing of the party. If the confidence vote goes awry, Venizelos will probably step in, and Papandreou will gladly pass on the poisoned chalice. Venizelos will then not be able to pass the bailout deal on account of street protests, and thus be stuck with a huge mess. Elections follow, and the next blind power hungry doofus steps in.

Spanish bond rates are rising, as are Italian CDS prices after Moody’s threatened a downgrade of Rome’s government debt. Italian banks are getting hit hard. That is enough to weaken Greece even further. And that in turn is a major danger in Romania and Bulgaria, where Greek banks are among the main investors.

And if that is still not enough to weaken any- and everything that has to do with the Eurozone, its very head, Jean-Paul Juncker (who, admittedly, is a self-professed obsessive liar -when things get serious-) delivered the coup de grace. And it doesn’t look like he meant to do it. I think he meant to strike fear in the hearts of the negotiators. Juncker became the first main voice to include Belgium in the group of endangered European animals. That gives us PIIGS +B. Can I buy a vowel?

Instead, Mr Juncker has now neatly lined up the row of Eurozone sitting ducks for the bond markets: Greece, Ireland and Portugal are obvious. Spain is getting there. Italy, and especially Belgium are the relatively new kids on the -chopping- block. Or the shooting range, if you prefer.

Now, if the EU wants to prevent its members from being picked off one by one, what can they do? Interestingly, I read two completely different approaches over the weekend. Unfortunately, neither makes much, if any, sense. In the Guardian, Larry Elliott writes: Greece must exit the eurozone, while the Telegraph’s Edmund Conway argues: Why Germany must exit the euro.

The problems should be clear: if Greece were to leave the Eurozone, either voluntarily or forcibly, conditions would have to be defined to enable it to do that. Such conditions don’t exist; there is nothing written on it in EU treaties. Once these conditions would be negotiated (something that can take months, if not years), countries like Ireland and Portugal would also either want to leave or be made to do so. Which would make all remaining parties involved look very closely at Spain and Italy. And Belgium.

If Germany were to leave, it couldn’t go alone either. The Netherlands would not remain in the EU without it, and in all likelihood, neither would Finland. With the three arguably strongest economies gone, France would find itself between two rocks and three hard places. Paris might be tempted by the power games, but not by the peripheral debt; it would have to leave, or at least strongly consider doing so.

A Greek exit may seem the more obvious way to go right now, but if such a thing happens, the Eurozone, if not the entire EU, would cease to exist in its present form. A German exit simply won’t happen.

For now, the Eurozone countries are stuck with one another. And there’s really only one way left to go for them. That is, to deliver haircuts to private investors, as well as to the ECB, the Federal Reserve, the Bank of Japan and perhaps China’s central bank. Yes, a credit event. It will take them a while to realize this is the only path to take, the resistance will be formidable. But then, so will the resistance to ever more bank bailouts with public funds.

The Greek protests are an established phenomenon that will not easily be eradicated (even though there’s plenty talk of tanks in the streets of Athens). That genie is out of the bottle. Spain’s protests are for now more subdued, but a country with over 20% unemployment, and almost 50% of young people jobless, has a limited life expectancy. If the ratings agencies get serious about downgrading French banks, as they announced last week -and given their exposure to Greece it seems inevitable-, and if that raises rates in Paris and beyond, it will be game on. A flag in the Athens protests read: "The French are sleeping – they’re dreaming of ’68". True enough, but how much longer?

*****

Article list:

Athenians used to stop off at Syntagma Square for the shopping, the shiny rows of upmarket boutiques. Now they arrive in their tens of thousands to protest. Swarming out of the metro station, they emerge into a village of tents, pamphleteers and a booming public address system….

The euro-zone finance ministers have decided not to approve the next tranche of aid to Athens until the Greek parliament passes new austerity measures. The move increases pressure on the Greek government, but it is unlikely to reassure the financial markets….

