Here we go again!

Here we go again!

It was only last Tuesday we were watching that 1,360 line on the S&P but, at the time, we were looking for it to hold as we finished last Monday at 1,370 – in a totally fake pump into the close. Even early Tuesday morning, the Futures were being pumped up to reel in the suckers but I warned in the morning post:

There is no particular reason for the move, other than this being Tuesday in a manipulated market. Neither oil ($97.38) or gold ($1,628) or copper ($3.71) or silver ($29.73) or even gasoline ($2.97) give any indication of consumer demand for commodities. "Fixing" the charts does not mean you have fixed the economy!

We all know what happened next – we failed to hold that 1,360 line on the S&P as the Euro failed to hold $1.30 and Greece was unable to form a coalition government (we also had disappointing Retail Sales numbers) and this morning (6:45) oil is $94.74, gold is $1,558, copper is $3.53, silver $28.23 and gasoline is STILL $2.97.

We all know what happened next – we failed to hold that 1,360 line on the S&P as the Euro failed to hold $1.30 and Greece was unable to form a coalition government (we also had disappointing Retail Sales numbers) and this morning (6:45) oil is $94.74, gold is $1,558, copper is $3.53, silver $28.23 and gasoline is STILL $2.97.

The last thing we should do is complain about gasoline prices – we still pay 1/2 of what Europe does and even China is paying $5.31 a gallon – 25% more than the US average $4.19. At this point, gas prices are the only commodity not falling down and that's because they are the easiest to manipulate – the last bastion of the speculator – if you will.

With that mythical summer driving season on the way, even we stopped shorting oil at $94 and gasoline is now a joke at $2.97 as that's $124.74 per barrel – a 33% per barrel mark-up at retail. At the pump, $4.19 a gallon means you are paying $175.98 at the pump – that's an 87% mark-up! Actually, we shouldn't look at it as 87%, that's misleading – when oil was $60 per barrel, gasoline was $1.85 at the pump and that was $77.70 and the refiners were making very good money. Why would it cost $81.98 to refine and retail a $94 barrel of oil when it only costs $17.70 to refine and retail a $60 barrel of oil? See – it's a rip-off! Somebody, somewhere is massively screwing you over – that much should be obvious to even a Republican Senator.

This 400% increase in retail mark-up is literally destroying the US economy. It's not about the price of oil but what consumers pay at the pump that matters and, with the average consumer driving 15,000 miles a year in cars that average 20 mpg, that's 750 gallons a year with the extra $2 per gallon sucking $1,500 out of the wallet of every driver in America. With 200M cars on the road, we're talking $300Bn a year of consumer spending power deleted – one fill-up at a time.

This 400% increase in retail mark-up is literally destroying the US economy. It's not about the price of oil but what consumers pay at the pump that matters and, with the average consumer driving 15,000 miles a year in cars that average 20 mpg, that's 750 gallons a year with the extra $2 per gallon sucking $1,500 out of the wallet of every driver in America. With 200M cars on the road, we're talking $300Bn a year of consumer spending power deleted – one fill-up at a time.

THAT plus the extra 12M people who are out of work are the reasons why this economy – indeed the entire Global Economy – will NOT be recovering until we get gas prices under control and begin creating jobs again. To pretend that the markets should be back to their 2007 highs when the underlying conditions are so much worse is a complete fantasy so let's not expect any big bounce back to levels we shouldn't have been at in the first place.

Sure the Fed or the ECB or the BOE or the BOJ or the PBOC can pump another Trillion here or a Trillion there to jam us back up again but it's nothing more than a sugar rush that quickly fades. Until our World Leadership gets serious about addressing the real problems that are plaguing us (and I mean 100% of us, not the 1% of us who benefit from QE) – all rallies will end in disappointment and already people are getting the message that long-term investing is a dead end and now we have sugar-rush markets as well – where traders run from sector to sector, stock to stock – looking for the next hot thing.

Again, this is great for the top 1%, who fleece the sheeple daily, but not so good for the sheeple themselves and then we act all surprised when the beautiful sheeple no longer have any money to buy the stuff we make.

Again, this is great for the top 1%, who fleece the sheeple daily, but not so good for the sheeple themselves and then we act all surprised when the beautiful sheeple no longer have any money to buy the stuff we make.

