Courtesy of Lee Adler of the Wall Street Examiner

The media was all excited about the weak ISM numbers this morning. Usually, I’m able to debunk the mainstream reporting of the headline seasonally adjusted bunk, but not today. The actual number was just as bad as the SA fictional number. In fact, it was the worst June reading in at least 12 years.

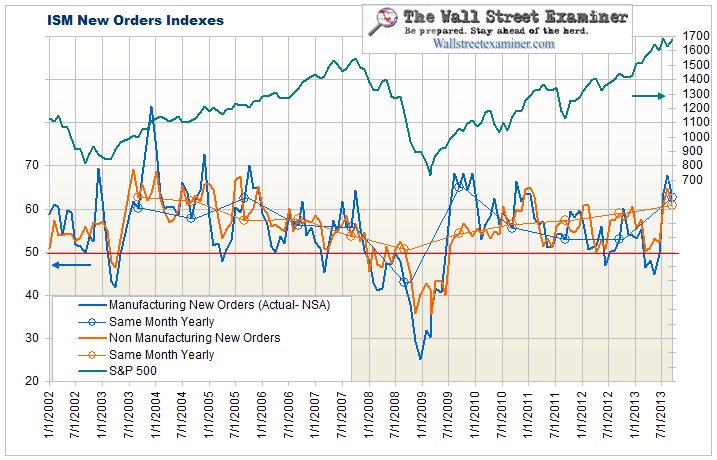

The ISM not seasonally adjusted (in other words, actual) new orders index had been diverging from the stock market as the growth rate of the US manufacturing sector slowed. In June the index reached its lowest June level in the past 11 years, at 45.2. This compared with a reading of 58.7 in May and 50.7 in June 2011. Last year the index dropped 3.0 points from May to June. This year the decline was 13.5. That compares with an average drop of 1.5 from May to June from 2002 to 2011. 50 is a neutral reading. Readings above 50 signify growth, and below 50 indicate contraction.

This suggests that June factory orders data will be weak. The manufacturing sector represents about 11% of the economy. The services sector data representing the bulk of the US economy, normally released a few days after the manufacturing data, typically shadows this index closely.

This index trended lower from 2004 to 2007, while stock prices continued to rise. That was a potential hint that the stock market may have been in a bubble beginning in 2005, since it kept rising while ISM’s new orders were slowing. They briefly went negative in early 2007, but then recovered until October, which is about when the Fed pulled the plug on the System Open Market Account (see below). The index next went negative in January 2008, by which time the market was down for the count.

The current slide has reached the same level the index had reached in March 2007. If it rebounds back above 50 for the June reading, then the stock market advance may resume. But if this number stays below 50, then the rally’s days are probably numbered. Federal withholding taxes were very strong in June, so there’s some reason to believe that business improved and ISM New Orders index could rebound.

Below is the ISM Non Manufacturing (Services) New Orders Index, not seasonally adjusted through May (See Why Seasonal Adjustment sucks). The June index will be released on Thursday, July 5. If it does not follow the manufacturing index, and stays above 50, then the stock market uptrend can probably hang on for a while longer. If it drops below 50, then there’s reason to believe that the rally has ended, or will soon end.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.