Wheeeeee!

Wheeeeee!

We are just loving these crazy-assed market moves. Every morning we have a pump job to short into and every afternoon there is a BS stick-save to re-establish our shorts. It's merely a matter of time before those floors begin to crack. I mean, really – how much of this abuse can they take?

Notice, in Dave Fry's SPY chart, the high-volume selling followed by low-volume pumping – that's the very unhealthy pattern the "rally" was built on, which means there really aren't any buyers waiting to scoop up shares when they dip – just Trade Bots that tease the indexes higher so the IBanks can keep pulling in the bag-holders as the "smart money" stampedes for the exits.

Yesterday was great fun. As I noted in the morning post, we went short on the Oil Futures (/CL) at $104.50 in our morning Member Chat and even in the morning post there was still time to catch it at $104. Oil sold off all the way to $102.60 at 2:10 and my 2:14 comment to Members nailed the turn as I said:

Oil coming right to our goal at $102.50 ($38.50 USO) so let's not be greedy and look to take $1.20 off the table on those 1/2 USO positions in the $25KP and $5KP as it's better to get out while the gettin's good.

That's what we mean when we talk about taking non-greedy exits (I had set $38.50 as my USO target for our exit at 11:08 but it didn't look like we'd get it so we got out). We caught the bottom and got out clean and this morning we got a chance to re-load our shorts at $103.50 on that predictable morning pump. Sure, you can say the markets aren't fixed and maybe we just have amazingly good timing – either way we make the same money!

That's what we mean when we talk about taking non-greedy exits (I had set $38.50 as my USO target for our exit at 11:08 but it didn't look like we'd get it so we got out). We caught the bottom and got out clean and this morning we got a chance to re-load our shorts at $103.50 on that predictable morning pump. Sure, you can say the markets aren't fixed and maybe we just have amazingly good timing – either way we make the same money!

We did manage to find a few things we liked, one of which was CHK, as the stock plunged to $17.20 on much ado about not too much as people took issue with the CEO borrowing money to invest in their wells. We didn't think it was such a big deal and our trade idea at at 10:23 in Member Chat gave us a good opportunity to buy right into the day's low at 10:50:

I do like selling the CHK May $18 puts for $1.30 and buying the May $15/18 bull call spread for $2 for net .70 on the $3 spread that's $2.65 in the money. Let's do 3 of those in the $25KP.

So that's net $210 on the $900 spread with a $690 upside (328%) if CHK can hold $18 for 29 days – not a bad ROI. Keep in mind the $25KP is our aggressive virtual portfolio and we're pretty bearish overall so this is a nice gamble to offset our bear bets with. CHK finished the day yesterday at $18.06 and the May $18 puts already fell back to $1.25 (still a good sale) and the spread jumped to $2.15 for net .90 – up 28% on the first day – not a bad start!

That was our only trade during Chat yesterday. We had already taken bullish pokes at BTU, FCX and TNA Tuesday morning as well as BA, ABX and FCX again later on in the day's session so it's not like we're all bearish – we just have more fun being bearish at the moment, while we wait to see if our 50% lines (see Monday's post) ever get crossed and give us an actual reason to be more bullish.

That was our only trade during Chat yesterday. We had already taken bullish pokes at BTU, FCX and TNA Tuesday morning as well as BA, ABX and FCX again later on in the day's session so it's not like we're all bearish – we just have more fun being bearish at the moment, while we wait to see if our 50% lines (see Monday's post) ever get crossed and give us an actual reason to be more bullish.

