We are at a serious inflection point!

We are at a serious inflection point!

As you can see from Springheel Jack's chart of the S&P, we've fallen out of that uptrending range and tested our support yesterday, saved only by a very weak Dollar in anticipation of massive dilution of said Dollar by our own Federal Reserve commencing sometime around 2:30 this afternoon (FOMC announcement at 12:30, Bernanke Speaks at 2:15 and "new open guidelines" somewhere around there) that has sent the Dollar down 2.5% in two weeks.

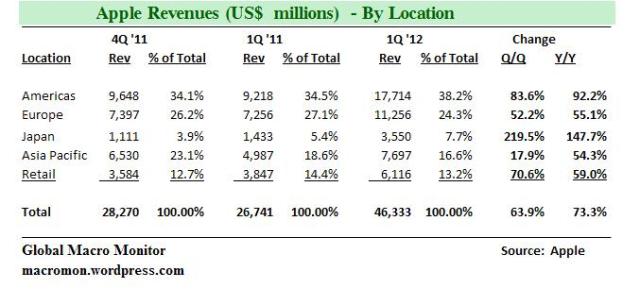

The Fed will do whatever the Fed will do but, since easing is already widely anticipated, we've generally bet against it into this meeting. Last night, the bears got quite a jolt at the end of a generally bearish day when AAPL announced blow-out earnings, with an 83% improvement in American sales and a 219% gain in Japan. Only the slow rollout of IPhones in China (remember the riots at the Apple store) stopped the company from having a $50Bn quarter.

This is good stuff, it's nice to know that it's still possible for US companies to USE (rather than complain about) the changing Global Infrastructure to create, manufacture and distribute profits to make oodles and oodles of money. So much money, in fact, that AAPL now has $97,500,000,000 in cash and investments on their books – which kind of puts their soon to be market-leading $450Bn market cap into perspective. If AAPL were a country, it would likely be passing Argentina ($435Bn GDP) to become the 28th largest country in the World and settling in right behind Norway ($479Bn) and Iran ($475Bn) – not bad for a country started by two hippies in a garage, right?

Still AAPL is only 1/33 of the entire US GDP so let's not get too excited and pay a little attention to what the other 96.7% of America is up to. That was neatly summarized for us by President Obama last night in his 4th State of the Union message.

