Courtesy of Lee Adler of the Wall Street Examiner

For now, I’ll return to looking at the seasonally smoothed data which, while not the actual numbers, should give us an idea of the trend. The MBAss stopped reporting the actual index levels about a year ago, but they still report the weekly percentage changes, so it is possible to reproduce a close approximation of their index.

Of course, if the news gets bad enough, like if purchase apps drop to new lows, they can always stop publicizing the data altogether. These are after all, the very same people who brought us the housing crisis in the first place. Things like fudging, lying, cheating, stealing, and committing fraud are part of their natural order. Getting the truth out–not so much. In fact, before joining the organization a prospective member needs to pass a sociopathy test.

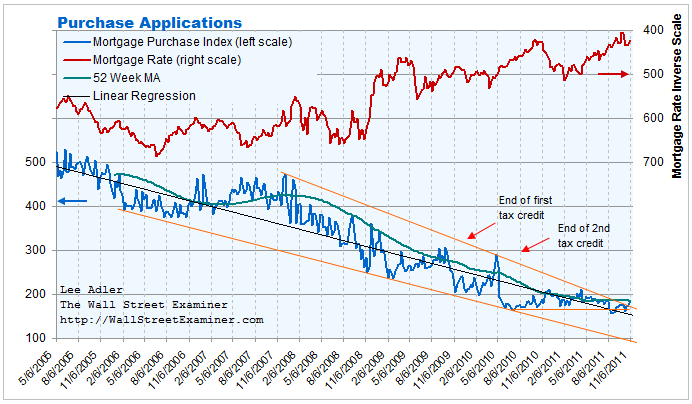

The seasonally adjusted mortgage purchase applications graph broke a long term downtrend line this week, but it remains below the one year moving average, which is flat. While the trend of purchase applications has apparently stopped weakening, it hasn’t turned up. Comparing the week ended November 4 with the same week last year, applications are down 2.9%. They remain down over 65% from the May 2005 peak. Furthermore, taking into account the 18% of deals that the NAR is reporting have recently been falling through, versus 9% a year ago, and an increase in cash deals of about 1% since last year, effectively purchases are down by around 11%.

That’s not the news the housing industry wants to hear, and certainly not news it wants potential market participants to hear. So organizations like the MBASS do their best to hide it, because it’s the truth, and from their perspective, you can’t handle it.

Lee posted his housing market update for subscribers to the Professional Edition yesterday. That report includes the relevant housing market data from the past month. Get regular updates on the US housing market, and stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Get the research and analysis you need to understand these critical forces…stay ahead of the herd. Click this link to try WSE’s Professional Edition risk free for 30 days!