Remember Operation Twist?

Remember Operation Twist?

Last week, Freddie Mac reported record lows on rates, with the 30-year notes at 3.91%. This has not, of course, encouraged many people to go out and buy homes but it has DISCOURAGED people from putting their money into bonds and ENCOURAGED them to put their money into stocks. There is, however, a problem with this. When people put money into Treasuries, it is "locked up" for a period of time but stocks are more liquid so, as soon as rates begin going up (and they will when the panic in Europe subsides despite the Fed’s efforts), then money can come out of stocks as quickly as it went in and move into 5% paper.

See, I said 5% paper and you were thinking "Yeah, I’d like some of that." So are Trillions of Dollars worth of other investors and that means, I am sorry to tell you, that this little Federally-funded rally is full of holes you can drive a truck through.

The Fed’s stimulus plan is the central bank’s third definitive attempt to aid the U.S.’s patchy economy since 2008. As expectations grew that the Fed would act in the weeks leading up to the bank’s actual announcement, which came Sept. 21, 10-year yields dropped nearly 0.30 percentage point. Since the Fed’s official statement, yields have already risen modestly, to 2.026% on Friday, from 1.95% on Sept. 20.

The Fed’s stimulus plan is the central bank’s third definitive attempt to aid the U.S.’s patchy economy since 2008. As expectations grew that the Fed would act in the weeks leading up to the bank’s actual announcement, which came Sept. 21, 10-year yields dropped nearly 0.30 percentage point. Since the Fed’s official statement, yields have already risen modestly, to 2.026% on Friday, from 1.95% on Sept. 20.

The program’s final debt purchase of the year was Thursday, when the Fed bought $4.6 billion in long-dated securities. The final sale Wednesday targets $8 billion to $8.75 billion worth of notes due in 2014. It will be a holiday-shortened week: The bond market was shut Monday and will close early, at 2 p.m., on Friday.

The problem is some corners of the market think the Fed’s tools are losing their punch. The financial system is already flush with money from the bank’s previous easing programs, and analysts argue that the Fed’s extra money is increasingly less useful. Borrowing costs, for instance, are at all-time lows and yet many investors aren’t taking advantage. If Operation Twist isn’t enough to get us through 2012 – what’s going to be left in the Fed’s tool belt once the Global panic into Dollars begins to subside?

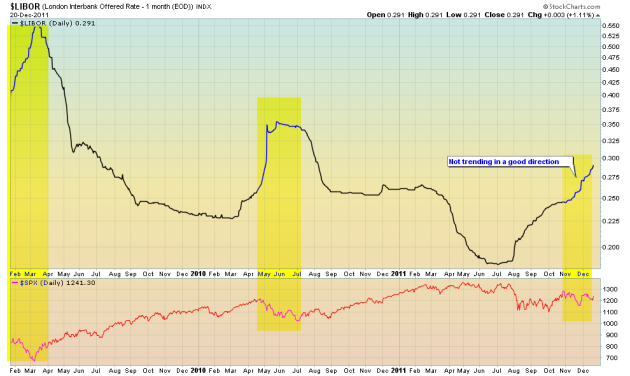

You can see, on the above chart, where the Fed announced Operation Twist in September as it allowed the oil crooks to borrow cheaply and jam prices back from $80 to $100 (25%) and that took money OUT of consumers’ pockets into Q4 but at least they were able to increase their debt load as borrowing costs came down so it all works out – for the oil companies…

Banks in Europe paid attention to my cash call this weekend and parked a record $540Bn in the ECB’s overnight deposit facility, up from $500Bn the day before. The previous record overnight deposits were $501Bn, at the onset of the Greek crisis in June of 2010 so – DESPITE all the nonsense to calm the markets – the European banks are as panicked now as they have ever been and the inter-bank lending system (LIBOR) is less liquid now than it was in the crash of 2008.

The ECB’s so-called benchmark allotment pointed to a major liquidity overhang in the euro zone’s financial system Tuesday. Benchmark allotment, which is the ECB’s estimate of the liquidity banks need to conduct routine operations, was minus €493 billion. The negative allotment figure indicates the presence of excess liquidity in the financial system. The ECB further said banks borrowed €6.13 billion from the ECB’s overnight lending facility, compared with €6.34 billion borrowed Thursday. When markets are functioning properly, banks only use the facility to the tune of a few hundred million euros overnight.

I’m sorry to be a Debbie Downer for the holidays but it’s my job to search the truth and, as I was doing research for this year’s Secret Santa’s Inflation Hedges, I discovered that I can’t advocate any at the moment because the pressure is more deflationary than inflationary and, in fact, I am leaning towards putting up Secret Santa’s Disaster Hedges for 2012 – getting in-line with the Mayans for the moment.

I’m still gathering my evidence so I don’t want to jump the gun but, as you can see from this post – I’m very much in macro mode at the moment, looking out at the bigger picture as we prepare to re-allocate our capital for 2012.

Barring some immediate disaster this week (and we are short already), our Secret Santa Hedges for 2011 are 4 for 4 with all 4 of our trades up well over 100% and XLF and XLE both at max returns with DBA just off our $29 target at $28.60 but that only applies to very greedy people who didn’t take this trade off the table in August, when DBA was $34 and we soured on the sector. I’ll do a full write-up as we officially close out that portfolio this weekend but, as I said, I can’t in good conscience replace it with 4 more bullish positions for 2012 as I’m not finding 4 things to be bullish about.

We’ll see how Europe acts this week but already they are not acting "fixed" and, if a Trillion Dollar commitment can’t cheer them up – what will it take?

Let’s be careful out there!

Top picture credit: thestreet.com

Cooling Off chart from the Wall St. Journal

Cartoon credit: Bizarro Comic