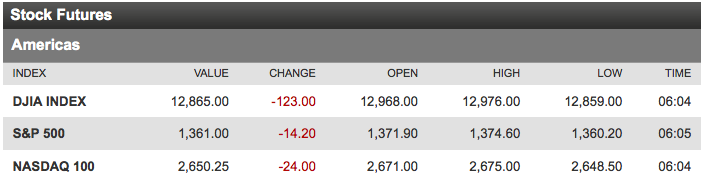

Now THIS looks a little more realistic, doesn't it?

Now THIS looks a little more realistic, doesn't it?

Last Monday we pointed out that the run-up, that was coming DESPITE a myriad of Fundamental negatives we were tracking, was essentially a load of crap aimed at bringing in more suckers before they pull the rug out from under the market. To keep ourselves from getting sucked in by the hype, we drew some very simple lines across our mult-chart which were 50% retacements of the month's dip. Not making those lines during last week's actions kept us from making poor decisions as the market hype continued all week. My warning was:

"How many times will the bulls be sucked in by the same empty promises? How many times will they reach into their pockets and BUYBUYBUY the snake oil valuations sold by the Reverend James Cramer?"

Tuesday I got a lot of sheeple angry by calling them sheeple for falling for Cramer and the rest of the Mainstream Media hype and we discussed a few of our hedges that were working already, like TZA, TLT and SQQQ as well as two that were still playable: CAT May $95 puts at $1.10 – up just 15% from our initial entry and DXD May $12 calls at $1.35, up just 12% from when our Members got the Trade Idea. Despite the market moving up, I reiterated my sell-off targets of Russell 775 and S&P 1,325.

Tuesday I got a lot of sheeple angry by calling them sheeple for falling for Cramer and the rest of the Mainstream Media hype and we discussed a few of our hedges that were working already, like TZA, TLT and SQQQ as well as two that were still playable: CAT May $95 puts at $1.10 – up just 15% from our initial entry and DXD May $12 calls at $1.35, up just 12% from when our Members got the Trade Idea. Despite the market moving up, I reiterated my sell-off targets of Russell 775 and S&P 1,325.

Wednesday we tried to find reasons to be bullish, presenting both sides but judgment was once again for the bears after weighing the evidence as I pointed out that the lack of economic improvement for the bottom 90% could not be ignored – something Nick Sarkozy just discovered this weekend. In the morning post, I mentioned going back to the well and shorting oil again as it dared to reach for $104.50 again – another lovely pay-off last week and we caught it again this morning at $103.50 (/CL Futures) for a quick $500 per contract – so far.

Thursday we were having great fun and we had a bullish spread on CHK at $17.20 that may still be playable this week as the market dips again. We discussed our goal of re-shorting PCLN (back in the July $560 puts at $8.50) and we added a nice CMG spread in the morning post, selling the May $475 calls for $4.75 and buying the June $375 puts for $5 for net .25 on the spread. As of Friday, the May calls were down to .60 and the June puts were $5.50 (still playable!) for net $4.90 – up 1,860% in just 48 hours.

That was a great finish to April's free samples and I hope a lot of people were able to profit from our ideas. We're about full once again in Basic and Premium Member Chat and we'll be closing down admission for new Members next week until there is more room. Friday went just as planned with a nice goose into the open that topped out around the EU close and then we had a nice little sell-off into the close.

That was a great finish to April's free samples and I hope a lot of people were able to profit from our ideas. We're about full once again in Basic and Premium Member Chat and we'll be closing down admission for new Members next week until there is more room. Friday went just as planned with a nice goose into the open that topped out around the EU close and then we had a nice little sell-off into the close.

In Member chat we added a new SCO spread for May expirations as the April spread (which I gave out on BNN) of the April $29/33 bull call spread at $2.10, selling the $30 puts for $1.35 for net .75 finished at the full $4 – up 433% in 6 weeks. We also had a chance to re-up our DIA puts as well as USO puts – even for our $5,000 Portfolio, where we also added a bullish bet on the Dollar with UUP May $22 calls at .17.

