Excerpt from "The Oligarchy’s Rule of Law: From Boris Yeltsin’s Russia to Aubrey McClendon’s Oklahoma – By Mark Ames – The eXiled"

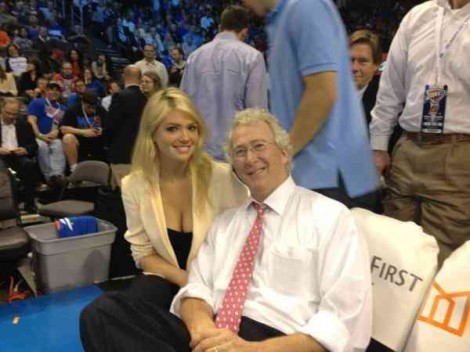

The reason I’m bringing this up now is because over the past month, one of America’s most rapacious oligarchs, Aubrey McClendon, was exposed by Reuters for plundering Chesapeake Energy, the second-largest natural gas producer in the country after Exxon-Mobil. McClendon, co-founder, CEO and until a few weeks ago Chairman of Chesapeake, was discovered running a hedge fund inside of Chesapeake, personally profiting on the side from large trading positions that his public company Chesapeake took in the gas and oil markets.

The reason I’m bringing this up now is because over the past month, one of America’s most rapacious oligarchs, Aubrey McClendon, was exposed by Reuters for plundering Chesapeake Energy, the second-largest natural gas producer in the country after Exxon-Mobil. McClendon, co-founder, CEO and until a few weeks ago Chairman of Chesapeake, was discovered running a hedge fund inside of Chesapeake, personally profiting on the side from large trading positions that his public company Chesapeake took in the gas and oil markets.

Reuters also discovered that McClendon took small personal stakes in natural gas wells bought by Chesapeake, then borrowed against the wells’ reserves from the same banks that Chesapeake borrowed from—basically, the banks kicked back sweet lending deals to McClendon on the side as McClendon arranged less-than-sweet loans to his publicly-owned company, Chesapeake, kicking profits from Chesapeake’s shareholders and employees’ pockets into the banks and into Aubrey’s accounts.

The loser in all this, as always: Employees, retirees, and shareholders. As Reuters reported, Chespeake is one of a small handful of companies whose employee 401k retirement packages consist mostly of Chesapeake stock, and the company requires employees to hold on to their stock for the maximum amount of time allowed by law:

Thousands of Chesapeake workers have retirement portfolios that are heavily invested in Chesapeake stock, which has declined sharply following revelations about Chief Executive Aubrey K. McClendon’s business dealings.

But while retail and institutional investors have sold the stock, employees don’t always have that option.

It’s not the first time McClendon has been caught plundering Chesapeake at the expense of shareholders, pension fund investors and employees: In 2008, McClendon bet and lost about $2 billion worth of Chesapeake Energy stock he owned—94% of Aubrey’s personal stake in Chesapeake– on a margin call when natural gas prices collapsed. Aubrey bet that natural gas prices would continue soaring, you see.

But like his peers in the oligarchy class, Aubrey’s loss became everyone but Aubrey’s loss: He was awarded a “CEO bailout” by his board of directors, who honored Aubrey with a $75 million “bonus” to bring his total pay in 2008 to $112 million, making Aubrey McClendon the highest-paid CEO in Corporate America that year. Even though Chesapeake’s earnings dropped in half, and its stock fell 60%, wiping out up to $33 billion in shareholder wealth.

Now, we’re learning, Aubrey was profiting in other ways off of Chesapeake that same year.

Full article: The Oligarchy’s Rule of Law: From Boris Yeltsin’s Russia to Aubrey McClendon’s Oklahoma – By Mark Ames – The eXiled.