Courtesy of Mish.

Zero Hedge, citing a Federal Reserve Bank of New York report on Shadow Banking, makes (without even realizing it) a sure-fire case for deflation.

I encourage you to visit the link shown above, but also take a look at On The Verge Of A Historic Inversion In Shadow Banking by Zero Hedge.

Here is the introduction by ZH.

While everyone’s attention was focused on details surrounding the household sector in the recently released Q1 Flow of Funds report (ours included), something much more important happened in the US economy from a flow perspective, something which, in fact, has not happened since December of 1995, when liabilities in the deposit-free US Shadow Banking system for the first time ever became larger than liabilities held by traditional financial institutions, or those whose funding comes primarily from deposits.

As a reminder, Zero Hedge has been covering the topic of Shadow Banking for over two years, as it is our contention that this massive, and virtually undiscussed component of the US real economy (that which is never covered by hobby economists’ three letter economic theories used to validate socialism, or even any version of (neo-)Keynesianism as shadow banking in its proper, virulent form did not exist until the late 1990s and yet is the same size as total US GDP!), is, on the margin, the most important one: in fact one that defines, or at least should, monetary policy more than most imagine, and also explains why despite trillions in new money having been created out of thin air, the flow through into the general economy has been negligible.

Empirical Proof of Deflation

Here are the pertinent charts and commentary.

That chart is from the NY Fed.

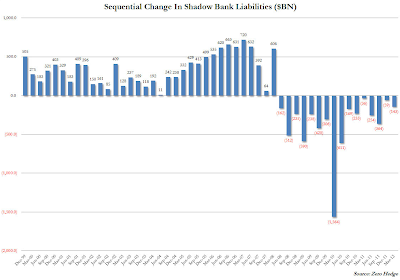

On a similar chart ZH commented … “As another reminder, US Shadow Banking liabilities – a combination of Money Market funds, GSE and Agency paper, Asset-Backed paper, Funding Corporations, Open market paper and of course, Repos – hit a gargantuan $21 trillion in March 2008. They have tumbled ever since, printing at just under $15 trillion at the end of March 2012, the lowest number since March 2005 when shadow banking liabilities were soaring. This is an epic $6 trillion in flow being taken out of credit-money circulation, with a $143 billion drop in Q1 alone!”

Sequential Change in Shadow Bank Liabilities

…