I have never hated an up market more.

Even on October 1st, 2008, when I wrote "Hedging for Disaster," where we added 3 ultra short ETFs at Dow 10,650 (SKF Jan $100s at $19, DXD April $55s at $14.20 and SDS March $77s at $9.95) we still had some hope that the Congressional bailout would stabilize the markets, although my comment at the end of that post is just as relevant today as it was at that market top:

Congress many think Paulson and Bernanke and Warren Buffett are kidding when they say we are about to go over an economic cliff but I think there is certainly enough evidence to merit serious concern. In part, we have a crisis of confidence and – even if it were true that we could "muddle through" without a bailout, if just 1/3 of the investors believe that we can’t and pull out of the markets, what good will it do the remaining optimists?

You know how that story ends, of course – the stimulated "recovery" was very short-lived and we went right back off that cliff, dropping 2,000 points that week and another 2,000 by March 9th the next year. Our hedges worked out nicely, of course, with SKF topping out at $1,200 on Nov 21st (up 5,600%), DXD was at $110 on October 10th for a nice $40.80 profit in 9 days (287%) and SDS ran to $130 on the same day and returned 430%.

The other day, I published a list of 12 Long Put Plays for Members (see yesterday's Alert), which I worked at in the morning, after I put up my 10 Bullish Ideas in the morning post. Why? Because, after watching the open and reading the news, I could only conclude that this rally is still fake, Fake, FAKE! Back in October '08, we were already 25% off our 2007 highs where I used to make fun of the market going up every day, like on October 2nd of that year, when I said:

Up, up and away – it’s Super Market!

It’s bugdet proof, oil proof, terror (threat) proof, housing proof, inflation proof and pullback proof 3 weeks in a row!

This is truly a Market of Steel (and the recent movement of X underscores that) and looking at the movement of the past week we really do have to believe it can fly… Is the US consumer (driver of 2/3 of the economy) really impervious to harm? What, if anything, is our stock market Kryptonite?

At that time, the Dow was just popping 14,000 but, a week earlier, on October 1st, as we were still climbing to new highs and everyone told me I was an idiot for not loving the rally, I said:

Is today the day?

I’ve been saying for quite some time that the banks need to step into the confessional box and tell us just how much of the $2 Trillion drop in the value of US housing (so far) they are on the hook for. So far we’ve had a Billion here, a Billion there but the big boys have so far had their heads firmly in the sand and that means it’s time for a kick in the ass.

Since ostriches are herd animals, we can expect one admission to follow the others as banks would always prefer to say "Yeah, I lost money too" AFTER someone else admits it. As usual, we have to look to Europe for leadership and we were on top of this story over the weekend (thank you Richard) as ING announced on Saturday that they would take over accounts at NetBank, WHICH WAS SHUT DOWN BY THE US GOVERNMENT FOLLOWING LOSSES ON "SUBPRIME MORTGAGES AND OTHER LOANS." Gee, wouldn’t you think this should be a more prominent story in the US? Once again the sharpies at the WSJ seemed to miss this one.

I do not point these things out to remind you how brilliant I was in my analysis at the time but I do have to remind you that A) I do kind of know what I'm talking about, B) Macro Fundamentals can turn bad long before the market realizes it and C) Once a rally gets this big, you can make incredible amounts of money with hedges which, ironically, makes it a little safer to go long!

While the technicals on the Market look great, as Springheel Jack noted on yesterday's SPX Chart, this is also what a blow-off top looks like and, with the volume we're seeing lately – how can you trust these moves in the first place.

It's very hard for me to simply convey why I don't like the rally but it's mostly because I read a lot, I talk to people from all over the World, many of them movers and shakers who are themselves astute business people – but I also have a certain perspective from outside the top 10% bubble that a lot of my peers lack.

Like it or not, the bottom 90% are ultimately your customers. Even if you exclusively service the top 10% in your business (I do!) still, at some point, the bottom 90% are their customers. Way back in June of 2007, I wrote "The Dooh Nibor Economy (that's "Robin Hood" backwards!)," where I pointed out that we (yes, I'm one of THEM) were extracting wealth from the Middle Class at a dangerous and unsustainable rate and I predicted that the continuation of the trend would lead to revolution.

Like it or not, the bottom 90% are ultimately your customers. Even if you exclusively service the top 10% in your business (I do!) still, at some point, the bottom 90% are their customers. Way back in June of 2007, I wrote "The Dooh Nibor Economy (that's "Robin Hood" backwards!)," where I pointed out that we (yes, I'm one of THEM) were extracting wealth from the Middle Class at a dangerous and unsustainable rate and I predicted that the continuation of the trend would lead to revolution.

So far, we've had the Arab Spring and Occupy Wall Street but not much else, yet already we are right back to where we were in 2007, with skyrocketing food and energy prices, lower wages and benefits (and even higher unemployment) and an ever-widening wealth gap. Rather than wake up the top 1% and instilling a sense of Social Responsibility, OWS has caused the wealthy to circle the wagons to the point where the GOP is running a Bankster to just end the pretense and directly sell this country out – MADNESS!!!

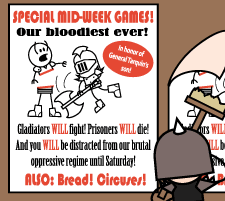

Now we understand how the French Aristocracy could have been so "stupid" and deaf to the complaints of the people – because we're doing it now. The top 10% is fiddling while Rome (and Athens and Madrid and Lisbon and London and Dublin) is burning all around us and we're playing the markets as our "Bread and Circuses" event, meant to placate the public with a spectacle that impresses them with the glory of the Empire, even as that Empire crumbles into dust.

Just like the Romans, our Government is emptying the treasury to put on a show and the nobles, as is their manner, are finding ways to profit from it while it lasts. While there is indeed good money to be made betting on an up market, there is PHENOMENAL money to be made catching a crash, which is why we like our Disaster Hedges (see "Fake News Friday – What a Fool Believes" for our main hedges as well as our top 10 bull plays) and, with DXD at $12.76, we can buy July $13 calls for just .90 – 1/14th of what we paid to insure ourselves in 2008, before DXD doubled on a 20% market drop.

Just like the Romans, our Government is emptying the treasury to put on a show and the nobles, as is their manner, are finding ways to profit from it while it lasts. While there is indeed good money to be made betting on an up market, there is PHENOMENAL money to be made catching a crash, which is why we like our Disaster Hedges (see "Fake News Friday – What a Fool Believes" for our main hedges as well as our top 10 bull plays) and, with DXD at $12.76, we can buy July $13 calls for just .90 – 1/14th of what we paid to insure ourselves in 2008, before DXD doubled on a 20% market drop.

So there's nothing wrong with having $100,000 of bullish bets – especially if you use our usual hedging techniques, as long as you have, for example, $3,000 of Disaster hedges. If the market keeps going up and up, you can always pull the hedges with a 50% loss and I'm sure you'll make more than $2K on your $100K (or you may as well have TBills!) but, if we do fall off a cliff – that $3K can become $15K and save you from a nasty drop!

We made plenty of bullish bets this month, let's make sure we're well covered into the weekend and, of course, as I said in last weekend's Income Portfolio Reviews, I'm for getting back to cash at this point anyway. The market is just too scary up here and, if the rally is real, we will have another 20% to participate in. Maybe we'll miss the first 5% but Dow 13,000, S&P 1,400 and Nas 3,000 are pretty solid floors to go bullish off if they hold up. On the downside however – get a daily chart and look back at October 2008. Then read what I said, then look at the chart, then read what I said.

What's different now?