Here we go again!

If this game feels familiar to you it’s because this is the 6th time in 8 weeks that we’ve made a run at S&P 1,200 with only 3 of those attempts being successful and none of those lasting more than a couple of days before busting again. That being the case, you will have to forgive me for being a little cynical just 2 days after I went bullish and called a bottom. It’s not that I’m flip-flopping – we’re simply playing the range and if the trip from the bottom to the top of the range is just 2 days – then flip-flop we must!

Of course we’re going to give the S&P a chance to prove us wrong but we’ll also be bargain-shopping on the bear side into any weakness so we’ll be setting some aggressive targets for today – 2.5% moves up at least to Dow 11,300, S&P 1,200, Nas 2,575, NYSE 7,100 and Russell 685 to keep us believing in the rally fairy. The Russell finished at 666 exactly, which was my target for the day from Monday’s Member Chat and also the mark of Lloyd, a great indication that the TradeBots are on the march and in control. The Dow and the Nasdaq made it our -5% levels on the Big Chart and the S&P should confirm that line this morning but we need to see the NYSE and Russell join the party at our targets or we’re just repeating the same old range.

It’s still the squeaky Greece wheeling around the Global markets with each twist and turn in this fiasco sending investors flying in and out of various assets. The WSJ saves me writing time this morning with their "Euro Zone Primer: Where Things Stand" and David Fry does an excellent job summing the situation up even further, saying:

It’s still the squeaky Greece wheeling around the Global markets with each twist and turn in this fiasco sending investors flying in and out of various assets. The WSJ saves me writing time this morning with their "Euro Zone Primer: Where Things Stand" and David Fry does an excellent job summing the situation up even further, saying:

IMF head Christine Legarde held a news conference which was frankly useless but typical as these things go. Her most significant answer came from a question posed by a Greek reporter: “What will the IMF do with these demands should there be great social unrest in Greece?”

Her response: “Implementation, Implementation, Implementation.” (This statement meant previous agreements must be taken seriously.) The WSJ was kind enough to post a description of just what’s going on as to the calendar and conditions in simple terms. The three primary Greek agreements include slashing pensions (“implementation” = riots); cutting public sector jobs (“implementation” = bloodshed) and raising taxes on the poor (“implementation” = all out war). Further, whatever actions are to take place will be strung out over the next few months as in “buying time”. The odd thing is so-called “Troika” is going to give Greece its October payment even with the likelihood they may not get any more money in November.

How ridiculous does that sound? What kind of rinky-dink Government runs their economy this way? Oh yes, OURS! Much like the Trioka – the US Senate had to perform their own stop-gap funding measure to keep the lights on in our own country as they almost unanimously approved (79-12) a bill last night to fund the US Government through November 18th and that’s 3 days longer than Greece has so – in your face Papandreou – USA, USA, USA!!! That right, with the ridiculous Government that we have, we will celebrate whatever small victories we may get.

Before you think that there was some kind of compromise in our Capital though, you should know that the major sticking point was that the Republican’ts wanted to strip funding from FEMA because, as everyone knows, disaster relief should be handled by the private sector.

Before you think that there was some kind of compromise in our Capital though, you should know that the major sticking point was that the Republican’ts wanted to strip funding from FEMA because, as everyone knows, disaster relief should be handled by the private sector.

Surprisingly the Democrats actually found this to be an issue they could finally put their foot down on – and we’ve been at an impasse over whether or not helping people who have had their homes destroyed by natural disasters was or was not something Governments should do. As I said, no compromise was reached – it was FEMA themselves who ended the debate by saying "F U, you petty sons of bitches – we have enough money to last the year without you." That may not be an exact quote but you get the gist of it.

Now before we get too excited, the Senate was only able to approve a stop-gap measure to keep us funded through October 4th BECAUSE the HOUSE recessed without voting to fund the Government. That’s right, those bastards actually went on vacation and left a Government shut-down up in the air for a Budget that ends on Friday. The drama recommences on the 4th as the House has one day to approve the Senate extension for the next 5 weeks and then we start this nonsense all over again.

"If it weren’t for House GOP efforts (of going on vacation without voting for a budget), the American taxpayers would have been on the hook for even more reckless borrowing by Washington Democrats," Michael Steel said in a written statement on behalf of House Speaker John Boehner. In the Senate, Republicans were pleased that the compromise included EVEN LESS disaster-aid funding than the bill passed by the House.

This has been an especially expensive year for FEMA, with a record number of federal disaster declarations, including severe flooding along the Mississippi and Missouri rivers, deadly tornadoes, wildfires in Texas, and floods along the Eastern Seaboard this month in the wake of Hurricane Irene and Tropical Storm Lee. Late last week, the emergency agency feared it could run out of money as early as Tuesday. But spokeswoman Rachel Racusen said Monday afternoon that FEMA’s disaster-relief fund still had $114 million left. Let’s just all pray that nothing bad happens anywhere in America for the rest of the year and everything should be fine…

This has been an especially expensive year for FEMA, with a record number of federal disaster declarations, including severe flooding along the Mississippi and Missouri rivers, deadly tornadoes, wildfires in Texas, and floods along the Eastern Seaboard this month in the wake of Hurricane Irene and Tropical Storm Lee. Late last week, the emergency agency feared it could run out of money as early as Tuesday. But spokeswoman Rachel Racusen said Monday afternoon that FEMA’s disaster-relief fund still had $114 million left. Let’s just all pray that nothing bad happens anywhere in America for the rest of the year and everything should be fine…

Idiots? Morons? Psychopaths? We report – you decide.

