NWS is down 20% of late.

NWS is down 20% of late.

Today we hear from the Murdoch family, owners of the venerated Wall Street Journal as well as Dow Jones, Inc., who will be explaining how their company allegedly broke the rules, lied, threatened and/or bribed almost everyone, engaged in cover-ups, slandered anyone who got in their way and callously ruined the lives of innocent people – all in the name of profits. Already Sean Hoare, the reporter who blew the whistle on Murdoch has been found dead inside his London apartment. "The death is currently being treated as unexplained, but not thought to be suspicious. Police investigations into this incident are ongoing," said a police statement.

Would that be the same British Police Department that’s had two high-level resignations over accepting bribes from Murdoch’s organization? The Daily Mirror newspaper quoted an unnamed friend as saying Hoare "thought that someone was going to come and get him, but I didn’t know whether to believe half the stuff he was saying." In other words, Hoare was poor and intimidated by NWS (he was refusing to testify against them) while the Murdochs are rich so every possible benefit of the doubt is being given to them just like Rebecca Nalepa was found with her hands and feet bound with a rope around he neck hung off a balcony in a San Diego mansion and the police there are thinking "suicide."

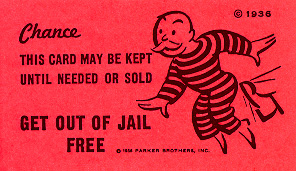

As F. Scott Fitzgerald once said: "The rich are different than you and me – they have more money." As Bill Domhoff pointed out this weekend, when we talk about the rich, we don’t mean the top 1% – people who "only" make $1.6M a year or more. Sure those of us in that group may have a "get out of jail free" card for when we speed and we may get our buildings approved quicker than most and we may get a local ordinance passed here or there but, when you move up to the top 0.1% ($36M or higher per year income) or the top 0.01% ($450M or higher annual income), where Mr. Murdoch lives – not only do you get both national and international laws rewritten to suit your needs (like taking over 100% of the UKs satellite broadcasts), but the other laws don’t even apply to you.

As F. Scott Fitzgerald once said: "The rich are different than you and me – they have more money." As Bill Domhoff pointed out this weekend, when we talk about the rich, we don’t mean the top 1% – people who "only" make $1.6M a year or more. Sure those of us in that group may have a "get out of jail free" card for when we speed and we may get our buildings approved quicker than most and we may get a local ordinance passed here or there but, when you move up to the top 0.1% ($36M or higher per year income) or the top 0.01% ($450M or higher annual income), where Mr. Murdoch lives – not only do you get both national and international laws rewritten to suit your needs (like taking over 100% of the UKs satellite broadcasts), but the other laws don’t even apply to you.

This lack of accountability leads to increasing bad behavior, as evidenced by our own financial crisis, where the Masters of our Universe screwed their own clients with "shitty deals" yet not a single arrest has been made other than finally shutting down one Ponzi scheme so that the rest of Wall Street can point to Madoff and say – "See, people were arrested" even though he had NOTHING to do with the sub-prime lending or CDS fiascos that destroyed the US economy and cost the taxpayers (so far) $9 Trillion Dollars or 180 times more than the size of Madoff’s entire fund, much of which has now been recovered. Unlike Madoff victims, the victims of the Banksters will never have a special prosecutor on their side with the power to recover our money.

That’s because just 10 banks, most in the famous international "Gang of 12" which includes both Murdoch and GE (both of whom control the media – especially the Financial Media) own 77% of our nation’s banking assets. That’s 40% up from 55% back in 2002, when Bush deregulation let these banks go totally wild. GS, MS , JPM, C, BAC and WFC are the 6 top US banks with $10Tn in assets between them. Others in our Gang of 12 are the EU powerhouses of CS, DB, BCS and Nomura in Japan – they are the masters of the financial universe and the expression applies to any of the majors who use their assets to influence the Global Economy in pursuit of (what else?) more wealth.

That’s because just 10 banks, most in the famous international "Gang of 12" which includes both Murdoch and GE (both of whom control the media – especially the Financial Media) own 77% of our nation’s banking assets. That’s 40% up from 55% back in 2002, when Bush deregulation let these banks go totally wild. GS, MS , JPM, C, BAC and WFC are the 6 top US banks with $10Tn in assets between them. Others in our Gang of 12 are the EU powerhouses of CS, DB, BCS and Nomura in Japan – they are the masters of the financial universe and the expression applies to any of the majors who use their assets to influence the Global Economy in pursuit of (what else?) more wealth.

Our current tax structure does not simply allow but ENCOURAGES wealth to pool into the hands of the relatively few. $10Tn in the hands of 6 US banks represents a 40% increase ($4Tn) over 2002. If we work that backwards then we see that there USED to be $4Tn in the bottom 99% that has now been transferred to the top 1%. That’s OK though, I’m sure they can afford it – after all, there’s 99 of them for each one of us and we are, after all, better (richer) than them, are we not?