All in all, it was a fantastic week of riding out a minor bullish bounce and, now that options expirations are over, we are back to the cold, harsh reality of the last week of April and things have certainly NOT improved over the weekend. Our biggest fear in getting too bearish is Central Bank intervention but any weekend (like this one) where it doesn't happen – realizes the biggest fear for the bulls because without a constant flow of MORE FREE MONEY – what is their premise?

This weekend, in Member Chat, we discussed On Balance Volume and how that indicator was cutting through the crap and giving us a very clear sell signal on the S&P. As you can see from StJeanLuc's SPY chart and, as we discussed last week, the minor bounce in the S&P and other indices is only masking continued deterioration of the OBV indicator – giving us a clear signal of real internal market weakness. As I said on Friday regarding the VIX's MACD indicator showing similar weakness:

Do you see that MACD line on David Fry's VIX chart? Do you really need 10,000 hours of TA training to figure out what's likely to happen in the near future? Complacency is what's wrong with the markets – we are pricing companies to perfection and not discounting any kind of risk premium into our stock valuations. Something is bound to happen – all we need to do is choose the form of the Destructor.

This weekend Gozer takes the form of the French elections, in which Socialist Francois Hollande came in first, with 28.8% of the vote, beating incumbent Nick Sarkozy (26.1%) and a very strong finish by Marine Le Pen, who's National Front picked up a surprising (and scary) 20% of the vote. “People are worried… because if [Hollande] beats Sarkozy, he’s going to look to renegotiate a lot of the treaties France has signed… The European problem hasn’t gone away,” said Piper's Andrew Sullivan.

This weekend Gozer takes the form of the French elections, in which Socialist Francois Hollande came in first, with 28.8% of the vote, beating incumbent Nick Sarkozy (26.1%) and a very strong finish by Marine Le Pen, who's National Front picked up a surprising (and scary) 20% of the vote. “People are worried… because if [Hollande] beats Sarkozy, he’s going to look to renegotiate a lot of the treaties France has signed… The European problem hasn’t gone away,” said Piper's Andrew Sullivan.

The economic data sure isn't saving us as HSBC's reading of China's PMI still came in at a contracting 49.1, up only slightly from March's 48.3. France's PMI went the other way – into deeper contraction with April falling to 46.8 from 48.7 in March led by MASSIVE declines in service, from 50.1 to 46.4. PMI services across the Eurozone fell from 49.2 to 47.9 while the Manufacturing PMI dropped into DEEP CONTRACTION at 46 vs. 47.7 in March prompting Markit's Chief Economist to say:

The flash PMI signalled a faster rate of economic contraction in the Eurozone during April, extending what appears to be a double-dip recession into a third consecutive quarter. Germany saw growth weaken to near-stagnation, while France saw a worryingly steep downturn. The rate of decline also regained momentum in the periphery, which will inevitably raise concerns about the impact of deficit-fighting austerity measures.”

Meanwhile, Spain's Central Bank says their economy contracted 0.4% in Q1 and down 0.5% from Q1 of last year, when the Global markets fell off a cliff over what a disaster Spain (and other EU countries were looking like). Now things are clearly WORSE yet the S&P is up 10% – does it make sense to you because it sure doesn't to me?

Meanwhile, Spain's Central Bank says their economy contracted 0.4% in Q1 and down 0.5% from Q1 of last year, when the Global markets fell off a cliff over what a disaster Spain (and other EU countries were looking like). Now things are clearly WORSE yet the S&P is up 10% – does it make sense to you because it sure doesn't to me?

