What a crazy ride!

What a crazy ride!

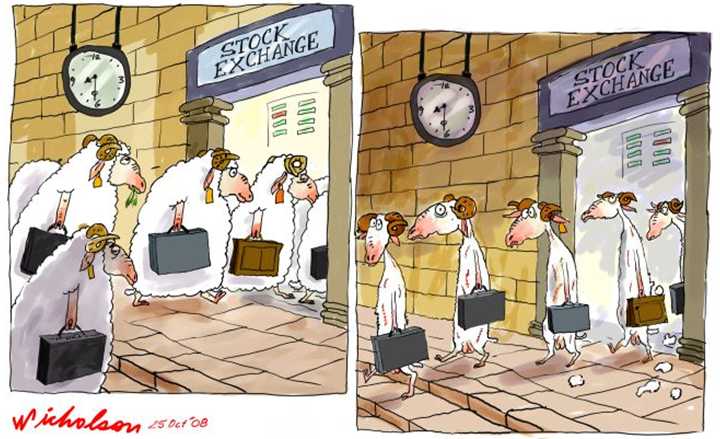

The chart on the left is a take on market sentiment but it’s the kind of mood swings that should be talking place over a span of weeks or months, not HOURS – like it has been recently.

Volatility has gone completely crazy this year, to the point where a stock like BKS has an AVERAGE intraday spread of 8.3%. 8.3% used to be considered a big year for a stock – now it’s considered lunch…

Even worse, BKS doesn’t even top the list: GMCR (8.7%), PDC 8.5% and PCX (8.4%) as well as BAS (8.2%) all have AVERAGE daily price swings above 8% and Bespoke has a list of 50 stocks (not even the ultra ETFs) that move 6% or more in the average day.

MS is one, so is X – as well as JEF, NFLX, AMED, ANR, FSLR, NILE, ZEUS, LZB (really Lazy-Boy?!?), TEX and HAYN among the well-known names that swing up and down like penny stocks in the "average" day. This is not rational. MS has a $32Bn market cap – do we really think the value of MS jumps up and down $1.8Bn a day based on anything other than sheeple stampeding in and out of the stock?

MS is one, so is X – as well as JEF, NFLX, AMED, ANR, FSLR, NILE, ZEUS, LZB (really Lazy-Boy?!?), TEX and HAYN among the well-known names that swing up and down like penny stocks in the "average" day. This is not rational. MS has a $32Bn market cap – do we really think the value of MS jumps up and down $1.8Bn a day based on anything other than sheeple stampeding in and out of the stock?

This creates tremendous opportunities for Fundamental investors as well as option SELLERS, which is what we prefer to be as – whether the market goes up or down – there is always someone who thinks it will go much lower or much higher and they are willing to give us lots of money to bet that they are right. All we have to do is BE THE HOUSE and take bets on both sides and wait for those times when nothing happens and we cash out both ends of the trade (kind of like bookies when a team wins but doesn’t beat the spread).

That’s right, bookmaking is illegal (unless you are Steve Wynn) but ordinary citizens like us can SELL options to suckers who think they are smarter than the markets. I was on BNN yesterday and I’m sorry I didn’t catch the guy’s name but I guess he was another host and we were discussing using offsetting short puts to lower the next cost of our GNW and AXP spreads and he said "but retail investor does have to understand (the risks)" – which is a very important point but let’s not overstate the risk COMPARED TO OWNING A STOCK.

That’s right, bookmaking is illegal (unless you are Steve Wynn) but ordinary citizens like us can SELL options to suckers who think they are smarter than the markets. I was on BNN yesterday and I’m sorry I didn’t catch the guy’s name but I guess he was another host and we were discussing using offsetting short puts to lower the next cost of our GNW and AXP spreads and he said "but retail investor does have to understand (the risks)" – which is a very important point but let’s not overstate the risk COMPARED TO OWNING A STOCK.

With GNW, for example, on October 24th, the stock was $6.15 and, rather than buy $6,150 worth of stock and hoping for the best, we instead bought the Jan $5 calls for $1.50 and sold the $7.50 calls for .40 to drop the net to $1.10 on the $2.50 spread. We also sold the December $6 puts for .85 to give us a net .25 entry on the entire spread. We did 10 of these spreads in our WCP and, while our obligation was to buy 1,000 shares of GNW as net $6.25, the margin requirement on the short puts was just $625.