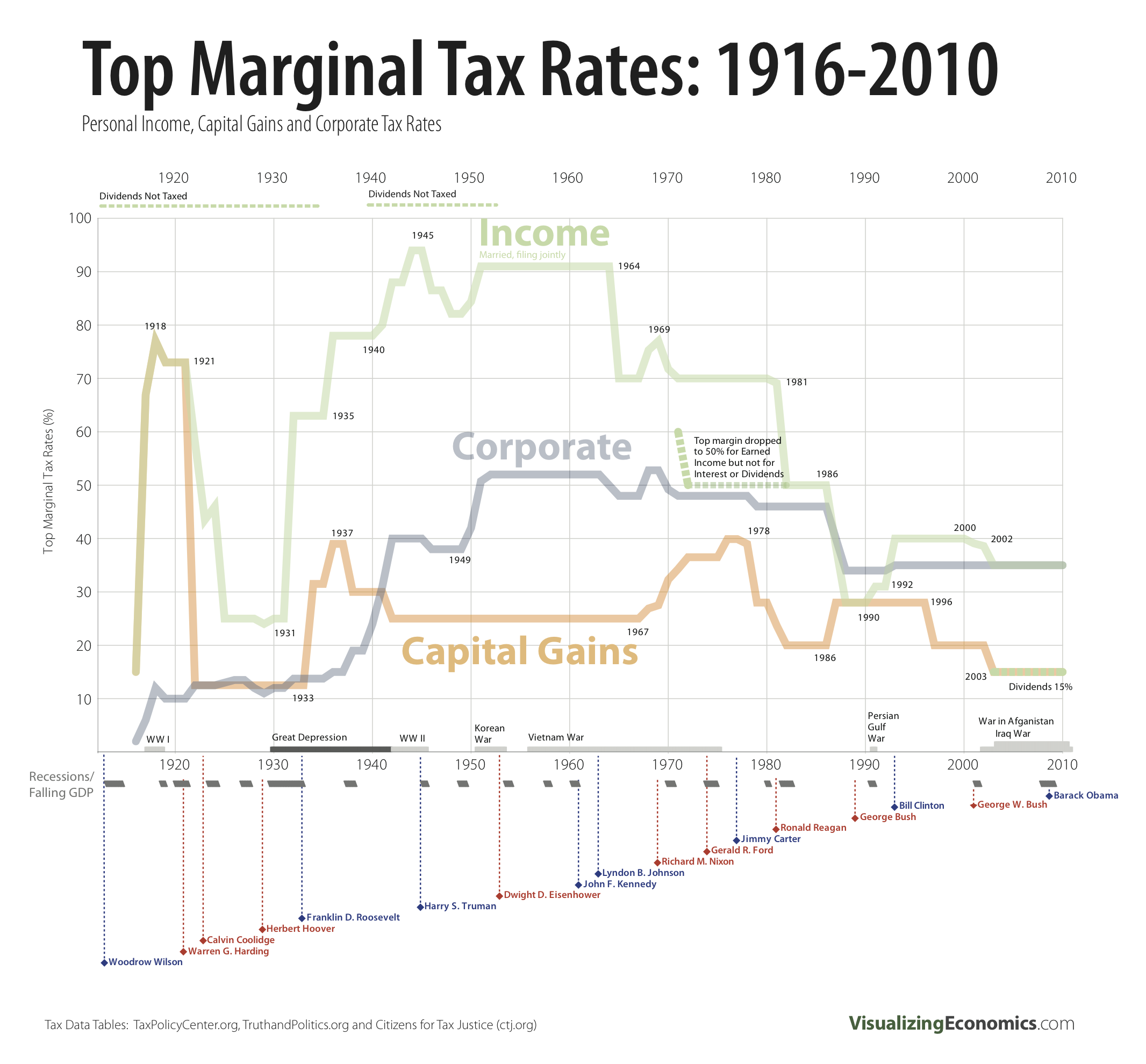

I'm already a fan but I thought it was a great speech and I'm sure a lot of top 1%'ers were tossing and turning last night as the President asked for a 30% minimum tax on people earning over $1M per year. While that may not seem like a big deal to you – to someone earning $1Bn and paying a Romney-like 13% tax rate – that's a $170M kick in the ass – annually. Methinks the Republicans will find their campaign funds overflowing with contributions after that one!

Gone was the soaring language of his last State of the Union address, when the president spoke of winning the future — a challenge he likened to “our generation’s Sputnik moment.” With the tents of the Occupy protesters catching snow in American cities, he was tapping into a national sense of grievance. “When Americans talk about folks like me paying my fair share of taxes, it’s not because they envy the rich,” Mr. Obama said, answering Mr. Romney’s charge that the president engages in the “bitter politics of envy.” “It’s because they understand that when I get tax breaks I don’t need and the country can’t afford, it either adds to the deficit or somebody else has to make up the difference.”

Now I know many of you out there think it's horrible that a person earnings $2M a year will be asked to pay an additional $150,000 on their 2nd Million in income – because that tax is more than 3 times the average US household's earnings and leaves the poor Job Creator with only $1,550,000 after taxes to scrape by on (30 times the average family's entire pre-tax income) and it's a valid point but keep in mind there's always a bigger fish.

Now I know many of you out there think it's horrible that a person earnings $2M a year will be asked to pay an additional $150,000 on their 2nd Million in income – because that tax is more than 3 times the average US household's earnings and leaves the poor Job Creator with only $1,550,000 after taxes to scrape by on (30 times the average family's entire pre-tax income) and it's a valid point but keep in mind there's always a bigger fish.

Romney, for example, earned $42.5M and paid $6.2M in taxes in the past two years. Under Obama's proposal, he would have to pay about $13M – this could possibly make Mitt Romney the most motivated Presidential Candidate of all time! Romney's tax rate of 13.9% is very fair and you can read his 500-page tax return yourself to understand why. Every American is free to hire a team of accountants, tax planners and tax lawyers to bury the IRS in paperwork and chop off 60% of their taxes so why should Romney not take full advantage of what is available to any average family?

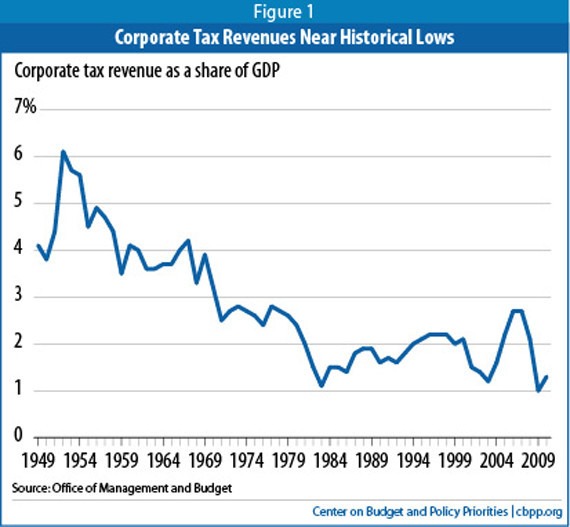

GE is one of our Corporate Citizens and they paid more in dividends ($26Bn) over the past 3 years than taxes ($954M) on $488Bn in sales and $104Bn in EBITDA – that's not even 1%, which means Obama wants to whack GE for $30Bn!

Now, if you have $2M in income, while you may think it's terrible that the President would like to get $150,000 from you, perhaps you should consider that the $10Bn (annually) that GE and other Corporate Criminals would have to pay covers 66,666 (coincidence?) of your $150,000 payments. That's right – the reason you need to pay $150,000 more is BECAUSE GE pays zero. THAT is the real problem in America – Corporate Taxes – or lack thereof!

Now, if you have $2M in income, while you may think it's terrible that the President would like to get $150,000 from you, perhaps you should consider that the $10Bn (annually) that GE and other Corporate Criminals would have to pay covers 66,666 (coincidence?) of your $150,000 payments. That's right – the reason you need to pay $150,000 more is BECAUSE GE pays zero. THAT is the real problem in America – Corporate Taxes – or lack thereof!

While our official Corporate tax rate is 35%, the effective tax rate paid by US Corporations is 6% – barely 1% of our GDP while ordinary citizens cough up 12% of our GDP in taxes to compensate. In fact, if Corporations actually paid 35% in taxes – people wouldn't need to pay any. That is not the spin you will ever get from the MSM – who happen to be owned by Corporations but that is what this is really all about. It is the UNWILLINGNESS of the GOP to close Corporate tax loopholes that creates the need to tax the top 10% – isn't that ironic – it's like they say they are working for you but they are totally lying to your face (unless you happen to OWN one of those Corporations that pay 6% – then they ARE working for you).

Bernanke's solution to this problem is, of course – to give more money to Corporations. Obama also wants to give more tax breaks to Corporations but at least he is tying it to the provision of creating ordinary jobs.

We'll have to wait for the official word to see how this all plays out but, officially, I'm still bearish – but I am willing to change my mind for about $1 Trillion Dollars!