Courtesy of Lee Adler of the Wall Street Examiner

Real Durable Goods New Orders and Stock Prices

April Real Durable Goods Orders, adjusted for inflation and not seasonally manipulated were up 3.7% over April 2011. In attempting to adjust for inflation, this measure represents actual unit volume of orders. Also, the use of actual, versus seasonally manipulated (SA) data allows an accurate view of the trend. With SA data, you’re always guessing as to whether it represents the trend accurately. There are no such issues when using the actual data, rather than the fictional numbers derived from the seasonal adjustment process.

Overall new orders volume remains well below the 2004 through 2007 levels, and the uptrend, if it can be called that, has flattened dramatically. However, the growth momentum was a little stronger in April than it was in March. The economy is gradually weakening, but it hasn’t yet gone negative.

April is always a down month. This April was down by 12.6% from the March level. That compares with a decline of 17% in April 2011. The average April decline over the last 10 years was 12.1%, so this year, while better than 2011, was slightly weaker than average. Four of the last 10 years were weaker than this year’s change. 6 were stronger. This was a middling number, in no way representing a crisis.

On a 3 month basis, April is always stronger than January. The average gain for April versus January over the last 10 years was 6.1%. Last year the gain was 3%. However, this year the April level was virtually unchanged versus January, which is more evidence of the flattening of the trend.

Remember how the pundits were touting the manufacturing led recovery a few months ago. Well, guess what? It’s not happening. Any time an idea becomes the unquestioned consensus, question it. Likewise, the current data isn’t the catastrophe that the mainstream pundits are calling it.

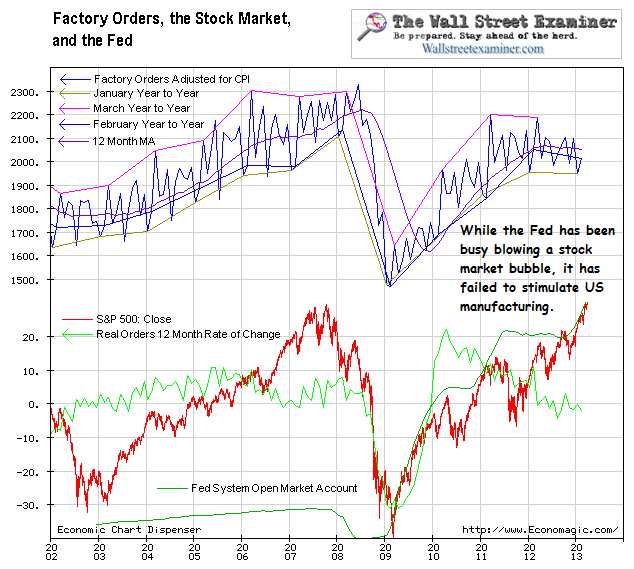

Real Factory Orders

New factory orders, which is a broader measure than durable goods orders, showed a similar pattern in April. This measure is also adjusted for inflation and not seasonally manipulated to give as close a representation as possible of the actual unit volume of orders, and the actual trend. Total new factory orders were up just 0.9% for the past 12 months.

The month to month change was a decline of 8.1%. April is always a down month, so the fact that April was down, in itself is neither negative nor positive. It was better than April 2011, which had a 9.3% decline, but it was slightly weaker than the 10 year average of -7.4%. Four of the last 10 years were weaker than this year. So it was also a middling performance. However, as the chart shows, the trend has flattened dramatically since the beginning of the year.

The average 3 month gain from January to April was 6.6%. Last year the gain was 7.3%. This year orders were only up 3.1% from January to April, indicating weakening demand for manufactured goods.

As the Fed has pretended to do something by moving the spaghetti around on the plate while holding the size of its balance sheet flat, factory demand has stalled and so has demand for equities. Based on the correlation between factory orders and stock prices, the S&P could easily fall to 1150 even if there’s no further deterioration in factory orders.

Obviously the Fed is the driver. If it decides to begin expanding its balance sheet (aka QE or printing money) again, stocks and manufacturing demand could modestly increase, but the Fed is getting incrementally less mileage out of each new dollar of debt that it enables and increasingly negative unintended consequences when it does print, most particularly in commodities and energy inflation. The negative unintended consequences of any further Fed balance sheet expansion could be greater than any short term increase in economic activity and stock prices.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.