A least we HOPE (not a valid strategy) it’s the bottom!

A least we HOPE (not a valid strategy) it’s the bottom!

Holy cow, what a mess the World has become in the past 7 days. It’s amazing how the markets can ignore everything for two whole weeks and then freak out about the same exact stuff they freaked out about last time for another week and undo all of the progress of those two weeks.

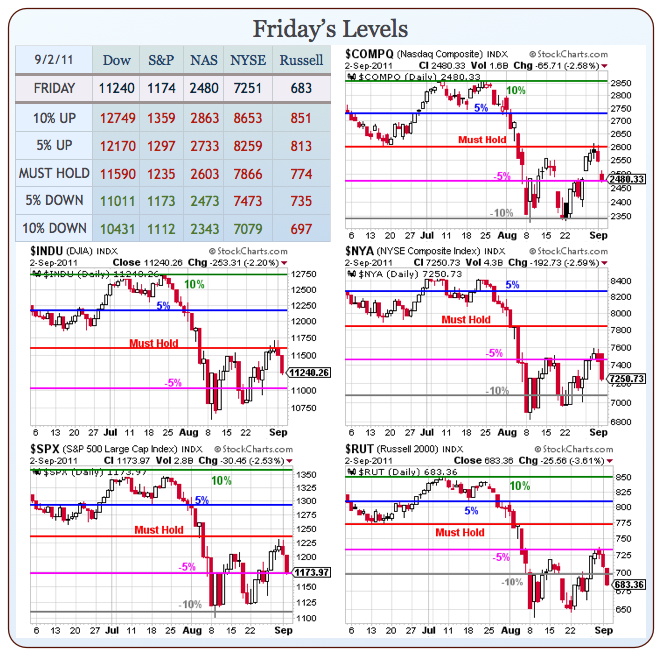

While we were on top of things, nailing the turn last Wednesday, we weren’t that aggressive on our downside betting as we thought those -10% lines would hold up without much trouble. Today we’ll find out if we’re right or wrong but yesterday it looked like we were wrong already as Europe plunged about 5% in one day while the US markets were closed.

All kinds of crazy stuff has been going on, including the Dollar rising to 75.53 WHILE GOLD IS GOING UP TO $1,900. So what happens now if the Dollar goes back to 74 (down 2%) – that could be enough to lift gold over that magical $2,000 mark. And why not – investors are fleeing every other kind of asset except, of course for German, US and Japanese bonds. What a perfect scam the industrialized nations are running – able to borrow infinite amounts of money at virtually no interest despite their own insane debt levels – this could not have gone better if they had centrally planned it!

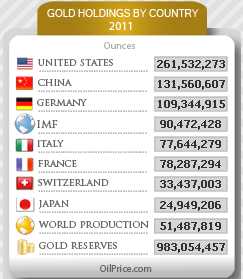

Don’t forget that Governments and their Central Banks have lots and lots of gold. In fact, the US has over 8,000 tons of gold, now worth about $500Bn, China 4,000 has tons while Germany has 3,500 tons, the IMF 3,200 tons, Italy (yes, Italy) 2,800 tons, France 2,700 tons… Where do people think that GLD is getting all it’s gold? That fund is growing at a rate faster than gold is being pulled out of the ground – those bars have to come from somewhere and I would not be surprised if our wise Central Bankers are going to pay off a little debt with some of that shiny stuff they have laying around.

Don’t forget that Governments and their Central Banks have lots and lots of gold. In fact, the US has over 8,000 tons of gold, now worth about $500Bn, China 4,000 has tons while Germany has 3,500 tons, the IMF 3,200 tons, Italy (yes, Italy) 2,800 tons, France 2,700 tons… Where do people think that GLD is getting all it’s gold? That fund is growing at a rate faster than gold is being pulled out of the ground – those bars have to come from somewhere and I would not be surprised if our wise Central Bankers are going to pay off a little debt with some of that shiny stuff they have laying around.

Switzerland also has plenty of gold (1,200 tons) and it’s the Swiss that are yanking the markets today with a MASSIVE currency intervention in which the Swiss National Bank has announced this morning that they will buy "unlimited" quantities of Euros to keep the EUR/CHF trade at 1.20. Interestingly, that means the Swiss will find themselves printing money and buying Euros, which they will then invest back in Germany and France’s bonds so, once again, those Central Banks win – isn’t this starting to get interesting?

Overnight deposits at the ECB jumped to €166.85B ($235.23B), reaching their highest level in more than a year as banks show increasing nervousness about the EU debt crisis. The figure was up from a 2011 peak of €151.1B on Friday. EU shares had turned briefly positive following the SNB intervention but are back to flat to down at 8:30 and that’s not good with the CAC under 3,000, the DAX at 5,230 and the FTSE at 5,116. For the DAX, 5,250 is a line that has not been crossed since July of 2009, when it market the early stage of a rally that took them to 7,600 in May of 2011 (up 44%). The 2,350 point drop back to 5,250 is "only" 30% of 7,600 and this is where we went long on EWG a few weeks ago, catching a 10% recovery. It looks like we can get $1 for selling the EWG Oct $18 puts and buy 2 Oct $18/19 bull call spreads for .65 each and that’s net .30 on the $2 spread, so a 566% upside potential if EWG can hold $19 through October expiration (45 days) and the worst case is we have a long on EWG at net $18.30.

