Courtesy of Lee Adler of the Wall Street Examiner

This report is an excerpt from the permanent Employment Chart page.

The edge that Federal Withholding Tax collections had held over last year continued to narrow last week, suggesting a weakening employment picture in May.

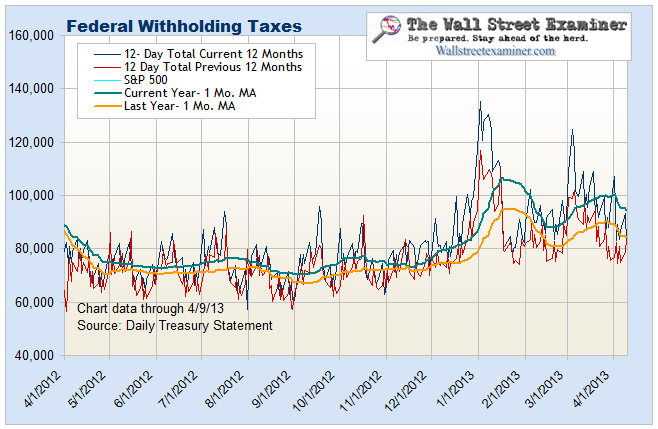

The chart below compares current withholding tax collections with last year on the same date. This year collections have been running slightly ahead of last year in nominal terms. As of May 17, collections for the prior 10 business days were 3% greater than last year. A month ago, the edge was 4%. The 1 month moving average was 2.4% higher than last year. At the end of April the 1 month moving average was 4.2% higher than last year.

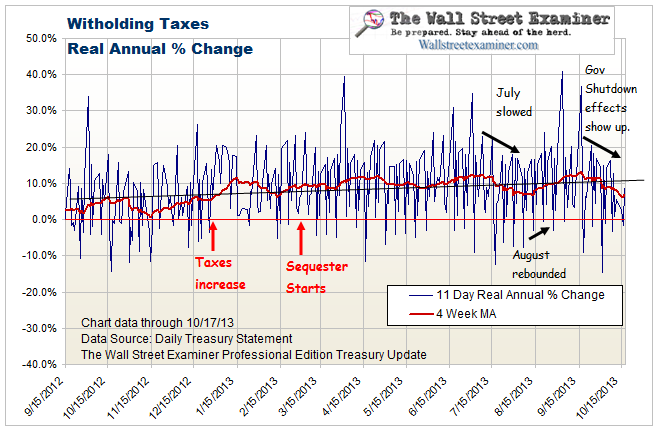

This chart looks at the year to year change in withholding in real terms, adjusted by the average weekly wage data from the BLS. On this score, following a bulge in March that was probably due to mutual fund withholding for capital gains distributions, the comparison is now slightly negative in real terms which does not bode well for employment in May. The employment surveys are taken for the week which includes the 12th day of the month. In real terms, adjusted for the increase in average weekly earnings, the current week was down 1.4% versus the same week last year. That does not bode well for the coming jobs reports for May.

These 2 charts are updated and analyzed weekly in the Professional Edition Treasury update in conjunction with their implications for employment, and in particular the Federal deficit and Treasury supply.

Enter your thoughts in the Comment Form at bottom of page. No registration necessary.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.