Also casting a shadow across Europe was news that the Netherlands will face an early general election (with more right-wing leadership) after budget talks, aimed at trying to meet European Union rules and keep its triple-A credit rating, fell apart on Saturday. The right-wing Freedom Party reportedly walked out of three-party talks, saying EU budget demands were impossible to meet. Dutch Prime Minister Mark Rutte has reportedly resigned. The Czech government is also collapsing – but no one seems to care..

“There is a growing sense that it’s getting hard for force the austerity program through both referendums but more so local parliaments — this increases the tail-risk which one month ago had all but disappeared, and reforms are now even more on the back burner,” said Steen Jakobsen, chief economist at Saxo Bank. “I remain extremely defensive as we move towards May 6th double referendum, and with no ‘salvation’ ahead we could see further losses,” he said, referring to the date of the second round of the French election along with a Greek election.

Mish summed up the situation in Australia this weekend with the very simple title: "Australia is Screwed," in which Ian Vettender notes: "Our retail malls, once proudly displaying two discounted sales a year, now are permanently emblazoned with discount banners, promising 30 per cent, 50 per cent or even more off the "regular" price. Our banks are faced with the very same dilemma. Month after month, the Australian Bureau of Statistics unveils figures detailing a drop in lending for new housing and for business, falls to levels not seen in decades, sometimes of a magnitude never before recorded. No-one is borrowing."

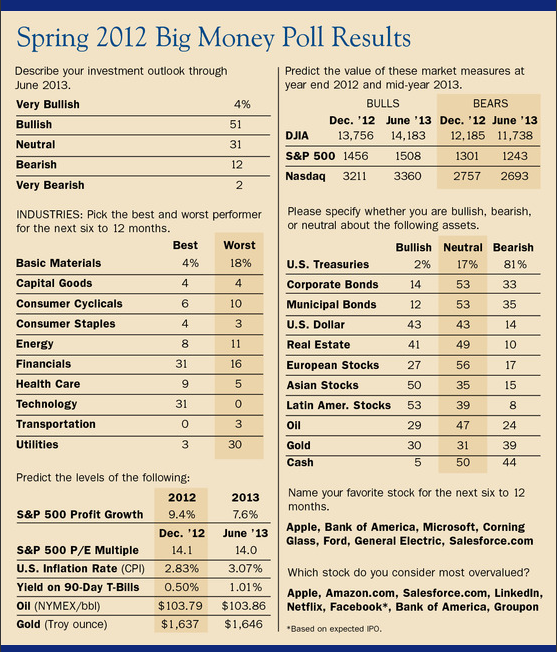

Back home, Barron's polled the top money managers and found them to be a generally bullish bunch with 51% in that camp and only 14% on the bear side so whoever told you that there's a lot of money to come in from the sidelines has been lying to you – but what else is new?

Back home, Barron's polled the top money managers and found them to be a generally bullish bunch with 51% in that camp and only 14% on the bear side so whoever told you that there's a lot of money to come in from the sidelines has been lying to you – but what else is new?

Since the "bears", like us only expect a small correction before the Central Banksters step in and turn the money machines back on – the overwhelming bullishness pumps up the S&P another 6% by the end of the year. Notice NOBODY wants to bet against the AAPLdaq and very few people are willing to bet against either Asia or Emerging Markets – truly this is 2007-2008 all over again and we have learned – NOTHING!

Call girls are, at least, fast learners and the International Alliance of Professional Escorts has, in the wake of the Secret Service scandal, already downgraded the US's credit rating saying it's members : "should be aware that doing business with the government of the United States carries with it a significant risk. We are urging our members to avoid conducting transactions with the United States and to focus on more reliable customers, like the International Monetary Fund,” the statement added." Maybe NOW Congress will take some action — as their own action is being curtailed…

As a rule of thumb – if a hooker won't do business with someone – you shouldn't either – so look for TBills to shoot up as people run to the relative safety of play money because that Global demand story is coming apart at the seams despite all the "positive" Q1 earnings reports (more on that when I have time).

Let's continue to be very careful out there!