Courtesy of The Automatic Earth

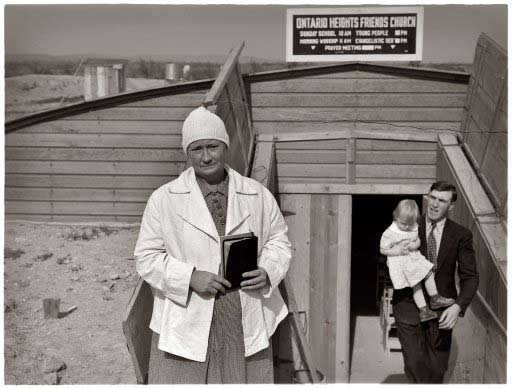

"Mrs. Wardlow [Wardlaw] at the Society of Friends church, Dead Ox Flat, Malheur County, Oregon"

Ilargi: In Wednesday’s The Next Bank Bailout Bloodbath is Here, I gave you an overview of my fictional Google Finance portfolio. For your viewing pleasure, here’s the follow-up graph after yesterday’s close:

Isn’t she lovely? Then on the present: $2.1 trillion in market value was wiped off the MSCI All Country World Index this week as of Thursday’s close, write Leika Kihara and Pedro Nicolaci Da Costa for Reuters. Clearly, most of that was lost in Europe and the US, and most of that in turn in the financial sector. So it’s no wonder that there’s high level political talks going on today between Germany, France, Spain and other EU members.

But what can they realistically do? You can bet they know they can’t do much at all at this stage in the game. They may not come out and say it in so many words, but that isn’t even necessary anymore either. The non-political side of the table, in the shape of the European Central Bank, has made a clear enough statement already.

The ECB went back into the bond markets yesterday, but where everyone expected them to buy Italian and Spanish debt, since both these countries see interest rates on their debt skyrocket, the ECB bought only Irish and Portuguese paper.

And while this may be temporary, and the bank might start buying Italy and Spain bonds soon, first: that’s not too likely given the circumstances, second: it’s wouldn’t make one iota of real difference, and third: the statement has been made regardless.

There are a lot of ‘experts’ in the press today who don’t understand this, or won’t. Which strikes me as odd, since the dice have come up as they have, and it’s no use debating the outcome.

From the Leika Kihara and Pedro Nicolaci Da Costa piece cited above:

Investors had hoped the ECB would target Spanish and Italian debt in reviving its bond-buying stimulus program, but it restricted the purchases to Irish and Portuguese securities, not Italy’s or Spain’s.

Roberto Perli, managing director at ISI Group and a former staffer at the Federal Reserve, called the ECB’s action "mysterious." "It sent the wrong message," he said.

Ilargi: The message may have been "wrong" and "mysterious" to Mr. Perli, or maybe he’s just saying that, but I think it’s crystal clear, and yes, even unusually brave for the institution, for any such institution, really.

Ambrose Evans Pritchard has his own views, and quotes Willem Buiter to boot:

The ECB throws Italy and Spain to the wolves

The European Central Bank has abandoned Italy and Spain to their tortured fate.

Its refusal to act in the face of an existential threat to monetary union has set off violent tremors across the global financial system, raising the risk that the crisis will spiral out of control. [..]

Jean-Claude Trichet, the ECB’s president, said the bank had purchased eurozone bonds for the first time since March but this token gesture was confined to Ireland and Portugal, countries that have already been rescued.

Professor Willem Buiter, Citigroup’s chief economist, said the apparent ECB action was pointless. "The warped logic of intervening in two countries that don’t need it is as strange as it gets."

Mr Buiter said Europe risks a disastrous chain of events and the worst financial collapse since the onset of the Great Depression unless Europe’s central bank steps in with sufficient muscle to back-stop the system.

"The ECB has yet so show it understands that it is the only institution that can save Italy and Spain from fundamentally unwarranted defaults. Everybody is afraid and real money investors are dumping their holdings. The ECB must step in to cap the yields at 6pc or 6.5pc and put a floor under the market," he said.[..]

"As long as the ECB stays on the sidelines, a speculative, fear-driven withdrawal of market funding can feed a self-fulfilling insolvency. Any number of banks and insurance companies would take huge hits. The ECB will have to come in, or accept the biggest banking crisis since 1931," Mr Buiter said. He said the "fundamental design flaw" in economic and monetary union is the lack of a lender of last resort.

