Can we end the week with a bang for a change?

Can we end the week with a bang for a change?

Google had tremendous earnings last night (10% beat) and that has the Futures flying (along with AAPL’s IPhone 4S release, which has, as usual, lines around the block to buy their product on the first day). We already made some quick futures money in Member Chat, shorting the Nas (/NQ), Dow (/YM) and Oil (/CL) at 6am in Member Chat. Why go short – just because we had a silly pre-market run-up and we wanted to lock in gains – now it’s 7:30 and we’re done – waiting and seeing how things go into the open.

Futures trading is very useful for locking in pre-market gains but you have to be very careful or it’s just as easy to blow them and, as we demonstrate in Las Vegas Sunday Night – the futures markets are clearly a load of manipulated BS – especially in thin after-hours and pre-market trading. Fortunately though, that’s fine with us as one of the main lessons at PSW is "We don’t care IF the market is rigged, as long as we can figure out HOW the market is rigged and place our bets accordingly."

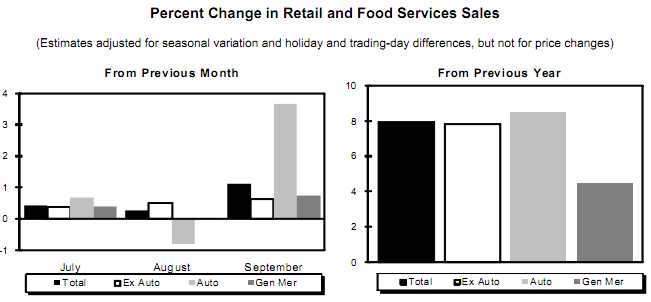

The news we didn’t want to risk the futures on comes up at 8:30, as we get the Retail Sales Report for September and not much is expected after a very weak August, where Auto Sales really dragged us down with a 0.2% drop and there was nothing sexy about the other items either. Still, one thing people fail to grasp when looking at these charts is that the numbers are in MILLIONS, not thousands – so August 2011 was $389,502,000,000 in total sales and up $26Bn from last August. That’s a pretty healthy pace of $4.6Tn in just Retail and Food Services – what recession?

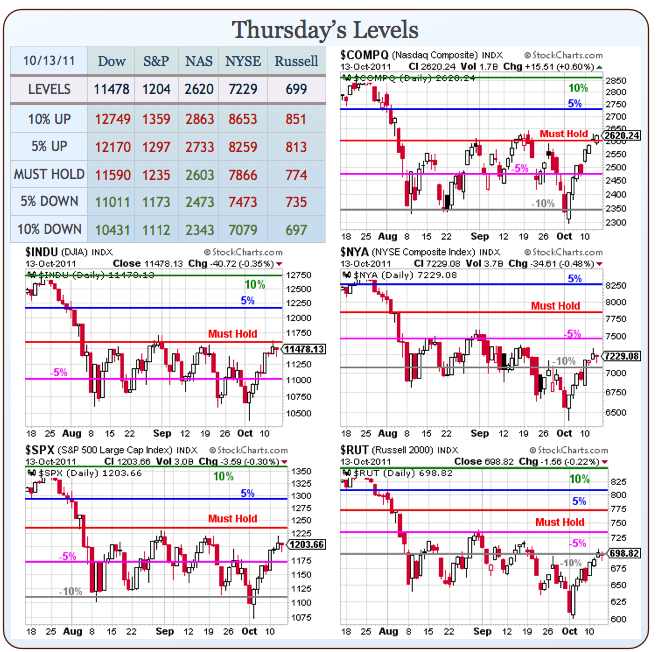

As you can see from David Fry’s chart, we probably need to work off some overbought conditions before we can have a proper rally. Also, in an early Alert to Members this morning, we looked over our updated Big Chart and determined it was very unlikely that we will hit the levels we need to go bullish into the weekend so we are already planning to short the Nasdaq into the morning pop to put us neutral into the weekend with a 15/15 allocation (short-term positions, of course).

As you can see from David Fry’s chart, we probably need to work off some overbought conditions before we can have a proper rally. Also, in an early Alert to Members this morning, we looked over our updated Big Chart and determined it was very unlikely that we will hit the levels we need to go bullish into the weekend so we are already planning to short the Nasdaq into the morning pop to put us neutral into the weekend with a 15/15 allocation (short-term positions, of course).

SQQQ is always fun to play at the $20 line and a hedge that makes sense there is the Oct $21/21 bull call spread at .30 and the Nov $21/22 bull call spread for .30 offset with the sale of the CHK Nov $23 puts for .65.

This trade is a net .05 credit on a $2 spread and CHK is not strongly correlated to the Nasdaq but is very unlikely to drop 10% (now $26.85) if the markets remain strong so – if the short play does not play off, this hedge is not likely to cost anything.

When we take bullish offsets to our bearish hedges, it’s because we are still on our bullish premise (hence our already successful TNA trade idea from yesterday’s post) – otherwise we could always be more aggressive and short the same SQQQ puts but, at the moment – we are still HOPING (not a valid investing strategy) that we finally get over those Must Hold levels on our Big Chart:

8:30 Update: Looking good for the bulls as Retail Sales posted a way better than expected (by "experts", not us) 1.1% gain for September and up 0.6% ex-auto, which is 50% better than forecast by leading Economorons. Import prices were 200% higher than Economoron forecasts (why do they even bother asking them?) and that’s pretty darned inflationary – as was China’s MoFo September CPI of 6.1% (but within 1.6% of their forecasts!) with a whopping 13.4% year/year food inflation rate. This makes it sort of hard to imagine China will pull back on their tight policies anytime soon. Euro-zone inflation was also accelerating – up 3% and much higher than August’s 2.5% pace. Again I must ask – what Recession?

Perhaps this is the dreaded "stagflation" but who cares for now as this should slam TLT down to the mats and give us the goose to the indexes we looked forward to shorting this morning. Even oil should get a nice pop and finally we have a good entry to our usual end-of-cycle USO puts. Hopefully, we’ll be able to pick up the November $32 puts for close to $1 (was $1.50 at the close) if oil gets to $86.50 on a move up. The declining VIX should help give us a discount on the 35-day puts.

Over in Europe (remember them?) Spain’s credit rating was cut by the S&P but no one seems to care and EU markets are up about 1.25% ahead of our open – about the same as our futures are looking. We’ll see if Europe can hold their gains for an early clue (11:30) as to whether we’re likely to hold ours but I’d expect a bit of profit-taking into the close. Berusconi won his confidence vote so once again the bearish rumors are quashed as we anxiously await their next prediction du jure for how the EU is about to unravel.

Over in Europe (remember them?) Spain’s credit rating was cut by the S&P but no one seems to care and EU markets are up about 1.25% ahead of our open – about the same as our futures are looking. We’ll see if Europe can hold their gains for an early clue (11:30) as to whether we’re likely to hold ours but I’d expect a bit of profit-taking into the close. Berusconi won his confidence vote so once again the bearish rumors are quashed as we anxiously await their next prediction du jure for how the EU is about to unravel.

It looks like we’re in for an exciting finish to the week. Dow 11,590 must hold but, as I said, it’s very doubtful we’ll want to stay bullish into the weekend and we’ll be looking to use this Nasdaq rally to hedge back to neutral as we await more earnings data.

Quote of the day from Barry Ritholtz:

“I’ll believe corporations are people when Texas executes one.”

-Seen at Occupy Wall Street rally.

Have a great weekend,

– Phil