Dude, where's my bailout?

Dude, where's my bailout?

The tentative deal at the G20 summit to mobilize the EU's rescue machinery to douse the raging fire in Spain and Italy comes in the nick of time, but is fraught with fresh dangers. According to Ambrose Pritchard:

Monday's explosive rise in Spanish two-year bond yields was a warning that Spain's crisis would spiral out of control within days, taking Italy with it. Yet the deal explored over ceviche and mango at Los Cabos in Mexico remains murky. Any plan will backfire horribly unless conducted in the right way, and with overwhelming force.

From what we know, the eurozone's leaders aim to deploy the European Stability Mechanism (ESM) to cap borrowing costs for Spain and Italy by purchasing sovereign bonds on the open market. Unfortunately, the ESM fund does not yet exist. It has not been ratified by Germany and Italy. When it does come into being, it won't have much money. It has a theoretical limit of €500bn — a nice wish — but its paid up capital will start at just €22bn.

Britain's George Osborne cautioned against exuberance. "One thing we have learnt is: don't expect a single summit to solve the eurozone's problems, otherwise you are going to be disappointed. The eurozone is inching towards solutions."

David Owen from Jefferies Fixed Income said the Franco-German plan will fail unless EU leaders give the ESM a banking licence to borrow from the European Central Bank. "This is not going work unless they let the fund gear up and draw on the full firepower of the ECB," said. Such a move that has been blocked until now by Germany.

David Owen from Jefferies Fixed Income said the Franco-German plan will fail unless EU leaders give the ESM a banking licence to borrow from the European Central Bank. "This is not going work unless they let the fund gear up and draw on the full firepower of the ECB," said. Such a move that has been blocked until now by Germany.

The ECB's chief Mario Draghi has in the past scoffed at the idea, saying it would be a back-door bailout of sovereign states and would violate the spirit — if not the letter — of the Lisbon Treaty. Mr Owen said the ECB is the "only institution with the credibility and balance sheet to reassure markets. It would be much simpler if the ECB carried out quantitative easing but that does not seem to be an option".

Lack of direct action by the G20 (in the G20 Communique, they essentially promise to do something, but no specifics) puts the ball back in Bernanke's court today (conference at 2:15, after Fed Statement) and then we have an EU meeting on Friday but, as Mark Cuban reminds us – "When your thesis is wrong, you don't wait – you just get out."

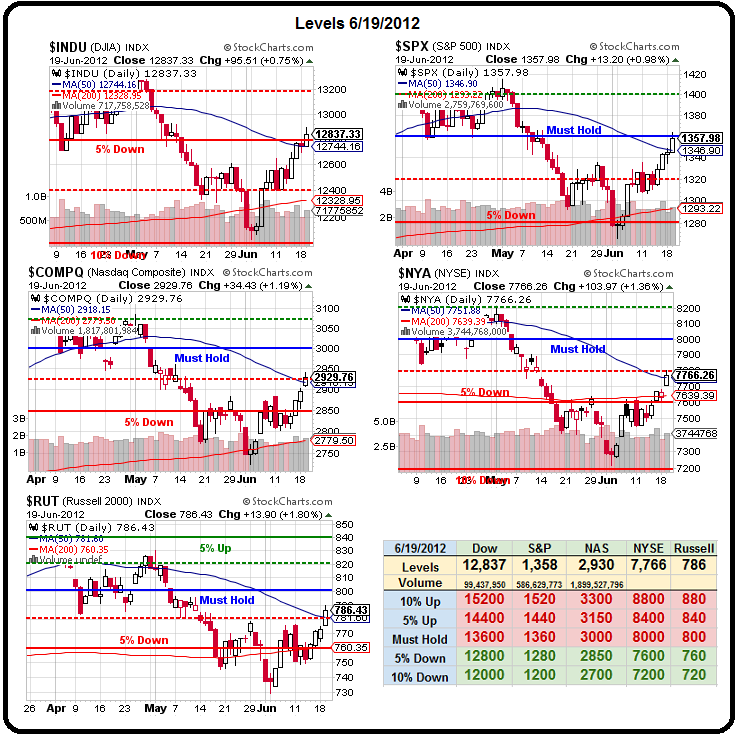

Our premise has been that the Fed and the G20, between them, would come up with $1.1Tn worth of stimulus THIS WEEK – to justify a rally in the S&P back to 1,412 (5% up from here) ahead of earnings, which we would probably short anyway. I discussed this on BNN yesterday but I do not consider what the G20 has done so far to be anything and our total still stands at the $125Bn that was given to Spain and we're $975Bn short of our goal. If Bernanke does not come up with $500Bn of new cash TODAY – then our thesis is wrong – and we need to GET OUT!