Europe’s finance ministers unexpectedly put off approval early Monday of the next installment of aid to debt-laden Greece, delaying the decision until July and demanding that the Greek Parliament first approve spending cuts and financial reforms that include a large-scale privatization program…

Europe delays decision on emergency loans to Greece

by Julien Toyer and Barry Moody – Reuters

Euro zone finance ministers postponed a final decision on extending 12 billion euros ($17 billion) in emergency loans to Greece, saying Athens would first have to introduce harsh austerity measures.

The ministers said they expected the money, the next tranche in a 110 billion euro bailout of Greece by the European Union and the International Monetary Fund, to be paid by mid-July. Greece has said it needs the loans by then to avoid defaulting on its debt. But keeping up their pressure on Athens, where public opposition to austerity has been growing, the ministers insisted that disbursement would depend on the Greek parliament first passing laws on fiscal reforms and selling off state assets…

Greek power firm unionists launch strikes

PPC protest action to cause rolling blackouts, starting Monday

The powerful union representing workers of the Public Power Corporation, GENOP, is to start rolling 48-hour strikes on Monday morning in protest at the government’s insistence on pushing ahead with the privatization of PPC. It is expected that the strikes will cause widespread blackouts. Unionists have called the action two weeks before the government is to submit legislation in Parliament paving the way for the state to reduce its holdings in PPC from 51 percent to 34 percent…

Europe May Withhold Half of Greek Payment

by James G. Neuger and Jonathan Stearns – Bloomberg

European governments weighed withholding half of Greece’s next 12 billion-euro ($17.2 billion) aid payment, seeking to keep the country solvent while maintaining pressure on the government to slash the debt that pitched the euro area into crisis.

Euro-area finance ministers may authorize only a 6 billion- euro loan to tide Greece through bond redemptions in July, while further aid hinges on Greek budget cuts, Belgian Finance Minister Didier Reynders said. "We will in any case try to release the necessary funds for the short term,” Reynders told reporters before a meeting of euro-area finance ministers in Luxembourg tonight….

Germany ‘dismisses Greek debt compromise plan’

by AFP

A German compromise plan to resolve a dispute with the European Central Bank over the Greek rescue that was reported by Der Spiegel magazine is no longer on the table, a government source said Sunday.

Der Spiegel had reported ahead of its Monday issue that the German finance ministry called for a beefed-up version of Europe’s temporary bailout mechanism lending to Greek banks to insure they have adequate collateral with the ECB. It would boost the effective lending capacity of the Emergency Financial Stability Facility (EFSF) to 440 billion euros ($629 billion) and see member states double the amount of guarantees they provide the fund.

Greek Default Would Spell ‘Havoc’ for Banks

by Aaron Kirchfeld and Elena Logutenkova – Bloomberg

A year after European officials bailed out Greece, investors say the region’s banks haven’t raised sufficient capital or cut loans enough to withstand the contagion that may follow a default.

Nervous investors send market to lower close

by GARETH COSTA and AAP, The West Australian

Global equity markets remained on a knife edge ahead of the Greek parliamentary confidence vote tomorrow, with the Australian sharemarket finishing a choppy session at a fresh 10-month low. European leaders dashed hopes of a weekend solution to the Greek sovereign debt crisis, and the S&P-ASX 200 surrendered two morning rallies to close 33.2 points or 0.74 per cent down at 4451.7 points, as weak regional data added to the gloomy outlook. The broader All Ordinaries index was 38.6 points or 0.84 per cent lower at 4,512.5, the day’s low…

Austerity protests continue to roil Greece

by Demetris Nellas – AP

Several thousand pro-Communist union members marched through central Athens yesterday to protest the government’s latest austerity measures and plans to sell off state enterprises to appease international creditors.

Battle lines drawn for a eurozone debt war

by Telegraph

While Molotov cocktails burn on Athens’ streets, more vitriolic battles yet are blazing over Greece’s debt crisis behind the scenes, as financial markets and eurozone politicians fight their ground….

