Courtesy of Mish

By now, everyone knows that "Greece is Saved" even though 2-year government bonds are trading today at 28.3%, up from 26.62% at the open.

Let’s turn our attention away from Greece to the "Not Saved Yet" group of countries including Spain, Portugal, Ireland, and the big Kahuna, Italy.

Portugal 10-Year Government Bonds – 13.05%

Ireland 10-Year Government Bonds – 12.43%

Greece 10-Year Government Bonds – 16.82%

Spain 10-Year Government Bonds – 5.61%

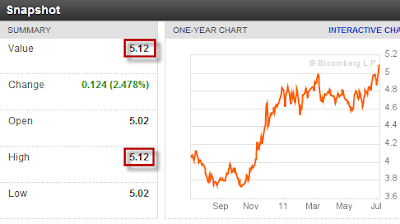

Italy 10-Year Government Bonds – 5.12%

Please note that 10-year yields in Italy are now approaching 10-year yields in Spain.

Also note that yields are not up across the board in Europe.

Germany 10-Year Government Bonds – 2.93%

Today’s Scorecard

| Country | Yield | Change | New High | Saved | Spread to Germany |

|---|---|---|---|---|---|

| Germany | 2.93 | -0.08 | 0 | ||

| Portugal | 13.05 | +2.03 | Y | 10.12 | |

| Ireland | 12.43 | +0.89 | Y | 9.5 | |

| Greece | 16.82 | +0.30 | Y | 13.89 | |

| Spain | 5.61 | +0.13 | 2.68 | ||

| Italy | 5.12 | +0.12 | Y | 2.19 |

I don’t know about you, but I am sure glad "Greece is Saved". I look for equally impressive results when Portugal, Ireland, Spain, and Italy are "saved".