First the good news:

First the good news:

India's industrial production grew at a slower-than-expected pace in February, weighed down by a contraction in consumer durables and consumer goods. Production of consumer durable goods shrank 6.7 percent in February from a year earlier. Consumer goods contracted 0.2 percent on year. Inflation is still running at 6.7% but at least it's down from 6.95% last month. Now the bad news, January's Industrial Production Report has been revised down from a blistering 6.8% to an almost contracting 1.14% (and when it's that low, 0.04% really matters!).

It turns out the massive 38% run in the EPI based on all these FANTASTIC numbers coming out of India may have been based on totally false information and it's funny how the selling begin along with the release of that spectacular 6.8% report – almost as if some Bankster was pumping out fake data in order to bring in the suckers so he could unload his shares before the real data came out.

Not that that would happen in our fine Kleptocracy, right? We had a similar run-up in our markets as analysts raised their earnings expectations for the S&P 500 from $90 to $100 to $110 and then raised the multiple they felt should be applied from 10 to 11 to 12 to 13 to 14 to 15 or even 16 – coming up with huge targets for the S&P – as well as our other indexes. This caused our markets to rocket higher as it was all sunshine and lollipops from our Corporate Media – all the way back to October.

Now that all the sheeple have been herded into the markets at those MASSIVE valuations, suddenly estimates are going the other way – $105, $102 and now Gary Shilling says $80 may be the right number.

Now that all the sheeple have been herded into the markets at those MASSIVE valuations, suddenly estimates are going the other way – $105, $102 and now Gary Shilling says $80 may be the right number.

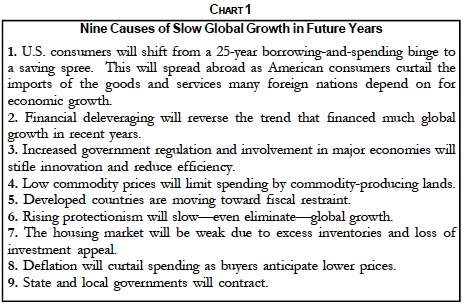

Shilling notes the S&P's dependence on foreign earnings, a stronger Dollar, higher oil prices, consumer retrenchment and a hard landing in China (and India!) and he recommends going long Treasuries and short stocks and commodities (see Gary's 2012 Investment Themes).

Garry was right on the money in 2011, missing just 3 out of 19 investment themes he was tracking at the time so let's not dismiss him out of hand. With S&P earnings dipping back to 80, Shilling says the p/e multiple is likely to contract back to 10 and that brings us all the way back down to S&P 800 – a whopping 43% drop from where we are not. While that's a bit more doom and gloom than I'm willing to buy into – 10% down from here to about 1,250 is certainly not out of the question and, if the Fed doesn't step in and turn those machines back on – things could get much worse.

Garry was right on the money in 2011, missing just 3 out of 19 investment themes he was tracking at the time so let's not dismiss him out of hand. With S&P earnings dipping back to 80, Shilling says the p/e multiple is likely to contract back to 10 and that brings us all the way back down to S&P 800 – a whopping 43% drop from where we are not. While that's a bit more doom and gloom than I'm willing to buy into – 10% down from here to about 1,250 is certainly not out of the question and, if the Fed doesn't step in and turn those machines back on – things could get much worse.

As I noted yesterday, we don't go back to being bullish until we see 1,372 hold on the S&P and then 1,384 to confirm – otherwise we're just in a weak bounce off of the first week of the sell-off. That, of course, didn't stop us from balancing our picks a bit with 8 bullish Trade Ideas on 6 Dow components going out to Members in yesterday's Morning Alert.

Of course the real money to be made in this scam of a market comes in the Futures and our play from the early morning Member Chat was the big money for the day as my 6:15am trade ideas for Members were:

Oil is $101.59, gold $1,657, silver $3.6545, copper (/HG) $3.666 and a good play higher off the $3.675 line if you want to play a recovery, nat gas is $2.04 and gasoline at $3.248 is also playable over the $3.25 line (/RB).

The RUT (/TF) is at 788.7 and would be playable (and confirm a move up) over 790 but very tight stops and only if the Dollar fails 79.75.