UK banks abandon eurozone over Greek default fears

by Harry Wilson – Telegraph

UK banks have pulled billions of pounds of funding from the eurozone as fears grow about the impact of a "Lehman-style” event connected to a Greek default…

Greece debt crisis likely to hit Italy, Belgium, warns Luxembourg PM

by International Business Times

Jean-Claude Juncker, head of eurozone finance ministers, on Saturday cautioned that the ongoing debt crisis of Greece and other countries in the region could hit Italy and Belgium, Suddeutsche Zeitung, a German daily reported.

Juncker, who is also prime minister of Luxembourg said Italy and Belgium with their high levels of debt could get affected by the sovereign crisis in eurozone countries even before the crisis hits Spain. Noting that the crisis could have disastrous effect on the currency of the region, euro, he warned "we are playing with fire"…

Merkel wants ‘substantial’ bank aid for Greek debt

by AFP

German Chancellor Angela Merkel Saturday urged "substantial" aid from private creditors to resolve Greek debt woes, as the Eurogroup warned the crisis could spread like a firestorm through EU economies. "We must be sure to try to have a substantial contribution" from private creditors like banks and insurance companies for debt-laden Greece, Merkel told a meeting of her Christian Democrat Union party in Berlin. However the German leader added that "at the moment we can only get the participation of the private investors on a voluntary basis."…

Pension funds, banks face risk in new Greek rescue

by Ivana Sekularac – Reuters

Pension funds and banks will take a big risk if they agree to take part in a new rescue plan for Greece, a European Central Bank policymaker said in a newspaper interview published on Saturday. "Pension funds must act in the interests of their beneficiaries," said Nout Wellink, a member of the ECB’s governing council, in an interview with Dutch newspaper NRC Handelsblad…

Papandreou seeks ‘national consensus’

by Peter Spiegel and Kerin Hope – Financial Times

George Papandreou, Greek prime minister, on Sunday asked parliament for a vote of confidence in his new government as eurozone finance ministers prepared to seek agreement amongst themselves on the structure of a €120bn bail-out for Greece. Mr Papandreou on Friday unveiled a cabinet dominated by tough socialist personalities, including Evangelos Venizelos, a former political rival, as finance minister, to push through a four-year package of new tax hikes and spending cuts agreed with international lenders.

Against the odds, the euro will scrape through

by Wolfgang Münchau – Financial Times

Last week taught us something important about the political economy of the eurozone. There were two serious and overlapping crises. The first was a deteriorating dispute between Germany and the European Central Bank. It was about whether private investors should be forced to pay a contribution to the next loan programme for Greece. The dispute promised to derail the discussion for a follow-up loan, and could have forced Greece into a default. The second crisis was the near-collapse of the government of George Papandreou, Greek prime minister.

Could the Eurozone Break Up? Possible Over a Five-Year Horizon

by Nouriel Roubini

The current "muddle through” approach to the eurozone (EZ) crisis is not a stable disequilibrium; rather, it is an unstable disequilibrium. Either the member states move from this disequilibrium toward a broader fiscal, economic and political union that resolves the fundamental problems of divergence (both economic, fiscal and in terms of competitiveness) within the union…

Imagine that in the worst year of our recent recession, the United States government decided to reduce its federal budget deficit by more than $800 billion dollars – cutting spending and raising taxes to meet this goal. Imagine that, as a result of these measures, the economy worsened and unemployment soared to more than 16 percent, and then the president pledged another $400 billion in spending cuts and tax increases this year. What do you think would be the public reaction?

Greece in turmoil: Run into the ground

by Kerin Hope and Peter Spiegel – Financial Times

Stelios, a 28-year-old electrician, has been spending several evenings a week at a tent camp outside the Greek parliament run by Indignant Citizens, a new protest movement. He joins hundreds of others attending a self-styled "popular assembly” – a nightly open-microphone event at which Greeks vent their anxieties and frustrations with the country’s disastrous economic and political situation.\ "I’m lucky because I’m still in work,” he says. "But my mother’s pension was cut last year and she’s struggling. It’s a relief to get out there and discuss stuff – and maybe the protest will help make things less bad.”