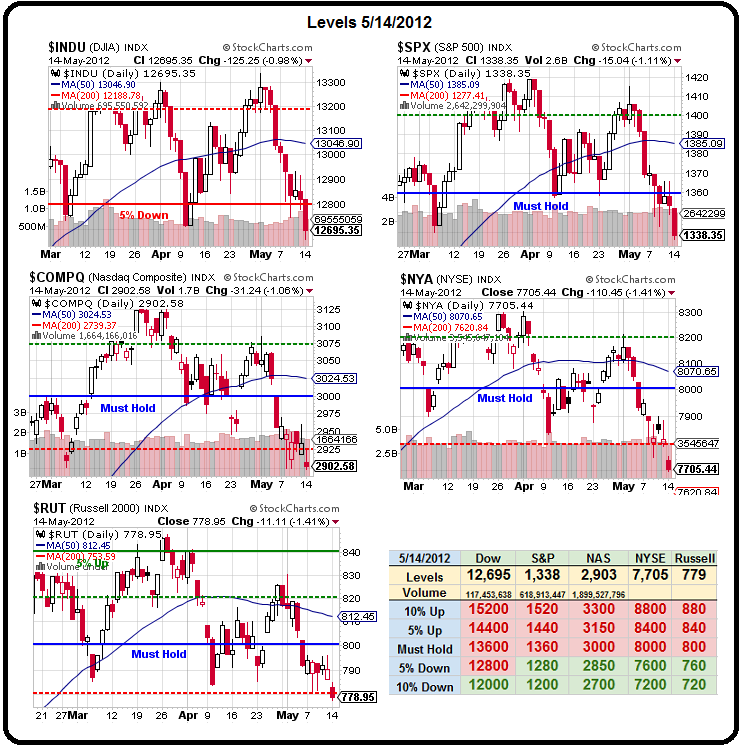

We've been doing a little bit of bottom fishing but not because we think the economy will recover – just because our Central Banksters don't seem to know how to leave the economy alone for 5 minutes without "fixing" something. Unfortunately, the more I read this week, the more bearish I get and we're certainly not going to get sucked into too many bullish bets until we see those "Must Hold" levels retaken on our Big Chart. It shouldn't be too much to ask if there's a real recovery in progress.

As you can see from Dave Fry's McClellan Oscillator, we're short-term oversold. We're going to bounce – the only question is how high and for how long? We were oversold in mid-June of last year and we bounced back from 1,258 on the S&P to 1,356 into the holiday weekend and we bounced up and down between 1,350 and 1,300 for the month of July and then fell to 1,100 in the first 10 days of August. If you look at the long-term chart of the S&P – this pattern is shaping up very similar to last year's.

As you can see from Dave Fry's McClellan Oscillator, we're short-term oversold. We're going to bounce – the only question is how high and for how long? We were oversold in mid-June of last year and we bounced back from 1,258 on the S&P to 1,356 into the holiday weekend and we bounced up and down between 1,350 and 1,300 for the month of July and then fell to 1,100 in the first 10 days of August. If you look at the long-term chart of the S&P – this pattern is shaping up very similar to last year's.

So, rather than looking up and wondering where we will bounce to, let's assume for a moment that we do NOT retake 3 of our 5 Must Hold levels and – even worse – let's assume that our Central Banksters are not willing to put in additional stimulus measures while all these elections are going on – as we've seen what a mess Greece and France have become as people are finally getting fed up with the Fed and their cohorts driving down the savings rates while doing nothing to improve things for the average person who, sadly, still have the right to vote (don't worry, the Supreme Court will be hearing this case next year in "Romney vs. People Who Don't Deserve a Vote").