Overall, I don't see the BOJ putting up with this (Yen 80.82) so I'd look for the Dollar to move back up but, if the Euro holds $1.31 and the Pound holds $1.59 – that's going to be bullish but, if they fail, then I'm not sure this early pop will last.

As you can see from the chart, we took that money and ran ($420 per penny, per contract = $2,100 per contract) and we rode the Russell all the way up to 795 for another $500 per contract. The early birds really do get the worms in the Futures and, if these jokers want to manipulate the markets higher in the mornings – we're more than happy to play along because, at PSW, we don't care IF the game is rigged – as long as we can figure out HOW the game is rigged and play along!

This morning they ran oil back up to $103 and the Russell hit 798 but we went short oil Futures (/CL) in this morning's chat off the $103 line as that was just utter nonsense – as is the move up in the indexes but we left ourselves bearish into the close so there was no need to pile on that side as we'll be perfectly happy just to get that reversal into the open.

As you can see from this chart the disconnect between inventories (approaching a record) and price (and demand!) has never been more ridiculous and, as you can see from the NYMEX Futures Strip on WTIC – there are over 600M more barrels on order (1,000 barrels per contract) in what will become the front three months after next Friday's contract rollover – unless they manage to actually use the 172,378,000 barrels that are current scheduled for May delivery by next week.

The good news for the oil bulls is Obama CAN'T release oil out of the SPR – THERE'S NOWHERE LEFT TO PUT IT. Like natural gas pipelines, our domestic oil storage facilities are beginning to spill over and, if consumer demand doesn't pick up soon, we will have to turn ships back from the Gulf of Mexico as Cushing is full and Private Inventories are full and even the SPR only has room for about 30M more barrels before it too is full. We can see the effect filling the pipelines had on natural gas – yesterday it slipped below the $2 mark – the lowest price ever recorded!

The good news for the oil bulls is Obama CAN'T release oil out of the SPR – THERE'S NOWHERE LEFT TO PUT IT. Like natural gas pipelines, our domestic oil storage facilities are beginning to spill over and, if consumer demand doesn't pick up soon, we will have to turn ships back from the Gulf of Mexico as Cushing is full and Private Inventories are full and even the SPR only has room for about 30M more barrels before it too is full. We can see the effect filling the pipelines had on natural gas – yesterday it slipped below the $2 mark – the lowest price ever recorded!

Keep in mind, we didn't go long on gasoline because there was demand or because of fundamentals – we went long on gasoline because energy prices in this country are nothing more than a manipulated Ponzi scheme that is VERY OBVIOUS to us at Philstockworld. This allows us to play along at home while the big boys screw the American people. We are not the wolves and we are certainly not the sheep but we do like a nice, juicy leg of lamb when it's served up for us like this – it sure beats being the sheep…

That's what this market is now – manipulation until the Fundamentals kick back in and then back to manipulation again. The NY Times had a nice article last night showing that speculators are adding 40% to the price we pay for oil, even while US production is ramping up to record levels. Our "Core PPI," it rose 0.3% in March, 50% more than Economorons had predicted while the 1% drop in March energy prices and a 2.5% dip in crude goods flattened the non-core PPI to 0% vs 0.2% predicted by clueless economists.

That's what this market is now – manipulation until the Fundamentals kick back in and then back to manipulation again. The NY Times had a nice article last night showing that speculators are adding 40% to the price we pay for oil, even while US production is ramping up to record levels. Our "Core PPI," it rose 0.3% in March, 50% more than Economorons had predicted while the 1% drop in March energy prices and a 2.5% dip in crude goods flattened the non-core PPI to 0% vs 0.2% predicted by clueless economists.

The Core PPI is the one the Fed is supposed to be paying attention to and tomorrow we'll get the CPI index along with Consumer Sentiment but that won't be the end of it as Big Ben himself rounds out the week with a speech at the Russell Sage Foundation titled "Rethinking Finance." Maybe Bernanke has finally rethought his own idiotic policies — nah….

We're watching the same levels as yesterday but the longer it takes to get to our weak bounce levels, the harder it will be to break them. We have massive Fed speak today from Dudley (11:00), Plosser (12:30), Kocherlakota (1:00) and Raskin (3:00) along with a 30-year note auction at 1pm and then, after hours, we have earnings from Google and the Fed's Balance Sheet is released for our amusement.

This is going to be fun!