Spanish Marchers Protest Unemployment, Austerity

by AP

Tens of thousands of Spanish protesters— young and old, those with jobs and those without—marched Sunday in Madrid to drive home their anger over high unemployment, bleak economic prospects and politicians they consider inept…

Britain is facing the biggest wave of industrial action since the 1926 general strike, Dave Prentis, the leader of the largest public sector union, has warned. In issuing his threat, Mr Prentis, the general secretary of Unison, has stoked the row over Government pension reforms. Unions are considering walking out on negotiations over plans to make most public sector employees work longer and pay more for less generous pensions. Mr Prentis said: "It will be the biggest since the general strike. It won’t be the miners’ strike. We are going to win.”…

How Sweden Steered Clear of the Greece Fiasco

by Brendan Greeley – BusinessWeek

The case for national sovereignty: By staying out of the euro, the Swedes have steered clear of Greece’s mess. Brussels, take note

They are taking to the streets in Stockholm, but not with demands. Swedes, this month, ask for no more than a spare patch of grass or dockside granite to bask in the midsummer. The country has never really gone in for protest anyway, and right now there’s nothing to protest about. The economy grew at an annual rate of 6.4 percent in the first quarter, after 5.7 percent last year, which was the strongest recovery in the European Union. And Sweden still has its krona…

Euro Jitters Ricochet Across U.S.

by Michael Corkery – Wall Street Journal

Municipal Borrowers Pay More Because of Link to Belgian-French Bank; An Extra $30,000 a Month

Dozens of U.S. cities and towns are being bruised by the deepening Greek debt crisis even though they are thousands of miles away and don’t own any of the country’s bonds. From a skating rink in Everett, Wash., to New York City’s schools to Chicago’s O’Hare International Airport, interest rates on some bonds have soared since late May and could rise even further because money-market investors are less willing to buy some of the $17 billion in municipal bond deals backed by Dexia SA, a Belgian-French bank shaken by its exposure to government debts in Greece….

America flirts with a fate like Japan’s

by Clive Crook – Financial Times

The stalling of the US recovery raises big, scary questions. After a recession, this economy usually gets people back to work quickly. Not this time. Progress is so slow, the issue is not so much when America will return to full employment but what "full employment” will mean by the time it does….

Toxic lending still capable of contamination

by Aline van Duyn – Wall Street Journal

It has been several years since an American with a poor record of paying debts or with no significant source of income was able to borrow to buy a house. Subprime lending has been largely consigned to the history books. But this does not mean that subprime mortgages have been shoved into the dustbin of history. At least $500bn worth of securities backed by such mortgages are still floating around the financial system….

UK homeowners benefit from fourfold surge in prices from to 1998 to 2008

by Julia Kollewe – Guardian

Homeowners in the fastest-growing parts of the UK have seen the value of their properties more than treble over the decade to 2008 while those in poorer areas lagged far behind, according to research by Halifax, the mortgage lender….

Economists, it’s time for the lawyers

by Alan Beattie – Financial Times

Got an economy that needs fixing? Hire a lawyer. That, disgruntled economists darkly mutter, is an emerging trend. Another grim week for the dismal science began with the International Monetary Fund’s executive board blocking Stanley Fischer, governor of the Bank of Israel, from applying to become its managing director. Mr Fischer is a legend within the economics profession but his pleas to appoint an economist to the job failed. He was two years over the age limit and that was that…

US orders news blackout over crippled Nebraska Nuclear Plant: report

by Nation.pk

A shocking report prepared by Russia’s Federal Atomic Energy Agency (FAAE) on information provided to them by the International Atomic Energy Agency (IAEA) states that the Obama regime has ordered a "total and complete” news blackout relating to any information regarding the near catastrophic meltdown of the Fort Calhoun Nuclear Power Plant located in Nebraska..