Our premise has been that the Fed and the G20, between them, would come up with $1.1Tn worth of stimulus THIS WEEK – to justify a rally in the S&P back to 1,412 (5% up from here) ahead of earnings, which we would probably short anyway. I discussed this on BNN yesterday but I do not consider what the G20 has done so far to be anything and our total still stands at the $125Bn that was given to Spain and we're $975Bn short of our goal. If Bernanke does not come up with $500Bn of new cash TODAY – then our thesis is wrong – and we need to GET OUT!

As you can see from BNN's notes from my last appearance, our bullish calls have been great – and that's just the performance of the underlying stocks. The options plays I suggested on BNN on May 22nd were:

- BBY Jan $18/21 bull call spread at $1.25, selling Jan $14 puts for $1.10 for net .15 on the spread. The spread is now $1.65 and the short puts are .80 for net .85 – up 500% in a month! BBY was $18.49 at the time and today it's $20.50 so up 11% on the straight stock play as well.

- WFR was $1.63 and now $2.17 – up 33% – IN A MONTH!

- XLF Jan $13/14 bull call spread at .59, selling Jan $12 puts for 0.75 for a .16 credit, now net .21 for a gain of .38, up 220% – IN A MONTH!

- CHK 2014 $5 puts sold for $1.25, now .70 is up 44% – IN A MONTH!

So we've had a fantastic run, those were just 4 of the 20 trade ideas from our Twice in a Lifetime List (Members only). Unfortunately, BNN cut me short yesterday because I had wanted to talk about Hedging for Disaster – something we were doing in Member Chat yesterday as we had a nice run-up in the morning and I was looking for a reason to take the money and run on our Income Portfolio (as we discussed in yesterday's post), as well as our other small portfolios – but our levels didn't trigger the stops (but came close in the pm sell-off).

Just because our stops (the 50 dmas) didn't trigger doesn't mean we sit there like idiots. At 1:30 pm in Member Chat we pretty much caught the dead top of the market run as we added our first major disaster hedges since we flipped bullish at the beginning of the month and my first two trade ideas were:

TZA – Always a good play but EDZ back to $14.90 (from $19.50) is getting fun again too. I like your hedge very much – good for all: TZA ($19) July 17/22 for $1.90, selling BTU July 23s for $0.90, for net $1 on the $5 spread.

Also, I like EDZ ($14.90) Aug $15/21 bull call spread at $1, selling USO $30 puts for $1 for a free bear spread (assuming oil holds $75).

It's possible those hedges will still be playable this morning but, either way, we'll add two more in the morning Alert and my intention is still to get back to cash ahead of the Fed unless we get such a ridiculous run-up that those gains themselves become our cushion. As I have been saying – I don't think the Fed and the G20 really have a choice – they MUST stimulate the economy or we risk a severe downturn but, then again, I also said that in September of 2008, right before the House Republicans sabotaged the original Paulson bailout plan and sent our Markets spinning out of control.

We have learned from that catastrophe there is no limit to the greed and stupidity of our elected officials – especially when they are in the pockets of business interests that do not align with the people who elected them. At the time, I said:

We have learned from that catastrophe there is no limit to the greed and stupidity of our elected officials – especially when they are in the pockets of business interests that do not align with the people who elected them. At the time, I said:

President Bush said to the renegade Republicans "If money isn’t loosened up, this sucker could go down” and still they let it happen!

Granted the G20 aren't a pack of psychopathic Republicans but they are also a fractious, self-interested group that's unwilling to make necessary sacrifices for the common good – and that's a recipe for disaster if they can't get out of their own way and actually accomplish something for a change.

