Courtesy of Benzinga.

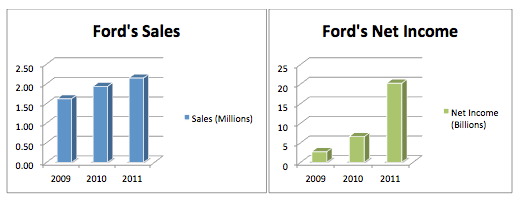

The automobile giant Ford (NYSE: F) posted what seemed to be impressive numbers on Friday, suggesting that the company may finally be on the right track. Strong sales in North America have helped Ford to overcome losses incurred in other parts of the world. Its 2011 net income surged to $20.2 billion – the company’s highest net income since 1999, and second-highest ever – as the company posted its third-straight full-year profit in a row. US Ford employees will receive a profit-sharing bonus of $6220, which also the largest seen since 1999.

However, an accounting adjustment last quarter worth $12.4 billion was responsible for much of the company’s net income for the year, putting somewhat of a damper on the good news. The adjustment eliminated most of the tax allowances the company received from 2006 to 2008, when it was losing billions of dollars due to a sharp global decline in vehicle demand.

Ford’s CFO Lewis W. K. Booth considered the adjustment a positive signal, believing that the deferred assets would help Ford to be more profitable in the future.

Still, investors were not convinced by Ford’s numbers, as many analysts had expected net income to be even higher. The company’s stock plunged 4.16% Friday to $12.21, on volume of 142 million shares. It was the second most actively traded stock that day.

The prevailing weak conditions in Europe and the continued aftereffects of the 2011 Thailand floods – both major challenges for Ford – discouraged investors as well. Ford had net loss of $119 million on the international front last year.

Meanwhile, at home, Ford saw 2011 US sales for its brand increase 17%, as it went on to sell over 2 million vehicles (last year, Toyota was able to sell only 1.6 million vehicles within the US). Ford’s total vehicle sales were up 11% for the year. Ford’s sales have improved considerable since 2009, when it sold just barely over 1.6 million cars.

Investors may be underrating Ford. Ford’s PEG ratio of 1.01 indicates solid growth prospects, and its ROE of 208% shows that the company uses investors’ money efficiently. These are key ratio indicators that aptly indicate the positive side of Ford.

Going into 2012, Ford has a good product line, which includes the Focus Electric, advanced versions of the Escape and Fusion, and an impressive new Taurus model.

As the US auto market continues to improve, investors may wish to consider Ford.

Neither Benzinga nor its staff recommend that you buy, sell, or hold any security. We do not offer investment advice, personalized or otherwise. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation.

For more Benzinga, visit Benzinga Professional Service, Value Investor, and Stocks Under $5.