EU leaders agreed in late July to boost the powers of the eurozone’s €440bn (£382bn) European Financial Stability Facility (EFSF) bail-out fund so that it may intervene pre-emptively in countries in trouble, but this has to be ratified by all national legislatures and may take months.

Mr Buiter said the fund needed to be increased five-fold to €2.5 trillion to be credible in the long run. "It is quite irresponsible that the euro member states decided to send their parliaments on holiday this summer before they had enhanced the EFSF to effective scope and size. Crises can happen even during inconvenient periods," he said. [..]

Ilargi: No, Willem Buiter. "The warped logic of intervening in two countries that don’t need it is NOT as strange as it gets.". It is a loud and clear signal to the world that the ECB can not and will not try to save Italy (or Spain). Because it doesn’t have the financial wherewithal to do so, let alone the political support.

As for: "The ECB has yet so show it understands that it is the only institution that can save Italy and Spain from fundamentally unwarranted defaults", no again. The ECB, unlike you, apparently, Mr. Buiter, understands it cannot save Italy and Spain.

Making the European Financial Stability Facility almost 6 times bigger (€440 billion to €2.5 trillion) than it isn’t even yet, but is at least supposed to become, is a dead on arrival idea. Germany won’t accept that, Holland won’t, Finland won’t.

Mr Trichet said the ECB’s governing council was divided over bond purchases but gave no further details. German sources said Bundesbank chief Jens Weidmann voted against intervention, repeating his well-known view that further "collectivisation of risks" poses a threat to monetary stability. German-led hawks say the ECB lacks treaty authority to keep amassing a portfolio of bonds, is on a slippery slope towards debt monetisation and is being drawn deeper into tasks that belong to fiscal authorities.

ECB officials are aware token purchases of Spanish and Italian bonds would soon be tested by the markets, pulling the bank ever deeper into a monetary swamp. The two countries’ tradable public debt is more than €2 trillion. The ECB has purchased almost a fifth of the combined debt of Greece, Ireland, and Portugal yet still failed to stem the crises in these countries. Any intervention in Italy and Spain would have to be on the sort of overwhelming scale undertaken by the US Federal Reserve.

"Italy is the third-biggest bond market in the world: the idea that a bit of ECB buying can make any long-term difference is very misplaced," said Marc Ostwald from Monument Securities. Mr Ostwald said the ECB appeared to have bought some Irish bonds today. "This is their way of giving Ireland a pat on the back for delivering on austerity, to show that Ireland really starts to divorce itself from others in crisis."

Ilargi: Mr. Ostwald has one thing right: " [..] the idea that a bit of ECB [bond] buying can make any long-term difference is very misplaced." indeed (that’s what the ECB is letting us know). But he’s wrong on the next point: Buying Irish bonds is not "their way of giving Ireland a pat on the back for delivering on austerity", it’s instead – and quite plainly- their way of telling the markets that the ECB will not try and save Italy and Spain.

The reason why, apart from the fact that there is no European facility endowed with sufficient financial or political means to save those two, is certainly also plainly in the sheer size of the debt and the risks that come with it. "Italy is the third-biggest bond market in the world..” Also, as per Charles Forelle in the Wall Street Journal, "its economy is 50% larger and its debt volume two-and-a-half times as big as Spain’s". And "just this month, Italy must repay €36 billion in government debt. That is roughly what Greece will redeem this entire year." As well as: "The IMF estimates that Italy’s gross financing needs—the amount of money it must borrow to repay maturing debt and cover deficits—will run between €340 billion and €380 billion annually over the next five years.

A chunk of that is short-term debt that Italy would likely still be able to roll over—Greece continues to sell short-term debt despite its bailout—but medium and long-term debt redemptions next year alone are around €200 billion. Italy’s budget deficit will be around €50 billion."

The Economist has another nice tidbit on Italy:

However bad the economic crisis in southern Europe may be for investors, it is proving lethal for the area’s political leaders. In March José Sócrates, Portugal’s beleaguered prime minister, resigned. Soon afterwards his Spanish counterpart, José Luis Rodríguez Zapatero, announced his intention to step down. In June George Papandreou, Greece’s prime minister, came close to ejection during a fierce debate over an austerity package.

So as he stood up to make the first of two eagerly awaited speeches to parliament on August 3rd, Italy’s prime minister, Silvio Berlusconi, may have had an uneasy feeling he was one in a line of dominoes. If so, there was nothing in the style or content of his address to suggest it. Nor was there much to indicate that he appreciated the magnitude of the crisis facing the euro or the case for drastic action to tackle it.

