Just like last July, we are off to the races again.

Just like last July, we are off to the races again.

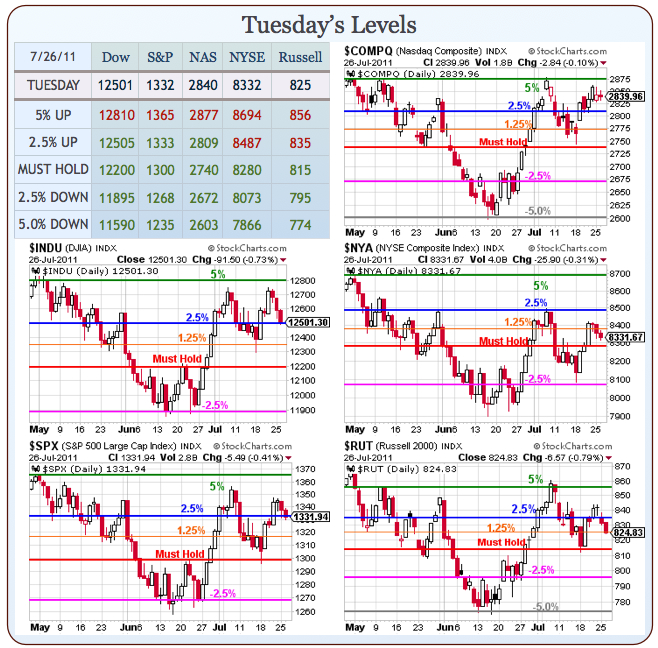

On the right is our Big Chart from July 26th of last year, when we also made a very impressive run-up over a month despite mixed earnings, worries in Europe and a looming fiscal cliff if the Reps and Dems couldn't manage to agree on a budget plan.

Sound familiar? We didn't have a drought but oil was topping out at $100.62 and gold was $1,600 but TLT was only at $92 – indicating far less panic than we have now at $128 because, even in the 2,000-point crash that followed over the next month – TLT never went over $123.

In this morning's Member Chat, I laid out a list of things I'm still worried about and we may be jumping the gun picking up some short-term bearish positions but they do balance out our long-term, still very-bullish positions in our Income Portfolio.

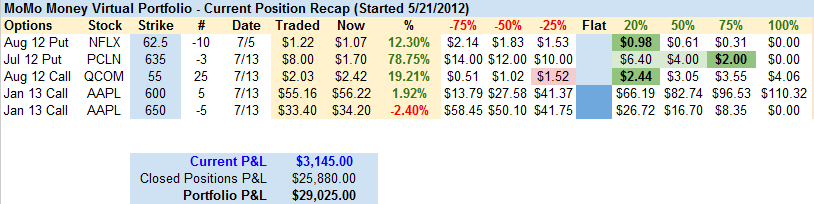

The real action in the market has been and continues to be those momentum plays and Lfantheman called us back to almost all cash yesterday in the MoMo Money Portfolio, taking the money and running on the QCOM Aug $55 calls at $2.40 for a 20% gain – removing the biggest open position and leaving just some small, speculative open trades on NFLX, PCLN and AAPL:

We're just two day's shy of two months on MoMo Money this morning and that's a very impressive gain off a virtual $50,000 base (58% in 58 days!) and it's so relaxing to take those quick gains and get the hell back to cash in this crazy market – there is certainly always something else to trade the next day when we have cash on the side. Our $25,000 Portfolios are also mainly in cash (about 80%) – as is our Income Portfolio, which I'm inclined to cash out if we get it back over $15,000 gained before we give it back again on the next dip.

As planned, we took advantage of the rocket start out of the gate yesterday to do a bit of shorting as we expected some reality to set in. As Dave Fry says: "search as one might for bullish news, there was little to be found from a normal perspective" but, like last July, simply beating low expectations is a reason to rally these markets and QE fever is gripping the planet as Uncle Ben said the Fed had "some room" left on their balance sheet.

As planned, we took advantage of the rocket start out of the gate yesterday to do a bit of shorting as we expected some reality to set in. As Dave Fry says: "search as one might for bullish news, there was little to be found from a normal perspective" but, like last July, simply beating low expectations is a reason to rally these markets and QE fever is gripping the planet as Uncle Ben said the Fed had "some room" left on their balance sheet.

Some room?!? Well, why didn't they say so? No wonder the indexes are up 2.5% this week – SOME ROOM! How can we possibly be short when there's SOME ROOM left for the Fed to ease?

For those of us who actually read the Beige Book yesterday (see yesterday's 2:45 Alert to Members for highlights and full commentary), there was little to be bullish about in the reports from the Fed's 12 Districts BUT, on the other hand, conditions have not really gotten worse enough to justify more easing from the Fed and, the way the market is rallying without actual QE3 – why should the Fed waste the firepower adding fuel to a raging fire?

TLT is up 30% from last year – Mission Accomplished on the long bonds. Oil is flat to last year, gold is flat, gasoline is flat, copper is cheaper, lumbar is flat, corn is up only slightly but DBA is overall lower by 10% – as is DBC. This is a huge success for the Fed and the Dow was 11,500 at the end of last July (down from 12,700 on the 21st) and is now back at 13,000 – up almost 15% in a year should have Ben heading off to Stockholm to pick up his prize. What could possibly go wrong (again) and why make changes when things are working so fantastically?

We had similar excitement right after the June 6th Beige Book release and the Dow flew from 12,035 to 12,898 on the 21st before plunging 450 points a week later. The April 11th release of the BBook ran us up from 12,710 to 13,338 before we fell back to 12,035 over the next 30 days so it's very possible that we do get a few more days of excitement out of this book as well but you'll have to forgive us if we use it as an opportunity to cash out our longs and build up our, so far, losing short-side positions because, while you can't predict when the market will dip, the dips have certainly been predictably nasty when they do come.

Today we'll be starting a new Long Put list in Member Chat. We initiated our last one on August 23rd of last year and, despite the fact that we began when the Dow was already down at 11,500 and it went up to 12,284 in October, we were able to roll with it and ended up with massive wins as we plunged back to 11,231 in November. This time, we have an opportunity to do the same thing with a lower VIX (we're long on the VIX) at Dow 12,961 with the 13,338 high not too far away and that's still 100% over the March 2009 low of 6,469 and still should take more than a light volume move higher to properly break over.

Clack, clack, clack – like a roller coaster going up in the dark, we don't know when we'll get that big "wheeee" but we do know it's coming!