This is not to say you should be reckless with margin but you can be realistic. The reason the margin is $625 is because many well-paid derivatives experts have determined that the loss-risk of holding 10 short contracts of GNW Dec $6 puts is approximately $625 – NOT $6,250. Can GNW go bankrupt and leave you with a $6,250 loss? Sure, anything can happen. It has, however, been determined by top analysts that the likelihood of this happening is roughly 10% or less so they are willing to extend you 90% margin against that possibility.

You all look at Lloyd Blankfien and Jaimie Dimon and even Warren Buffett and say, "why can’t I make money like that" and one reason is that, when someone allows them to leverage their money 10:1 against REASONABLE risks – THEY TAKE IT!!! The reality of having 10 contracts of GNW for net $6.25 is that perhaps GNW drops 20% (to $5) on some catastrophe before we stop out then we lose $1,250 – but not $6,250. That’s why we’re playing with GNW and not NFLX – we think the odds of GNW suddenly going bust in the next 90 days is thin – beyond black swan thin…

You all look at Lloyd Blankfien and Jaimie Dimon and even Warren Buffett and say, "why can’t I make money like that" and one reason is that, when someone allows them to leverage their money 10:1 against REASONABLE risks – THEY TAKE IT!!! The reality of having 10 contracts of GNW for net $6.25 is that perhaps GNW drops 20% (to $5) on some catastrophe before we stop out then we lose $1,250 – but not $6,250. That’s why we’re playing with GNW and not NFLX – we think the odds of GNW suddenly going bust in the next 90 days is thin – beyond black swan thin…

When the calls dropped to .14, we bought them back for a small profit, leaving us in the $5 calls at net $1.34 along with the short puts, now .13. With the Jan $5 calls now at $1.90, less the .12 we require to buy back the short puts if we closed it out today (but we are confident they will expire worthless), the net on this trade has gone from .25 to $1.78 up $1,530 (612%) in just over a month. The stock is at $6.71, up "just" $656 on the same 1,000 shares (10%). At 50% margin, $3,000 was committed to owning the stock while we committed $675 of cash and margin.

This IS how the big boys make money. We did not risk more than a typical retail investor who just buys GNW for $6.15 and crosses his fingers. In fact, our net entry with the short put sale was $5.25 per share so we had a better than 15% downside buffer before we would begin to take a loss. This is the fairly simple math of option strategies – we SELL the premium – we don’t buy it. It puts us in a BETTER position than the retail investor but, as you can see from the BNN interview – there is always someone lurking around who wants to keep retail investors out of options.

Of course the big boys want this to themselves – it’s where they make all their money!

We don’t control the kind of Billions that let us design our own derivative deals (yet – see Build a Berkshire Workshop for our plan in that regard) but we can take advantage of leverage to sell our options – essentially taking out loans in order to operate our own little casino, where traders line up every day to take our bets – handing us cash so that they can speculate that, for example, TLT will be over $120 on Friday, for which they will bet us .50, even though TLT is at $118.40.

That’s our "spread" – we’re the bookies and they are spotting us $2.10 (the $1.60 out of the money plus the .50 they pay) on the bet. Now, we may win and we may lose but we know that there’s another sucker lined up next week to spot us another $2.10, and then another and another. It’s not about us winning or losing a single, $2.10 bet – it’s about the fact that, over 52 weeks, we can collect $26 against $2 spreads betting TLT stays under the $120s. Sometimes we may be wrong and sometimes we’re right – but our bet is that we won’t be $26 wrong!

That’s our "spread" – we’re the bookies and they are spotting us $2.10 (the $1.60 out of the money plus the .50 they pay) on the bet. Now, we may win and we may lose but we know that there’s another sucker lined up next week to spot us another $2.10, and then another and another. It’s not about us winning or losing a single, $2.10 bet – it’s about the fact that, over 52 weeks, we can collect $26 against $2 spreads betting TLT stays under the $120s. Sometimes we may be wrong and sometimes we’re right – but our bet is that we won’t be $26 wrong!

The gamblers come and go but the casino is always there – always taking the bets. That’s how you win over time…

As to the markets, we’re waiting and seeing as we continue to test our levels, generally consolidating in a pretty healthy way – the same way we did in mid-October, prior to making another big move up to close the month – a move that would give us a classic Santa Claus rally to finish 2011. Lots of "bad" news yesterday did not do significant damage and even Europe down half a point isn’t bothering the US futures (however we did short oil this morning at $101 in Member Chat and got a quick ride back to $100.25) so, on the whole, it’s very impressive so far.

We’ll just have to see how things shake out but, if the Dollar goes back over 79 – I would certainly get a lot more cautious.