The Market Has Spoken, and It Is Rigged

Simon Johnson is the Ronald A. Kurtz Professor of Entrepreneurship at the M.I.T. Sloan School of Management and co-author of “White House Burning: The Founding Fathers, Our National Debt, and Why It Matters to You.”

In the aftermath of the Barclays rate-fixing scandal, the most surprising reaction has been from people in the financial sector who fully understand the awfulness of what has happened. Rather than seeing this as an issue of law and order, some well-informed people have been drawn toward arguments that excuse or justify the behavior of the Barclays employees.

The behavior at Barclays has all the hallmarks of fraud – intentional deception for personal gain, causing significant damage to others.This is a big mistake, in terms of the economics at stake and the likely political impact.

The Commodity Futures Trading Commission nailed the detailed mechanics of this deception in plain English in its Order Instituting Proceedings (which is also a settlement and series of admissions by Barclays). Most of the compelling quotes from traders involved in this scandal come from the commission’s order, but too few commentators seem to have read the full document. Please look at it now, if you have not done so already.

Keep reading: Simon Johnson: The Market Has Spoken, and It Is Rigged – NYTimes.com.

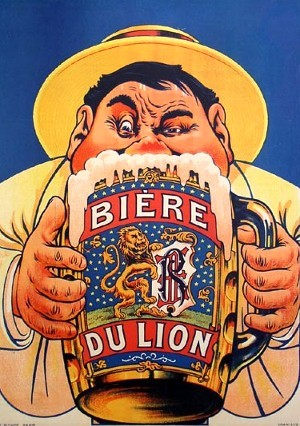

Picture credit: Jesse's Cafe Americain

By

By