What if we fail to hold our levels though? Our favorite disaster hedge, EDZ, is now getting away from us for new entries – up around $23.50 already, which is up 15% since Thursday, when our Disaster hedge was the Oct $19/23 bull call spread at $1, selling the $17 puts for $1.15 and that trade is already 100% in the money, on the way to a 2,766% gain off the .15 credit entry. I hate to chase but I love to layer and we could add the Oct $22/26 bull call spread at $1 but I’m not keen on selling EDZ puts at higher strikes so we’ll look for some nice stocks we can sell puts against in Member Chat this morning. Of course, just the bull call spread pays 300% if it finishes in the money and, for most traders, that’s a nice return – we’re just spoiled!

What if we fail to hold our levels though? Our favorite disaster hedge, EDZ, is now getting away from us for new entries – up around $23.50 already, which is up 15% since Thursday, when our Disaster hedge was the Oct $19/23 bull call spread at $1, selling the $17 puts for $1.15 and that trade is already 100% in the money, on the way to a 2,766% gain off the .15 credit entry. I hate to chase but I love to layer and we could add the Oct $22/26 bull call spread at $1 but I’m not keen on selling EDZ puts at higher strikes so we’ll look for some nice stocks we can sell puts against in Member Chat this morning. Of course, just the bull call spread pays 300% if it finishes in the money and, for most traders, that’s a nice return – we’re just spoiled!

In case you thought yesterday was a holiday, make sure you read Monday’s post, where we talked about how to use leverage to hedge risk as well as some trade ideas on BCS and XLF – both of which will give us MUCH better entries today than the prices we were using from Friday’s close (as expected).

I also did a review of our trade ideas since the August 19th bottom and, right now, we are back where we were on the 19th so, if you don’t have time to read that whole post, at least read the summary from our Range Trading Review as there’s no point in identifying a trading range if we don’t take the time to study and review how best to play it, right? I am, however, LESS enthusiastic to buy things now than I was on the 19th as we have broken our overall pattern and now it looks more like the August highs may have been nothing more than a weak bounce as we consolidate for a move BELOW our -10% lines. Now we’ll have to be convinced that is not the case as our "Dead Cat Indicator" has flipped from the left to the right side of the bounce in the past two weeks:

As I said yesterday, with TLT at $114 and GLD at $185 and BCS at $9.50 and XLF at $12 (FAS below $12!), we are clearly trading at irrational levels but, also as I said yesterday (and Keynes said 100 years ago): "Markets can remain irrational a lot longer than you or I can remain solvent." So let’s not go too crazy and maintain our Cashy and Cautious stance (see our cool, new allocation indicator in this week’s Stock World Weekly). If anything, we are a bit too bullish (20%) unless we hold our line at Dow 11,000 and the Nasdaq can hang on at 2,473, then we’re going to have to add to our 15% bearish allocation because HOPE is NOT a valid strategy!

We can play gold $2,000 by picking up the Oct $185/195 bull call spread at $3.15, selling ABX 2013 $35 puts for $2.20 for net .95 on the $10 spread. Rather than spending $3,700 on two ounces of gold, you can commit to owning 100 shares of ABX for net $35.95 and, if gold shoots up to $2,000 and holds it through October expiration, 2 bull spreads you can buy with the cash should hit $1,000 each for a $1,905 profit (2,005%). If you had $3,700 worth of gold, gold would have to rise to $2,800 to make the same profit! This is a good rollover trade from our last bullish gold play on the 24th which, as noted in the weekend review, is already up 225% (maybe more this morning) so we can set stops on that one and use the new trade to ride the continued craziness.

We can play gold $2,000 by picking up the Oct $185/195 bull call spread at $3.15, selling ABX 2013 $35 puts for $2.20 for net .95 on the $10 spread. Rather than spending $3,700 on two ounces of gold, you can commit to owning 100 shares of ABX for net $35.95 and, if gold shoots up to $2,000 and holds it through October expiration, 2 bull spreads you can buy with the cash should hit $1,000 each for a $1,905 profit (2,005%). If you had $3,700 worth of gold, gold would have to rise to $2,800 to make the same profit! This is a good rollover trade from our last bullish gold play on the 24th which, as noted in the weekend review, is already up 225% (maybe more this morning) so we can set stops on that one and use the new trade to ride the continued craziness.

Keep in mind I still don’t think gold will keep going higher but I’ve certainly been wrong about that one before and, since the downside on that trade is owning my favorite gold miner for 32% off the current price – I think that’s a hedge we can live with!

We’re not trying to be heroes out there – this is a wonderful time to be in cash and just watch the carnage from the sidelines. We get ISM Service data at 10 and Fed speak at 1pm. Tomorrow we get the latest Beige Book and then not too much excitement this week other than Obama’s speech on jobs, now moved to Thursday at 7pm, after Wednesday’s Republican debates and AFTER Bernanke’s speaks at 1pm that day.

Hopefully we hold our levels today and things get more sane — hopefully.