“Capitalism threatens our existence.”

“Capitalism threatens our existence.”

That's the message today from legendary investor Jeremy Grantham, who's GMO Capital manages $97Bn and, like Buffett, writes an annual letter to his investors. Part one of the letter has some great general investing advice but part two gets very interesting as Grantham titles it "Your Grandchildren Have No Value (And Other Deficiencies of Capitalism)" exposing what he considers the "two or three main flaws" of Capitalism that are "potentially fatal and have gone largely unaddressed."

A sustainable economic system, for instance, can’t be based on ever-increasing debt, corporations can’t be allowed to run governments and loot treasuries, and “growth at any cost” is a recipe for planetary suicide.

Grantham points out that a company is now free to spend money to influence political outcomes and need tell no one, least of all its own shareholders, the technical owners. So, rich industries can exert so much political influence that they now have a dangerous degree of influence over Congress. And the issues they most influence are precisely the ones that matter most, the ones that are most important to society’s long-term wellbeing, indeed its very existence.

Thus, taking huge benefits from Nature and damaging it in return is completely free and all attempts at government control are fought with costly lobbying and advertising. And one of the first victims in this campaign has been the truth. If scientific evidence suggests costs and limits be imposed on industry to protect the long-term environment, then science will be opposed by clever disinformation. It’s now getting to be an old and obvious story, but because their propaganda is good and despite the solidness of the data, half of the people believe the problem is a government run wild, mad to control everything.

Here are some of Grantham’s finer points:

Here are some of Grantham’s finer points:

- Capitalism too heavily discounts the future value of cash flows as it seeks to raise debts: “Your grandchildren have no value.”

- "For example, let us say that a firm’s current actions are going to cost society at large a billion dollars’ worth of harm in 50 years. Further, let us agree that all of the costs will definitely be imposed on the company. The company would feel that pain today as equivalent to only a mere $1 million hit to earnings. Why should they care?"

- Companies foolishly reward executives for taking on debt: “Total remuneration … for senior officers … rose as a percentage of the average worker’s pay from 40 times in Eisenhower’s era to over 600 times today with no indication of any general improvement in talent.”

- It’s about profit, not people: “Capitalism in general has no sense of ethics or conscience. Whatever the Supreme Court may think, it is not a person.”

- The more people borrow, the more they just gamble: “Leverage … increases your returns over and over until, suddenly, it ruins you. … There are no Investors Anonymous meetings to attend.”

- This time, it’s not so different: “Ignore the … inevitable cheerleaders who will assure you that this time it’s a new high plateau … even if that view comes from the Federal Reserve itself. No. Make that, especially if it comes from there.”

- Washington is becoming a corporate subsidiary: “What Capitalism has always had is money with which to try to buy influence. … The issues they influence are precisely … the ones that are most important to society’s … very existence.”

- Big companies can’t help it: “Ethical CEOs can drag a company along for a while, but this is an undependable and temporary fix.”

- Economic theory ignores natural laws. It suffers an “absolute inability to process the finiteness of resources. … Capitalism wants to eat into … limited resources at an accelerating rate with the subtext that everyone on the planet has the right to live like the wasteful polluting developed countries do today.”

- It’s not just inexpensive oil we are running out of: The “loss of our collective ability to feed ourselves, through erosion and fertilizer depletion — has received little or no attention.”

- Americans are too optimistic: “They adopt a hear-no-evil approach to life and listen exclusively to good news. … There are always a few experts lacking in long-horizon vision, simple common sense, or whose co-operation has been rented, like “expert” witnesses at a murder trial, who can be dragged out to reliably say that everything will always work out fine.”

- Governments must step in. “To interfere with Marx’s apocalyptic vision, we need some enlightened governmental moderation … before capitalism gets so cocky that we have some serious social reaction.”

- Where Marx and Engels got it wrong was in thinking workers would unite. “It’s going to be hard to have a workers’ revolution with no workers. Organizing robotic machine tools will not be easy.”

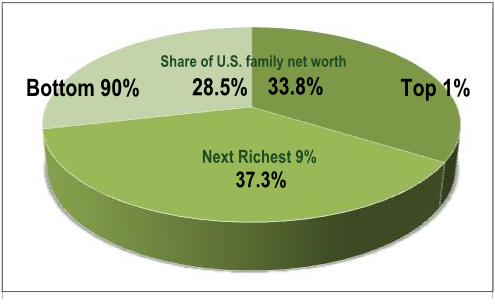

Does Grantham go too far or is he just part of the growing chorus of Capitalists questioning Capitalism? As I said way back in 2009 in "A Tale of Two Economies," the widening gap between the rich and the poor has gotten to the point where it is now harming the system and some (not too many, I'm afraid) of us Capitalists don't think it's prudent to simply take what we can from what's left of the bottom 99%'s wealth as if our fate is not entwined with theirs.

