By Andrew Butter writing at EconMatters

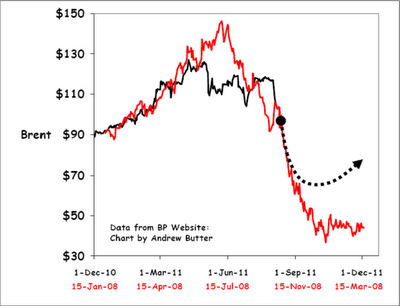

I suspect that even the most sophisticated student of Econ-101 would concede that the trajectory of the price of oil in 2008 was a bubble and that 2009 was a bust?

Not that anyone has come up with a convincing theory for what it was that pumped up the bubble or what finally popped it, outside of the old favorites such as…the insanity of crowds, terrorist plots, and Goldman Sachs.

The dynamics of the price in 2011 are eerily similar to what happened then:

I have argued previously (a) the “correct” price for oil at this juncture is about $90 (b) that according to Farrell’s 2nd Law the bust will be a mirror of the over-pricing at the top of the bubble…127/90 = 1.41…so the bottom of the bust will be…90/1.41 = $64…(c) the main cause of the blowing of the bubble in 2011 was the conflict in Libya (d) the “pop” was going to happen on 30th April 2011.

Let’s see what happens next…

Read more here: Crude Oil Falling Off A Cliff: A 2008 Redux? (Guest Post) | EconMatters.