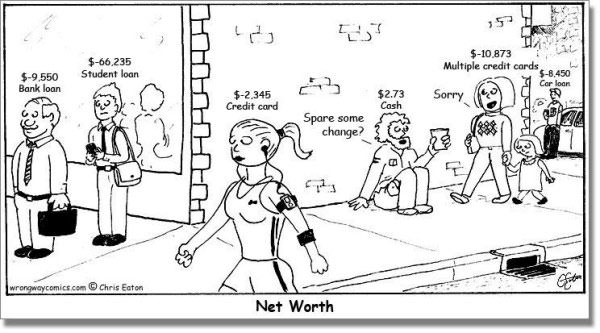

How much crap will the American people take before they WAKE UP? Bloomberg reports that Household Net Worth fell by $149Bn in Q2, a 1% annualized drop to $58.5Tn led by a loss of $947Bn in real estate assets over the past year. The erosion in wealth, which remains below pre-recession levels, and a stagnant job market may prompt Americans to keep trimming debt and rebuild savings, limiting the spending that accounts for 70 percent of the economy.

“Households’ ability to spend is being constrained,” said Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia. “Consumers are just tired to death of seeing the value of their homes fall.” The decline in wealth “provides the argument for long-term stagnation in consumer spending.”

Fortunately (for us) the $149Bn of net worth that was lost by the bottom 99% was almost entirely transferred to the top 1% as Financial Assets improved by $139Bn. House Speaker John Boehner pledged to spend as much money as it takes to find out what happened to that other $10Bn and make certain it goes to the "job creators," who shipped 350,000 US jobs overseas in Q2. Meanwhile, as Boehner digs around in the wallets of the bottom 99%, looking for loose change, consumer continued to borrow to stay afloat – racking up a 3.4% increase in Consumer Credit. We’ll see how confident those consumers are in today’s 10 am report on the subject.

Meanwhile, our Corporate Masters had a record $2,050,000,000,000 of cash on their balance sheets, up $90Bn in 3 months – which represents $90,000,000,000 removed from circulation in our economy which translates into the 3-month payroll for 7.2M people at $50,000 a year. This pace of Corporate Profit expansion has now kept up for 10 straight quarters as Government Bail-Outs go straight into the vaults, completely bypassing any possible benefit to US workers.

The really good news is that those Corporations are making record campaign contributions to the Republican Party – to make sure no one rocks the boat in either of the upcoming elections so we can look forward to 4 more years of wealth extraction.

While 96% of the President’s donations are in amounts of $250 or less, only 6% of Mitt Romney’s contributions fall into the category of "small donations." That is allowing the GOP to crow about how "loved" Romney is because, of course, their only measure of love is money.

While 96% of the President’s donations are in amounts of $250 or less, only 6% of Mitt Romney’s contributions fall into the category of "small donations." That is allowing the GOP to crow about how "loved" Romney is because, of course, their only measure of love is money.

That’s a good thing as Romney got his ass handed to him by McCain in the vote department, collaring just 34% of the Republican vote in the last cycle compared to 42% for McCain. Fortunately for Romney, we don’t have John McCain to kick around anymore and Rick Perry managed to scare even his GOP supporters away in the last debate so it looks like it will be Romney Care vs. Obama Care in 2012.

CNN reports that a record 15.4M suburban residents in the US are now living below the poverty line – an 11.5% increase (1.7M US Citizens) over last year. Since 2000, the number of suburban poor has skyrocketed by 53%, battered by the two recessions that wiped out many manufacturing jobs early on, and low-wage construction and retail positions more recently. The suburban poor are catching up in numbers to the 18M rural poor and have pulled way ahead of the 12.7M city folk who live below the poverty line in the wealthiest country on Earth. "We think of poverty as a really urban or ultra-rural phenomenon, but it’s not," said Elizabeth Kneebone, senior research associate at Brookings. "It’s increasingly a suburban issue."

15.4% of US households (1 in 6) are now living below the poverty line of $22,314 for a family of 4. They still pay about $3,000 worth of FICA taxes on that $22,314 but they are included in the Republican count of the 45% of households who pay no taxes. Another 15% of non tax-payers are Sub Chapter S Corporate households that declare losses for the year. Most of them have garages that are bigger than the homes of the 15.4% of the genuine poor. The rest of the non-tax payers are mainly retired people, also with no taxable income and, of course, cheats – which is why the Reps dropped that talking point as it turns out those cheats are very big contributors and don’t want the attention drawn to them in the debates.

The genuine poor make up 46.1M of the 49.9M uninsured in this country, but in the words of Ebeneezer Scrooge:

If they are going to die, then they had better do it quickly and decrease the surplus population. Good night, gentlemen.