What a wild ride these markets are on!

What a wild ride these markets are on!

The S&P held flat on low volume but sold off sharply after hours, only to recover early this moring from a dip all the way back to testing the 1,360 line at the Dollar ran back to test 80.

As David Fry notes: With over 400 of S&P 500 earnings being reported only 60% are beating estimates whereas in the previous quarter the level was over 80%. Consumer credit rose sharply by $21.4 billion in March vs expectation of $9.8 billion. Most of this gain was concentrated in the new bubble, student loans.

Spain is up again this morning (1.5%) on bailout talks but the FSTE and DAX are barely flat after poor opens and the CAC is still down 1%. Our Futures are down about 0.25% overall, which is a vast imrpovement from the lows at 4am.

There is no particular reason for the move, other than this being Tuesday in a manipulated market. Neither oil ($97.38) or gold ($1,628) or copper ($3.71) or silver ($29.73) or even gasoline ($2.97) give any indication of consumer demand for commodities. "Fixing" the charts does not mean you have fixed the economy!

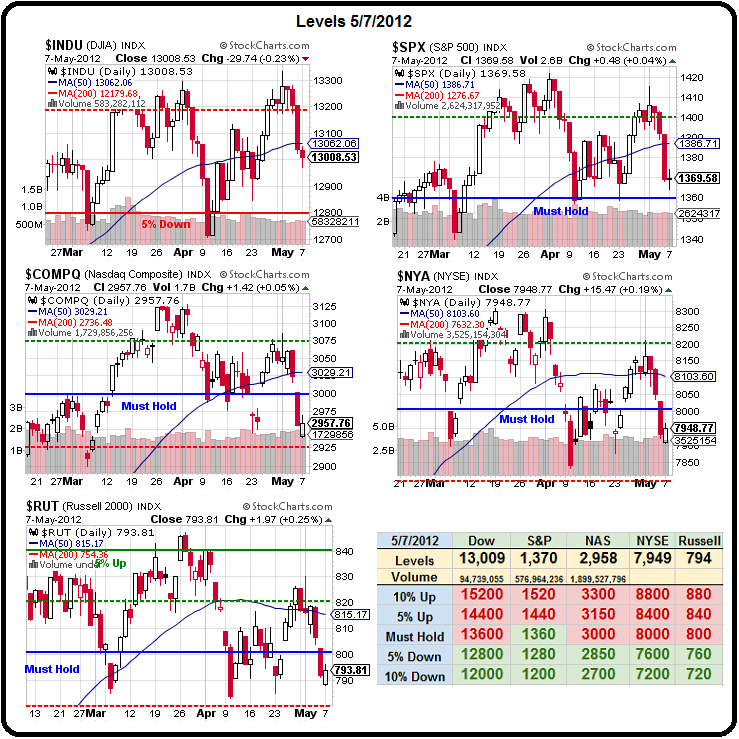

In fact, as you can see from our Big Chart, huge technical damage has been done to all of our major indexes with the S&P acting as the sole hold-out over its 1,360 line, where it has bounced 3 other times since March. Does that make it solid support or a dangerous floor to break below? We'll probably find out in the very near future.

In fact, as you can see from our Big Chart, huge technical damage has been done to all of our major indexes with the S&P acting as the sole hold-out over its 1,360 line, where it has bounced 3 other times since March. Does that make it solid support or a dangerous floor to break below? We'll probably find out in the very near future.

As I mentioned in yesterday's post – none of the structural issues that affect the EU are going away and we need to dig deeply to figure out what is really going on in the International Markets. Yesterday was very much a watch and wait day as we certainly didn't take the low-volume move up too seriously – as you can see from the Big Chart – we haven't even made an attempt at what we would classify as a "weak bounce" so far.

Speaking of weak – ICSC Retail Store Sales were down -0.8% week over week – leaving them up 3.3% for the year but that is softening fast from a 4.2% annualized reaading. The decline in sales is due to consumers concentrating on staples especially groceries.

The Euro is trading at $1.30 – 0.6 percent from a three-month low as Greece’s political leaders meet for a second day in a bid to form a new government, after an election raised questions about the country’s membership of the euro bloc. The 17-nation currency maintained a two-day decline against the yen after French President Nicolas Sarkozy, German Chancellor Angela Merkel’s preferred partner for enforcing debt reductions, was defeated by Socialist Francois Hollande.

The Euro is trading at $1.30 – 0.6 percent from a three-month low as Greece’s political leaders meet for a second day in a bid to form a new government, after an election raised questions about the country’s membership of the euro bloc. The 17-nation currency maintained a two-day decline against the yen after French President Nicolas Sarkozy, German Chancellor Angela Merkel’s preferred partner for enforcing debt reductions, was defeated by Socialist Francois Hollande.

Demand for the Yen was also limited as Asian stocks climbed before data that may show German industrial production rebounded. The Australia’s dollar dropped against all of its 16 major peers after the country’s trade deficit more than doubled in March. “Regardless of which party eventually manages the Greek government, the next period here looks to be full of uncertainty,” said Imre Speizer, a strategist in Auckland at Westpac Banking Corp. (WBC), Australia’s second-largest lender. “That’s going to be a negative for the Euro.” A negative for the Euro is a positive for the Dollar and that's bad for stocks and commodities in the short run.

In Asia, the Nikkei fell another 1% today despite the Bank of Japan stepping back into the stock market Monday, making its largest single-day purchase of exchange-traded funds to date, though the move failed to prevent a sharp fall for the Tokyo equity market. If this is how the market is behaving WITH the BOJ as a major buyer of equities – how bad is the reality they are trying to cover up?

In Asia, the Nikkei fell another 1% today despite the Bank of Japan stepping back into the stock market Monday, making its largest single-day purchase of exchange-traded funds to date, though the move failed to prevent a sharp fall for the Tokyo equity market. If this is how the market is behaving WITH the BOJ as a major buyer of equities – how bad is the reality they are trying to cover up?

According to Economist Andy Xie, both the US and Europe have run out of monetary tricks at this point. Industrial production is stalling in India, and its credit rating may be downgraded to junk. Power consumption in China has slowed to about half of last year's level, while consumer price inflation remains stubbornly high. It's obvious the world's largest emerging economies are no longer in a position to carry the global economy through tough times, as they did during the "recovery" years of 2009-'11. And that spells trouble for the United States and Europe.

Meanwhile, the president of the Federal Reserve Bank of Dallas, Richard Fisher, rejected the idea that higher inflation would spur the economy on Monday. Saying the last thing businesses needed in this economy was uncertainty, Fisher sided with Federal Reserve Chairman Ben Bernanke in his public feud with Paul Krugman. Called “The Battle of the Beards” by The Washington Post, the back-and-forth between the two economists began when Krugman called on the Fed to raise inflation targets, a move Bernanke called “reckless.” “I would say that Ben Bernanke’s guilty of understatement. It would be more than reckless. It’s a silly thing to recommend,” Fisher said.

Doesn't sound like QE3 is right around the corner to me and we sure don't want to be forced to see how well (or how poorly) our markets are able to hold up on their own.