Courtesy of Lee Adler of the Wall Street Examiner

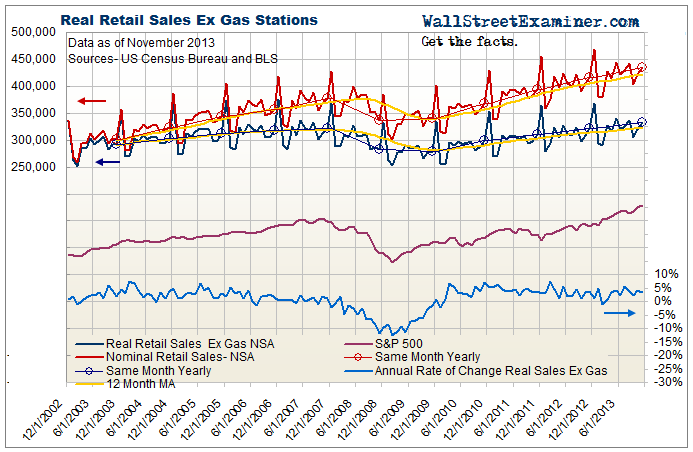

The year to year gain in real retail sales, ex gasoline prices, and adjusted for inflation in June was 2.07%. This is toward the lower end of the range of annual growth rates since March 2010. It compares with a nominal annual gain in unadjusted total retail sales of 3.27%, which is much slower than the growth rates seen in 2010 and 2011 when rapidly rising gas prices were skewing sales upward and obscuring the weaker underlying buying of discretionary items.

Explanatory Note: When analyzing retail sales, I’m interested in the actual volume of sales, not the inflation skewed dollar total. To get to the kernel of the matter, I look at the real, not seasonally finagled retail sales, adjusted for top line CPI inflation (not core which normally understates the actual). Then I back out gasoline sales, which are a substantial portion of total retail sales. Gasoline sales distort total retail sales higher when gas prices are rising, when they actually act like a tax on disposable income and reduce non-gasoline sales. On the other hand, when gas prices fall, the top line total retail sales figure will understate any gains in the volume of sales. Gasoline sales typically account for around 12% of total retail sales. By subtracting gas sales and adjusting for inflation, the resulting number represents the actual volume of retail sales.

This analysis uses not seasonally adjusted (NSA) data due to the inaccuracy and potentially misleading nature of seasonally adjusted data. In this context, historically, June is virtually always a down month in this series. This year, real sales ex gas declined by 3.2% in June versus May. That was weaker than June of last year (-0.9%) and June 2010 (-1.8%), and below the 2002-2011 average decline for June of -2.8%.

Does this represent a material weakening, or is there some other explanation? My guess is that it is non material, as portions of the US experienced record heat in June. People probably don’t shop as much when the temperature outside is 104 degrees. Might that have knocked a couple tenths off sales? Possibly. But July was worse, so the weather effects could impact the entire summer season, making the underlying trend look worse than it otherwise would have been. That could impact other economic indicators this summer.

The initial advance estimate is subject to revisions that could make the comparisons slightly more or less favorable when the final estimates are in. This month May was revised down. The change was only 0.1% and the year to year change for May was still near the center of the growth rate range for the past 27 months.

In the big picture, this recovery is poor. Unlike nominal retail sales, retail sales ex gas remain below 2003 to 2007 levels. This difference is even more striking considering that US population has grown by 10% over that time. That means that real retail sales per capita have been falling for 9 years, a fact which no one in the Wall Street mob ever mentions. They are too busy worrying about the top line, headline numbers, which are typically reported out of context. At best they don’t give the full picture and at worst, they’re misleading, although this month the headline numbers are consistent with the underlying actual data. That was not the case in May, when the actual data was much stronger than the headline numbers.

The mob is only concerned with how much sales increased this month. They’re really looking at inflation, driven by the spending of the top 10%, not growth in the volume of sales, and not broader growth in real demand. The majority are buying less, not more. The idea of the “resilient US consumer” is a myth. Only the 10% is resilient. The other 90% is losing ground. But in June at least, while sales were weaker, they were not inconsistent with the normal variations within the trend of the past 27 months. That may be disappointing to many observers, but it doesn’t mean that the economy is weakening. I doubt that it will have a material effect on the Fed’s deliberations at the end of the month. There’s too much more data to come that, based on how Federal withholding taxes are tracking in real time, will probably show the economy continuing to grow at a rate similar to the past couple of years.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.