Papandreou is trying to convince us he almost destroyed (the) Universe to get my consent. – Opposition leader Antonis Samaras

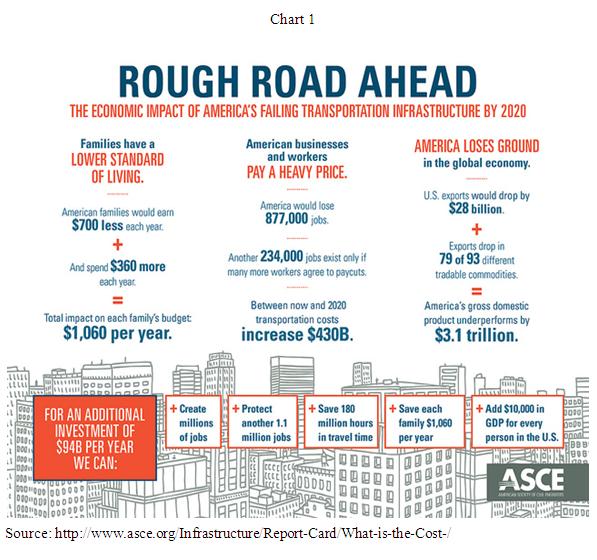

Ah the old "destroying the universe" ploy. It's the same one the Republicans are using in the Senate as they once again kill Obama's $60Bn infrastructure program that was meant to provide direct aid for highway and rail projects and set up an infrastructure bank. Without 60 votes, bills can't even make it to the Senate floor so nothing gets done.

This is ironic because, on the same day, China APPROVED another $160Bn of infrastructure spending – just to build new underground subway systems in 28 cities by the end of the decade – creating millions of Chinese jobs, lowering transportation costs and laying the foundation for continuing to kick our asses in the 21st Century. So, to be fair, the Republicans aren't destroying the Universe to advance their political agenda – just America.

Meanwhile, China's subway plans are coming AFTER they have developed the World's largest high-speed rail lines to connect to their World class shipping ports so goods can now be whisked around the country in a cheap and efficient manner while the knuckle-draggers in Congress debate whether or not it's worth fixing the potholes that are ripping the tires off trucks on our nation's roadways.

You don't make a nation great by talking about how great we are – you make a nation great by building a great nation and we are doing almost the exact opposite – squandering what once seemed to be an insurmountable lead in education, transportation, utilities, health care, housing and even environmental progress – and turning America into what is now one of the lowest-ranked developed nations in each of those categories.

Rather than employ millions of people to maintain our infrastructure, we allow it to decay and ship our manufacturing and jobs overseas to Nations that are willing to invest in their future and that leads to trade deficits that suck hundreds of Billions of additional Dollars out of our economy along with the hundreds of Billions of Dollars we ship overseas every year to pay for our addiction to oil because, for 40 years now – our Republican leaders have told us it's too difficult to kick the habit. Vote these fools in again and we're doomed – that's all I have to say about it. Fail to give Obama the majority he needs to get this country back on track and we're doomed. That's right, DOOMED!

In more bad new for the Republicans, 50M of the bottom 99.9% woke up this week and made a commercial telling them it's time to look elsewhere if they want to balance their budgets on the backs of the poor. Like the man said, they are 50M seniors who EARNED their benefits and every time these jackasses pontificate in their debates that our nation's retirees are holding their hands out for entitlements, as if there were no promises made to them by the "job creators" for the past 40 years, they just push more and more people over the picket line.

8:30 Update: Speaking of our "job creators," America only added 80,000 jobs in the month of October with unemployment (as undercounted by the Government) still at 9%. This is what we expected as we stayed a bit bearish into yesterday's rally and ahead of the weekend but we blew it with oil puts (USO) and took a quick loss there and I imagine we'll be lucky to get even on our QQQ puts, which were a bit too aggressive, perhaps with today expirations.

8:30 Update: Speaking of our "job creators," America only added 80,000 jobs in the month of October with unemployment (as undercounted by the Government) still at 9%. This is what we expected as we stayed a bit bearish into yesterday's rally and ahead of the weekend but we blew it with oil puts (USO) and took a quick loss there and I imagine we'll be lucky to get even on our QQQ puts, which were a bit too aggressive, perhaps with today expirations.

The bulls are pointing out that revisions to September were pretty good but I will point out that we got very weak consumer confidence, comfort and spending data in October so if that was the result of BETTER jobs numbers than we thought we had, then the suckiness of these numbers cannot be understated!

While the jobs report may not have been a big downer, we still may have a no-confidence vote in Greece, which is fun for chaos and then we have Groupon's (GRPN) IPO today and that may not do so well and that could send the Momo's back down on a sea of doubt. Meanwhile Canada, very surprisingly, LOST 54,000 jobs with unemployment spiking to 7.3% over there – and they have oil! Come on folks, something is wrong with the Global economy as that's like the US losing 500,000 jobs in a month.

You won't hear about Canada in the MSM because it doesn't fit the current bullish narrative but let's stay ahead of the curve and remain bearish into the weekend and until they prove they can hold those +5% lines on our Big Chart for more than a couple of days.

Of course I still like shorting oil over the weekend. We got blown out of USO puts yesterday but I love playing the futures (/CL) bearish below the $94 line ($10 per penny per contract, so be careful) as well as those USO Nov $35 puts at .67 and we'll be grabbing 20 of those in our White Christmas Portfolio.

Be very careful out there and have a great weekend,

– Phil