Courtesy of Lee Adler of the Wall Street Examiner

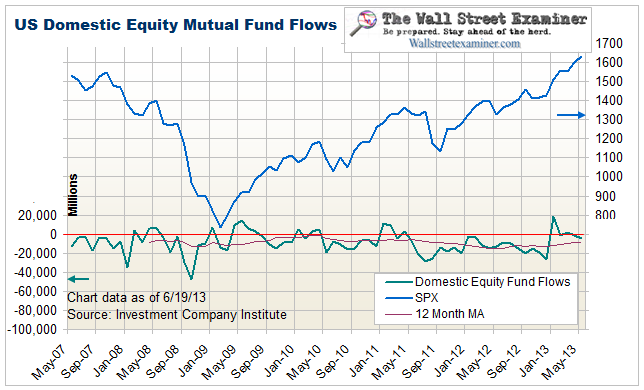

It is small wonder mom-and-pop investors are showing no love for U.S. stocks for a fourth consecutive year.

Not only has the U.S. economic recovery remained fragile, but the so-called “headline risk” is dominating investor psyche again…

But it has been clear—to some of us, at least–that mom-and-pop investors threw in the towel a while ago.

And looking to the pros for guidance in this time of madness may not be of much help either.

Consider that Laurence D. Fink, chief executive officer of BlackRock Inc., the world’s largest money manager, said in February that investors should have 100 percent of investments in equities because of valuations and higher returns than bonds.

via It’s Baaaack…The madness of Wall Street | Unstructured Finance.

Fink is a shill who obviously had stock to sell. Lots of it. So he went on CNBS and sent out free “research” telling everybody to buy so that he could unload his stash. In Wall Street parlance, this is called “distribution.” Over at Capitalstool.com, we call it “disturbation.”

Meanwhile, Ma and Pa Sixpack smartly continue to run away, run away. Only it’s not because they are smart. It’s because they need the cash to live. So much for Dr. Bernankenstein’s monster, ZIRP, boosting the market and the economy. It’s forcing folks to liquidate whatever they can. I call it Bernankecide, the mass financial genocide of US elderly retirees and savers.

Meanwhile here’s how they run away.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.