Does Grantham go too far or is he just part of the growing chorus of Capitalists questioning Capitalism? As I said way back in 2009 in "A Tale of Two Economies," the widening gap between the rich and the poor has gotten to the point where it is now harming the system and some (not too many, I'm afraid) of us Capitalists don't think it's prudent to simply take what we can from what's left of the bottom 99%'s wealth as if our fate is not entwined with theirs.

The concept of "giving back" has been ground out of the American mind-set and it's led to mountains of unsustainable debt World-wide as well as the destruction of the US and European Middle Class – turning the First World into a nation of haves and have-nots – a situation that simply cannot last, no matter how many new reality shows we come up with to distract the masses.

Eurozone unemployment hit 10.7% in January, the highest level since the Euro was established in 1999 and, outside of Germany, it's over 12% with Spain and Greece at 20% unemployed. December was revised up another 0.2% to 10.6% as well. 24M people in the Eurozone are unemployed and inflation is up 2.7% so those benefit checks buy less and less every month yet investors continue to believe that, where there is a whole lot of smoke – there is no fire.

Our own economy lost another 351,000 jobs last week with 7.5M people in the US collecting benefits and the other 9M finding that even 99 weeks isn't long enough to find a job before those benefits run out.

Our own economy lost another 351,000 jobs last week with 7.5M people in the US collecting benefits and the other 9M finding that even 99 weeks isn't long enough to find a job before those benefits run out.

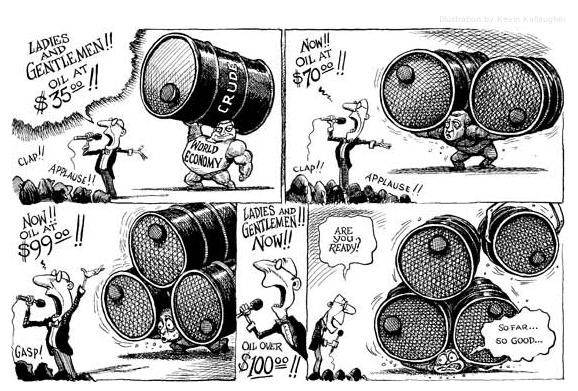

Personal income was up 0.3% in January but Disposable Personal Income was up just 0.1% as every dime of that extra $14.1Bn went straight into our gas tanks. That left Real Disposable income up just 0.1%, which is down from 0.3% in December and half of what was expected by Economorons, who don't seem to know that people buy gas and food – despite what the Fed says.

We wisely shorted oil (/CL) at $107.50 and gold (/YG) Futures at $1,720 in the morning's Member Chat and we've had two runs back to $107.25 on oil already and gold is back to $1,704 as the Dollar heads back up to test the 79 line with the Euro already failing to hold $1.33 and the Pound rejected at $1.595 but with a long way to fall to catch up to the Euro. We expect oil to run up to perhaps $108.50 again into natural gas inventories at 10:30 but then we'll want to get short again, most likely.

The Pound is holding up well because Martin Weale, of the BOE says that U.K. inflation may prove more persistent than expected, making it unlikely the economy will require further stimulus once the current round of bond purchases ends. Higher oil prices and potential wage pressures as the economy recovers “suggest a risk that there may be more persistence to inflation than one might expect at a time of rising unemployment and weak demand,” Weale said in a speech in London late yesterday. “I do not think there is likely to be a further case once our current program is complete” in early May for more bond purchases.

The Pound is holding up well because Martin Weale, of the BOE says that U.K. inflation may prove more persistent than expected, making it unlikely the economy will require further stimulus once the current round of bond purchases ends. Higher oil prices and potential wage pressures as the economy recovers “suggest a risk that there may be more persistence to inflation than one might expect at a time of rising unemployment and weak demand,” Weale said in a speech in London late yesterday. “I do not think there is likely to be a further case once our current program is complete” in early May for more bond purchases.

That will be good news for JP Morgan, who purchased $147.3Bn worth of insurance against just $142.4Bn in debt against bonds they sold to the PIIGS as well as for Goldman Sachs, who reported yesterday that they had purchased $147.3Bn worth of insurance against just $142.4Bn in debt. Before you go thinking there might be some sort of conspiracy involving what would have to be clearly illegal communications and coordination between our biggest Banksters, and not just the most amazing cosmic coincidence of all time – let's hear what one of their pet analysts, Chris Kotowski of Oppenheimer, has to say on their behalf:

"There are a nearly infinite number of possible coincidences that could occur any day of the year but don't. Every now and then, they do."

Well, I certainly feel better. Until I remember that we have a 1 in 625 chance of being destroyed by a giant asteroid in 2040 – we'd better hope that JPM and GS aren't rolling those dice!