So the poor banks (and the poor people who bank there) used to have 45% of the nation’s assets just 9 years ago but hey, look on the bright side – they STILL have 23%, that’s more than half! This is why we have to tax the bottom 99% more – otherwise we would have less to trickle on them with!

So the poor banks (and the poor people who bank there) used to have 45% of the nation’s assets just 9 years ago but hey, look on the bright side – they STILL have 23%, that’s more than half! This is why we have to tax the bottom 99% more – otherwise we would have less to trickle on them with!

As you can see from this chart (thanks Jessie’s Cafe American), the US already taxes our Corporations and Citizens FAR less than almost any other nation on Earth and that, of course, had led us to run up TREMENDOUS deficits, to the point where we had to borrow $15 Trillion – just to keep pretending we could run our Government without collecting the taxes to pay for it. That’s BRILLIANT though because the rich people get 99% of the tax breaks while the deficit is EVERYONE’s problem.

In fact, for the past few years, our Federal Reserve has placed a stealth tax on ALL of the American people by devaluing our Dollar by 15%. The cool thing about taxing the population by devaluing the currency is it’s not just a tax on one year’s earnings but a tax on everything they have worked to accumulate over their entire lives! That’s right – through inflation, the Fed is able to reach into your bank account and under your mattress and, of course, into your home equity and take 15% of EVERYTHING you have – whether you declare it or not.

There are no loopholes (which are now over $1Tn a year for the top 1%) to escape from inflation unless, of course, you are a Member of the investing class and you own stocks or commodities or collectibles that rise against inflation. Then you are in such good shape that 40% of the nation’s wealth actually migrates from the bottom 99% into your bank account in less than a decade. Come on, you’ve gotta love this country – Go Capitalism!

There are no loopholes (which are now over $1Tn a year for the top 1%) to escape from inflation unless, of course, you are a Member of the investing class and you own stocks or commodities or collectibles that rise against inflation. Then you are in such good shape that 40% of the nation’s wealth actually migrates from the bottom 99% into your bank account in less than a decade. Come on, you’ve gotta love this country – Go Capitalism!

At this point, as Charles Hugh Smith points out, the bottom 80% have just 7% of the Financial Wealth left and own just 8.9% of all stocks so these engineered market rallies are not helping those who need help the most and then you get these jackasses on TV telling us that we can pay off the deficit (the one we built up because the rich people didn’t pay their taxes) by gutting the retirement accounts of the bottom 80%.

Forgetting the fact that a person who worked for 40 years and had 10% of his income (call it an inflation-adjusted $25,000 since we’re talking bottom 80%) removed every year – even at just 4% interest, should have $259,068 coming to them (10 years of full SS checks) – forgetting the great crime we are all planning on perpetrating against these people who have been counting on this money (THEIR MONEY) coming back to them in their old age – what is the actual end game planned for when we do stop giving 40M people their retirement checks?

I know that we, the people, are trained not to examine the potential consequences of our actions so when some blowhard politician talks about cutting the post office, we don’t wonder how we will get our mail and when they talk about cutting back regulation, we don’t think about Three-Mile Island, Love Canal or any of those horrible side effects of the drugs they DO approve but what exactly will happen to Grandma and Grandpa when the day they stop working is the day they start starving?

Of course, if Grandma and Grandpa are rich (and, for the top 1%, the chance that they already came from wealth is 89%) – then this is not a problem. The $2,500 monthly Social Security check is just funny money to them and they wouldn’t go to those Medicare doctors anyway, right? But, for the bottom 99% – Mom and Dad will be moving in and that too is yet another tax that will be placed on the poor – who now have to support their parents as well. But don’t worry, this will only go on until Mom or Dad get ill and then the family will go bankrupt very quickly.

Fortunately, our leaders already planned for this contingency and Bush signed the "Bankruptcy Reform Bill" of 2005 to make sure there would never be an escape from debt for the working poor. This means that, if you are foolish enough to take your Father or Mother to the doctor and put your name on hospital paperwork, you too can rack up millions of Dollars in debt once their insurance runs out (which would be IMMEDIATELY under most Republican plans).

Of course if you are poor and you bind your sick Mother’s hands and feet and put a rope around her neck and toss her off a balcony – you probably won’t get it ruled a suicide because, well – you are poor and nobody owes you any favors, do they?

Do I have a solution for this? No, I do not (not one that would be politically acceptable, anyway). All we can do is to get as rich as possible before this whole mess begins to come unglued so we can be one of "THEM" ourselves! Along those lines, we went long on the S&P yesterday as the market bottomed out in the afternoon with aggressive bullish plays on both SSO and SPY and those should be helping us get closer to goal this morning as a combination of positive earnings reports and much improved housing starts gives the markets an early boost.

We’ll see how our lines hold up, in Member Chat this morning we set levels to watch for at Dow 12,500 along with 1,317 on the S&P, 2,775 on the Nasdaq, 8,300 on the NYSE and 825 on the RUT – if we can make those and hold it, we may actually have a reason to make some more bullish picks but, for now, we remain cashy and cautious as we get ready to enjoy the Murdoch show!