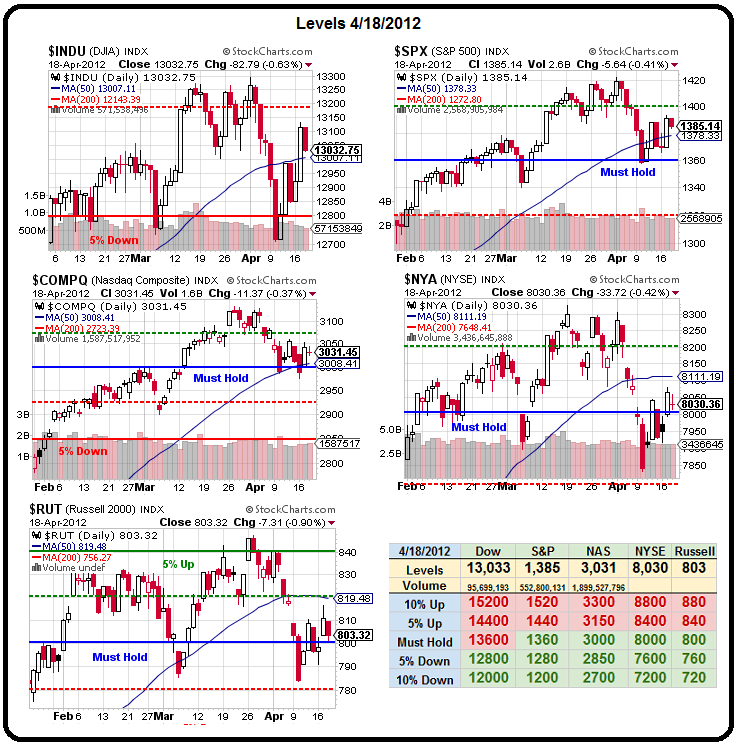

As you can see from our Big Chart – we are barely holding 3 of 5 of our Must Hold lines – just enough to keep us making some bullish pokes but not enough to flip us bullish just yet.

In fact, we're hoping PCLN contines to climb so we can short them again but this afternoon's star, for us, is going to be CMG's earnings, not MSFT, COF, SNKD or WYNN – as we're dying to see if people are still buying those $8.50 burritos. CMG isn't just priced to perfection – they are priced to the anticipation of continued perfection for at least 5 more years plus about 20% on top of that – so we like the June $375 puts at $5 as a gamble on tonight's earnings and you can sell the May $475 calls for $4.75 to pay for them and they you're in the puts at net .25 and hoping CMG doesn't move 10% higher in 29 days (although that only forces you to establish a short position on CMG at net $474.75 so really not bad either way).

8:30 Update: The Dow Futures (/YM) are testing 13,000 and we love that spot for a short with a tight stop over the line as it makes for a strong bull/bear indicator and WHEEEEEEEEEEEE!, Unemployment is a whopping 386,000, which is a very bad number as it's more than last week (380,000), more than was expected (375,000) but NOT so bad that the Fed is more likely to step in. Nope it's just a WEAK number that reflects the WEAK real economy we've been warning you about since March.

8:30 Update: The Dow Futures (/YM) are testing 13,000 and we love that spot for a short with a tight stop over the line as it makes for a strong bull/bear indicator and WHEEEEEEEEEEEE!, Unemployment is a whopping 386,000, which is a very bad number as it's more than last week (380,000), more than was expected (375,000) but NOT so bad that the Fed is more likely to step in. Nope it's just a WEAK number that reflects the WEAK real economy we've been warning you about since March.

It's 8:42 now and oil dropped to $102.85 and a stop at $103 locks in $500 per contract and pays for the morning McMuffins. Hopefully we hit our next target at $102 later today but that's going to depend on the Euro ($1.3078) and the Dollar ($79.93) with the Pound holding $1.602 at the moment. A breakdown in the Pound below that $1.60 line will be our first clue that the EU can't hold it together and the Euro blowing $1.30 would be catastrophic and not likely to happen until next week.

Gold (we're short) is back down to $1,635 and we'd love to see them fail $1,600 but it's not going to happen with the Dollar below 80 and that's going to be tough to beat with the Fed meeting next week (announcement Weds 12:30). We also get our first look at Q1 GDP on Friday next week – that's going to be fun!

Gold (we're short) is back down to $1,635 and we'd love to see them fail $1,600 but it's not going to happen with the Dollar below 80 and that's going to be tough to beat with the Fed meeting next week (announcement Weds 12:30). We also get our first look at Q1 GDP on Friday next week – that's going to be fun!

As you can see from the graphic on the right, Europe is still in BIG TROUBLE and that's just Spain – Italy may be worse and who says France is any better? "The market has been treating the LTRO as a panacea," said James Ferguson, head of strategy at Westhouse Securities in London. "It's absolutely better than what would have happened without it, but that doesn't mean it's a fix."

I'll close on a positive note as earnings are actually coming in pretty good so far with 77% of the reporting companies beating low expectations. If the rest of the World would just go away and leave us alone, that would be great but, no matter how many laws Arizona passes, we can't get those damned foreigners completely off the planet. That means what happens there is going to continue to affect us here.

So let's be careful out there!