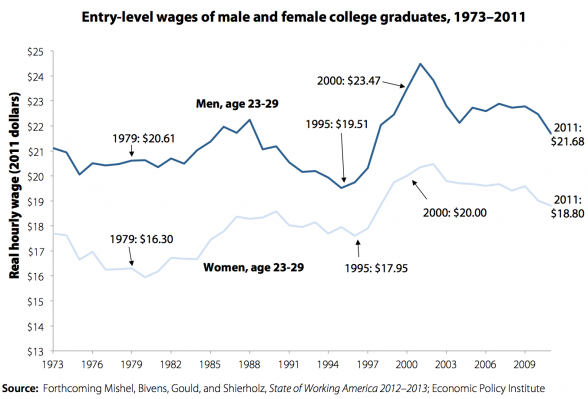

Unlike the GOP, the G20 must come up with a plan that actually helps THE PEOPLE, whose suffering during the past few years has reached biblical proportions and the erosion of the middle class that is evident from this chart, continues at a rapid pace and only a stimulus program that creates JOBS (not BS from "job creators" while they ship another Million overseas) and puts money into the pockets of the bottom 80% – where it is desperately needed and will be spent in the economy – and not into the troughs of the top 1%, where it will stagnate along with the rest of the Economy.

Unlike the GOP, the G20 must come up with a plan that actually helps THE PEOPLE, whose suffering during the past few years has reached biblical proportions and the erosion of the middle class that is evident from this chart, continues at a rapid pace and only a stimulus program that creates JOBS (not BS from "job creators" while they ship another Million overseas) and puts money into the pockets of the bottom 80% – where it is desperately needed and will be spent in the economy – and not into the troughs of the top 1%, where it will stagnate along with the rest of the Economy.

As noted in "Who Destroyed the Middle Class": A 39% decline in median net worth over a three year time frame is almost incomprehensible. Even worse, the decline has surely continued for the average American household through 2012 as home prices have continued to fall. Median family income plunged by 7.7% over a three year time frame and has not recovered since the collection of this data 18 months ago. Even more shocking is the fact that median household income was $48,900 in 2001. Families are making 6.3% less today than they were a decade ago. These figures are adjusted for inflation using the BLS massaged CPI figures. Anyone not under the influence of psychotic drugs or engaged as a paid shill for the financial oligarchy knows that inflation is purposely under reported in order to keep the masses sedated and pacified. The real decline in median household income is in excess of 20% since 2001.

The destruction of the blue collar jobs has been underway since the early 1970s. And the relentless decline in real blue collar wages has followed a bumpy downward path for decades. Sadly, the average person doesn’t understand the insidious destruction caused to their lives by the Federal Reserve generated inflation, as they actually believe their wages today are higher than they were in 1973. The reality is the oligarchy has used foreign wage differentials and the perceived benefits of globalization to ship manufacturing and now service jobs to Asia while using their captured mainstream media to convince the average American that this has been beneficial to their lives. Using one of their 15 credit cards to buy cheap foreign goods made by people who took their jobs was never so easy. I wonder if the benefits of being able to buy cheap Chinese electronics, toxic dog food, and slave labor produced igadgets outweighed the $2.3 trillion increase in consumer debt, 27% decline in real wages, 7 million manufacturing jobs lost since the mid-1970s, 46 million people on food stamps, $15 trillion increase in the National Debt since 1978, and a gutted decaying industrial base.

Not only have the oligarchs gutted our industrial base, resulting in enormous job losses among middle aged industrial workers, but they are now in the process of impoverishing the youth of this country by sucking them into crushing college debt with the false promise of decent paying jobs when they graduate with a degree in feminist studies from the University of Phoenix. The fabricated mantra that a college education guarantees a good paying job and a better future is not borne out by the facts. There are over 4,800 institutions of higher learning in this country, with only about 50 considered elite. There are another few hundred top notch institutions, with a few thousand mediocre schools and hundreds of for profit on-line diploma mills exploiting the easy Federal government debt to lure millions into their profit scheme of bilking unemployed naïve middle aged dupes and eventually the American taxpayer. The average student loan debt per student is $29,000. Student loan debt outstanding has risen from $200 billion in 2000 to over $1 trillion today. The Federal Government is blowing another bubble. They are the issuer, regulator and guarantor of these loans. They are making the loans with teaser rates to the ultimate in subprime borrowers – students without jobs going for worthless degrees at mediocre schools. The taxpayer is on the hook for the billions in loses that will surely follow. The payoff for this quadrupling of debt has been an 8% real decline in wages for college graduates since 2000. The monetary policies of the Federal Reserve and bipartisan fiscal policies of our government have led to this dreadful job market for the middle class.

I highly recommend the whole article, hopefully we'll be featuring it on our main site today as well. Send it to your friends, your Congresspeople, your World Leaders – tell them it's time to WAKE UP!