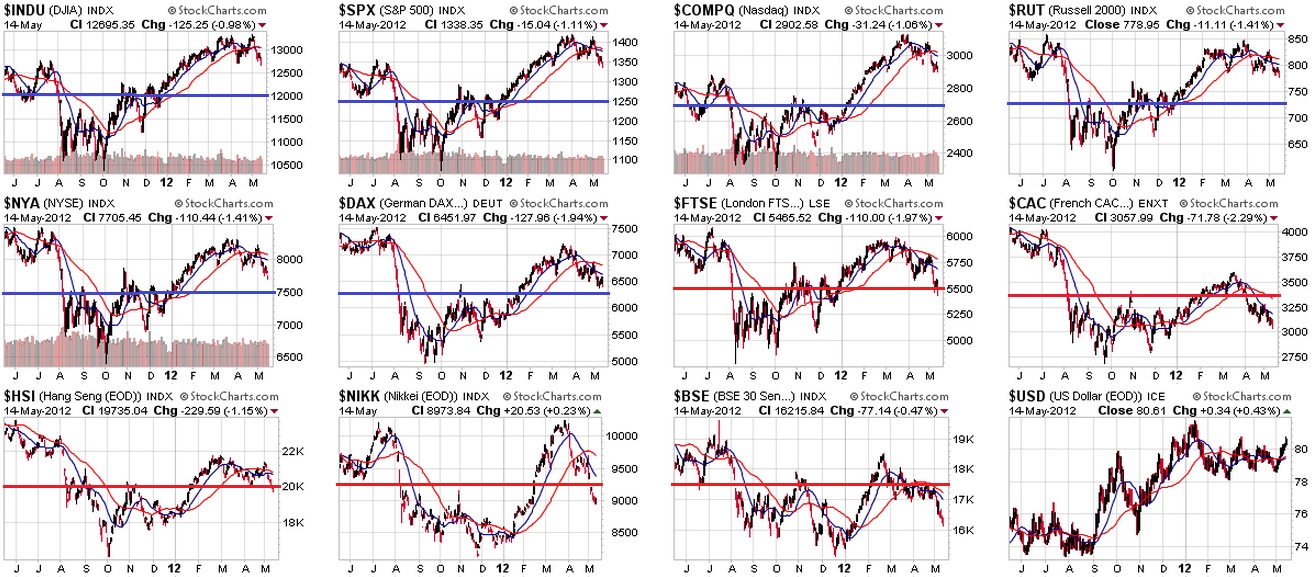

Notice it has not been a great 12 months for most of the World. Are US equities superior or delusional – that is the question? If the DAX fails to hold that 6,250 line, there's no way you're going to convince me to be bullish again until Europe and Asia get back over those red lines or the US corrects down enough to join them and at least give us credible entry points. As it stands now, we're still over-achieving globally by a solid 5%, at least and that leaves us open for one Mofo of a correction in the near future.

Gosh, this hasn't happened in so long I can hardly remember when the US last ignored first a collapse in the emerging markets, then Europe and then a sell-off in commodities – it must have been way back in – 2008! That's right, if you want to match what's going on now to something historical, this is JUST like 2008 – even including the "isolated" incident at JPM which is nothing at all like what's happening in Europe (where Moody's downgraded 26 Italian banks yesterday).

Gosh, this hasn't happened in so long I can hardly remember when the US last ignored first a collapse in the emerging markets, then Europe and then a sell-off in commodities – it must have been way back in – 2008! That's right, if you want to match what's going on now to something historical, this is JUST like 2008 – even including the "isolated" incident at JPM which is nothing at all like what's happening in Europe (where Moody's downgraded 26 Italian banks yesterday).

We continue to party like it's 1999 when it's more like September 10th, 2001, where our President gets ready to pretend he can read for a photo op despite the gathering storm he was clearly warned about (assuming someone read it to him) just a month earlier.

We have a gathering storm in the markets – cash is going to be king and you can see that from the rising demand for Dollars. This is not a stable economy, we are being attacked from all sides by bad data and this is NOT a good time to be jumping into long-term trades until we get some better signals. Yes, we are finding some stocks to buy that are simply, fundamentally cheap and we don't mind picking up entries on those but let's not lose our heads and remember to keep one hand on the exit door at all times – just in case.

We have a gathering storm in the markets – cash is going to be king and you can see that from the rising demand for Dollars. This is not a stable economy, we are being attacked from all sides by bad data and this is NOT a good time to be jumping into long-term trades until we get some better signals. Yes, we are finding some stocks to buy that are simply, fundamentally cheap and we don't mind picking up entries on those but let's not lose our heads and remember to keep one hand on the exit door at all times – just in case.

Germany had a 0.5% increase in GDP but that's so 2 months ago now – who cares? Italy was down 0.8% in Q1 so Recession/Depression – whatever you want to call it – it's on! France's GDP flatlined (and this is with MASSIVE EU stimulus, don't forget) and the overall Eurozone was at 0% growth – DESPITE the MASSIVE bailout package. In CURRENT NEWS – the German ZEW Economic Sentiment Indicator for MAY dropped 54%, from 23.4 in April to 10.8 this month and far, far below the 19 that was predicted by economorons, many of whom obviously were consulted by JPM recently.

Eurogroup chief Juncker dismisses as "propoganda" and "nonsense" the idea of Greece exiting the Eurozone, which probably means they'll be out this weekend as I would rather trust Lloyd or Jamie to tell me what's real in this World than Juncker.

What's painfully real in our World is ICSC Retail Store Sales were down 0.8% last week after being down 0.8% from the week before that. Overall April Retail Sales were up just 0.1% vs 0.2% expected and 0.8% in March and that's WITH gasoline sales giving us an 6.9% "boost" over last year. This month is not included on the chart on the right but 0.1% will look like that tiny little bar in December – no wonder we were shorting XRT!

What's painfully real in our World is ICSC Retail Store Sales were down 0.8% last week after being down 0.8% from the week before that. Overall April Retail Sales were up just 0.1% vs 0.2% expected and 0.8% in March and that's WITH gasoline sales giving us an 6.9% "boost" over last year. This month is not included on the chart on the right but 0.1% will look like that tiny little bar in December – no wonder we were shorting XRT!

Our last two plays in Member Chat yesterday were aggressively bearish plays using SQQQ (ultra-short Nasdaq) and TZA (ultra-short Russell) as we did not like the action into the close one bit. At 3:06 my comment to Members was: "Getting ugly signs again across the board. No Greek government leads to weeks of additional uncertainty" and, in the morning Alert my warning about getting bullish yesterday is exactly what is going wrong this morning:

Retail Sales, CPI and Empire Manufacturing will have to turn us around tomorrow. After that we have lots of housing news and our own Industrial Production, which is not likely to be thrilling so no knight in shining armor on the horizon if we fail to hold the above levels and a long way to the bottom.

Looks like we'll have to wait a bit longer to find that elusive bottom….