Many analysts argue that the euro’s difficulties are beyond resolution by any one member. But Italy is crucial. It is the biggest country on the euro zone’s troubled southern flank, and its €1.8 trillion ($2.6 trillion) borrowings dwarf those of any other country in the single currency."

Ilargi: British think tank CEBR (Centre for Economics and Business Research) is about as clear as can be, reports the BBC:

Italy ‘to default’ but Spain may ‘just’ escape

Debt-laden Italy is likely to default, but Spain might just avoid it[..]

With the countries weighed down by debt, the think tank modelled "good" and "bad" economic scenarios for both. It found that Italy will not avoid default unless it sees an unlikely big jump in economic growth. However, it said, "there is a real chance that Spain may avoid default".

Even though Italy has managed to run tight budgets, and has vowed to eliminate its deficit by 2014, the economy needs a significant boost in growth. But its economy grew by just 0.1% in the first quarter of 2011 and further growth is expected to remain sluggish.

[..] In a report published on Thursday, the CEBR calculated that Italy’s debt would rise from 128% of annual output to 150% by 2017 if bond yields stay above the current 6% and growth remains stagnant. "Even if the cost of borrowing goes back down to 4%, the growth rate is so anaemic that we see the debt-GDP ratio remaining at 123% in 2018," said Doug McWilliams, the CEBR’s chief executive.

The conditions in Spain are better because its debt is much lower. Even under the "bad" scenario, Madrid’s debt ratio would climb to no higher than 75% of national output. "Fingers crossed but there is a real chance that Spain may avoid default and debt restructuring, unless it gets dragged down by contagion," Mr McWilliams said. "Realistically, Italy is bound to default, but Spain may just get away without having to do so," he said.

If the ECB refuses to even try and rescue Italy, and a major economic think tank bluntly states that it cannot be saved no matter what, I’m thinking that people like Roberto Perli and Willem Buiter have simply not caught up with reality. Not that I see Buiter admit to anything like it, mind you. People like him can argue until the end of time that if only, if only, if people would just have listened to them, things would have been much better.

It’s like Paul Krugman or Robert Reich in the US: economists are people who cling to faith-based arguments, who in this case believe that if Europe or America would spend all of their children’s money into a black hole of debt, those children would greatly benefit. It’s all just conjecture, conveniently omitting facts like a few hundred trillion dollars in debt here and there. "If only we would spend, then we would certainly grow!". No, there is no such certainty.

What is certain is that the Economist list of European politicians in election trouble, José Sócrates, José Luis Rodríguez Zapatero and George Papandreou, will grow rapidly, and increasingly so. This would lead to additional problems in solving issues: whichever "leader" you talk to in a given country, may be gone tomorrow. Argentina in its early 2000’s crisis had 5 different presidents in 2 months, or something along those lines.

That is the sort of volatility we will see come to Europe, in particular the Mediterranean, going forward. It’ll be chaotic, volatile, and it will lead to a lot of societal unrest. But none of it will make the financial problems go away.

And that brings us to another theme I touched on in The Next Bank Bailout Bloodbath is Here, and arguably the most important one of all. Derivatives. Credit default swaps on PIIGS debt. Yes, there will be credit events, and so, yes, counterparties will demand payments. And since the majority of swaps have been issued by American institutions, these will either go belly-up or either the American government or the Federal Reserve must step in.

However, given the numbers -JPMorganChase’s derivatives exposure is estimated at about $90 trillion- the Fed will in the end be as helpless and useless in this situation as the ECB is with regards to Italy.

If financials keep on losing stock value the way they have in the past few days, we are well on our way to bank holidays in some countries (Italian trading was temporarily halted yesterday). And where there are bank holidays, bank runs are not far behind: if people see the stock prices of their banks evaporate, why would they keep their money in them?

Yes, you can enjoy the relative calm provided by the US jobs report that wasn’t as bad as feared, for a few hours today. But the U3 rate is still 9.1%. And no economy with that many jobless people will show substantial growth; it won’t even be able to stand still to recover. And this bank rot won’t go away by itself anymore. BofA and Citi are already losing 3% and 4% respectively again at 11 am EDT (UPDATE: make that 5.5% and 6.5% at 11.35 am. Yikes!) [UPDATE 2: each some 8% at noon].

The debt must be flushed, and we’re not doing it. Here’s hoping that the ECB reality check will wake up a few more people before present day policies cause entire societies to descend into chaos. But here’s also thinking it’s probably too late for that.