What a mess!

What a mess!

In quantum mechanics, the Heisenberg uncertainty principle states a fundamental limit on the accuracy with which certain pairs of physical properties of a particle, such as position and momentum, cannot be simultaneously known. In other words, the more precisely one property is measured, the less precisely the other can be controlled, determined, or known.

That’s what’s going on in the markets recently, as soon as we know the outcome of one thing, the outcome of other things in reaction to it becomes a new thing to worry about. The EU passed the EFSF and all seemed well for 2 days but then the Greeks, now certain that further austerity measures would be asked of them, said perhaps (58% of those polled) they don’t want a bailout at that cost.

Now the banks, who nicely "volunteered" to take 50% haircuts on their debt are faced once a gain with the REAL ISSUE, which is that an INvoluntary default by Greece (and the country rejecting the package and defaulting would seal that deal) would trigger $500Bn worth of Credit Default Swaps, the majority of which are insured by Gang of 12 Members in the TBTF Club like GS, MS, CS, DB, BAC, JPM, C…

Guarantees provided by U.S. lenders on government, bank and corporate debt in those countries rose by $80.7 billion this year alone to $518 billion, according to the Bank for International Settlements. Almost all of those are credit-default swaps, said two people familiar with the numbers, accounting for two-thirds of the total related to the five nations, BIS data show.

Guarantees provided by U.S. lenders on government, bank and corporate debt in those countries rose by $80.7 billion this year alone to $518 billion, according to the Bank for International Settlements. Almost all of those are credit-default swaps, said two people familiar with the numbers, accounting for two-thirds of the total related to the five nations, BIS data show.

MF Global Holdings Ltd. (MF), is/was a broker-dealer run by former Goldman Sachs co-Chairman Jon Corzine – so we can assume GS has a similar formula for offsetting their CDS exposure. MF reported $1 billion of net exposure to Spain and $3 billion to Italy in its second- quarter financials, explaining in a footnote that the net was partly due to a short position on French bonds. Those hedges weren’t enough to protect MF Global, which filed for bankruptcy yesterday after losses in the portfolio wiped out its capital. Keep in mind Lehman, Merrill and Bear Stearns assured us to the last moment that they were "just fine."

So more scary stuff for the banks who pretend to be insurance companies – only without all those silly reserves against losses that insurance companies would be required to have.

So more scary stuff for the banks who pretend to be insurance companies – only without all those silly reserves against losses that insurance companies would be required to have.

Oh wait, they do have reserves – it’s called your wallet. As members of the TBTF Club, it is vital to your well-being that Goldman Sachs does not suffer losses from insuring $500Bn worth of debt with money they didn’t have. That’s what we did with TARP1 (and it gets a one now because there will certainly be another if this hits the fan) and it will be the same dire emergency that will lead to TARP2.

That, in a nutshell, is what we fear this week. Will the IBanks let things go that far or will they just GIVE Greece $50Bn to pay off a year’s worth of debts so the whole thing can go away for 12 more months? Either way, what’s another $500Bn between friends?

Is it going to affect how many IPhones get bought in Q1? Will people drive less or eat less or wear less clothes because GS goes under or will we dance on their graves and reinstate Glass-Steagall to make sure this doesn’t happen again (or at least until the next time Republicans take over and roll back all the sensible controls on banking and insurance).

The banks stopped lending people (the bottom 99%) money two years ago. They could all fold up tomorrow and as long as the Government prints some funny money to backstop the deposits, I doubt anyone in the bottom 99% would really care. As members of the investing class, we tend to have an overinflated view of the value of the Financial Community in the overall economy. While we view it as an engine of wealth creation – the majority of people in this country see nothing but bill collectors. Sure the Banks did loan them money once – but that was years ago in a relationship that has long since soured and become very one-sided – even abusive…

f

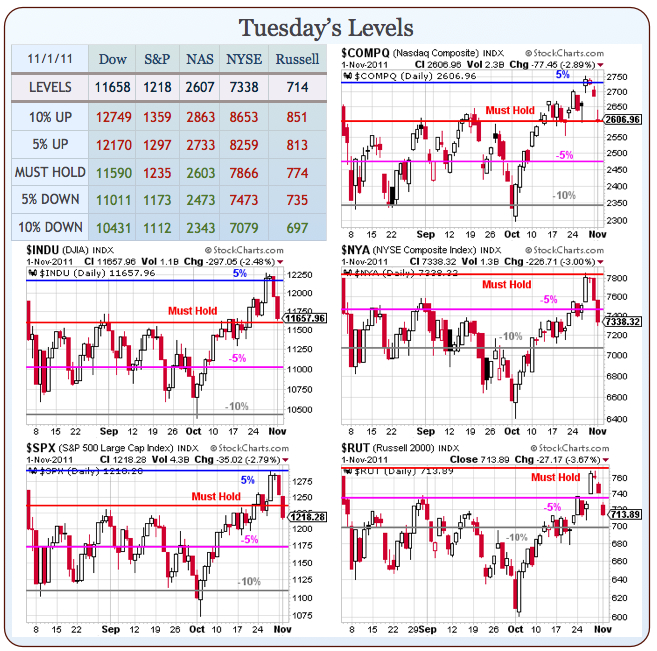

Today we are getting a slight pop in the futures on hopes that the Fed will be kind to us this afternoon and that has worked out perfectly with our plan from yesterday’s post to get a bit more bullish on yesterday’s plunge but it’s a very cautious bullish as we wait to see if our levels can be re-taken before too much technical damage is done.

Yields on Italian debt are back on the rise, with 10-year notes now fetching 6.25% as the Bank of Italy denies a report that it’s planning emergency intervention, possibly with the BOI buying short-term bonds from the banks in exchange for their commitment to buy the Government’s long-term debt.

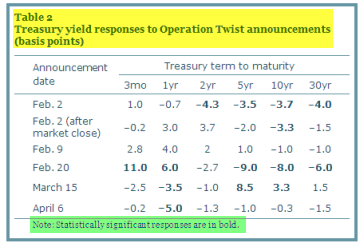

Man, Italy must be in BIG TROUBLE to resort to that kind of desperate, TWISTED strategy – imagine investors being so stupid as to let that sort of blatant manipulation by their Central Bank comfort them – they would have to be complete morons, right???

Man, Italy must be in BIG TROUBLE to resort to that kind of desperate, TWISTED strategy – imagine investors being so stupid as to let that sort of blatant manipulation by their Central Bank comfort them – they would have to be complete morons, right???

As Italian borrowing levels become unsustainable, Silvio Berlusconi calls an extraordinary cabinet meeting for this evening to discuss further economic measures. These would reportedly include unpopular taxes on bank accounts and real-estate. Thank goodness we live in a country where unpopular taxes are never assessed because, as we know, we never have to do anything we don’t like and there will never be any consequences. Come on, sing "I’m Proud to be an American" with me!

It’s all about the handouts today and the Fed Statement comes out at 12:30 with Bernanke speaking around 2pm and that’s what the bulls are hanging their hats on. We’ll need a strong indication of QE3 at least being planned or we’re back to bearish – watching our levels closely, of course – none more so than the Dollar, which needs to stay below 77 to keep the pre-market magic going.