Wheeeeee!

Wheeeeee!

How great is this? We flipped bearish on Wednesday's poor Beige Book outlook (not to mention drought concerns and Hugh Hendry's warning that "Bad things are going to happen") and Thursday we noted it was looking a little too much like last July, where we fell off a cliff right after options expiration and my very appropriate comment at the end of Thursday morning's post was:

Clack, clack, clack – like a roller coaster going up in the dark, we don't know when we'll get that big "wheeee" but we do know it's coming!

Fortunately, we did not wait with our Long Put List going out in the Thursday Morning Alert to Members at 10:18, with all bearish trade ideas that included these gems:

- AMZN Oct $180 puts at $2.75, still $2.75 – even (all as of Friday's close)

- CMG Sept $350 puts at $5, now $35 – up 600%

- DIA Dec $117 puts at $2.50, now $2.80 – up 12%

- ISRG Jan $350 puts at $1.70, now $5 – up 194%

- MA Jan $290 puts at $2.85, now $3.40 – up 19%

- SPY Oct $120 puts at $1, now $1.15 – up 15%

- V Jan $100 puts at $2, now $2.30 – up 15%

- XRT Jan $53 puts at $2, now $2.20 – up 10%

So a couple of big winners already and, of course, we're done with those (see Stock World Weekly for more trade ideas) and the way we work our Long Put List is to take those winners off the table and utilize our "fresh horses" for the next leg down. Don't worry, we won't run out, there are 13 more picks on deck for our Members with AMZN (above) our top choice for this week (also featured with a slightly different trade in SWW).

So a couple of big winners already and, of course, we're done with those (see Stock World Weekly for more trade ideas) and the way we work our Long Put List is to take those winners off the table and utilize our "fresh horses" for the next leg down. Don't worry, we won't run out, there are 13 more picks on deck for our Members with AMZN (above) our top choice for this week (also featured with a slightly different trade in SWW).

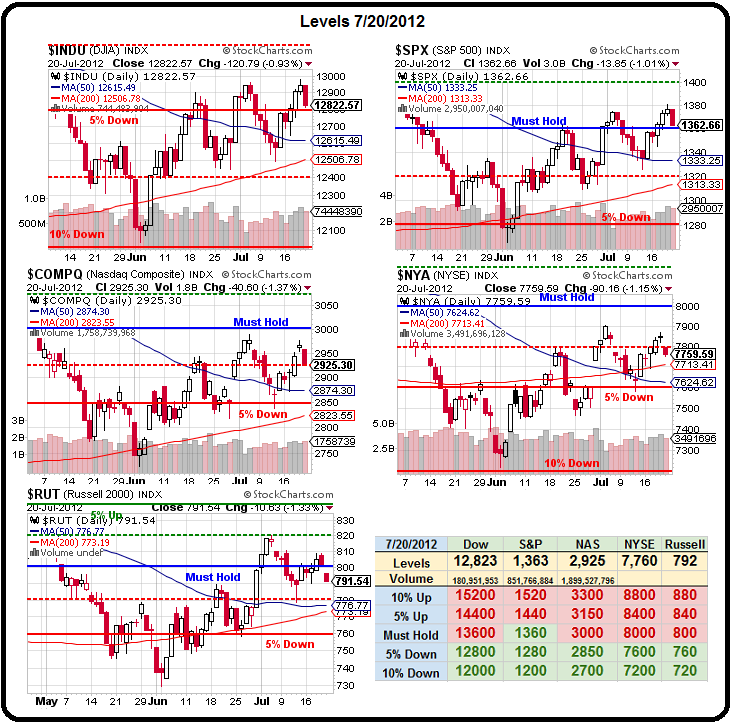

Even our aggressive oil puts should be doing well in our small portfolios as well as our bullish VXX trade and, of course, our EDZ and TZA hedges as China dropped 600 points this morning and the Russell is testing our 775 target already. Things may be worse than we thought they were going to be as 775 may not hold on the RUT and that breakdown can lead us to test our -5% lines on the Russell (760), Nasdaq (2,850) and the NYSE (7,600) as well as our 2.5% lines at 1,320 on the S&P and 12,500 on the Dow. Failure to hold those can take us right back to our June lows.

As you can see from the Big Chart, we're simply completing those "M" patterns we saw forming earlier in the month and following through with our game plan as we trade the channel until the channel betrays us. To that end – we will be looking for some bottom-fishing opportunities this morning but we also have to be aware that we expect AT LEAST weak bounces (20% retraces) off our 200 dmas but anything less than a strong bounce (40% retrace) means nothing and will keep us bearish.

As you can see from the Big Chart, we're simply completing those "M" patterns we saw forming earlier in the month and following through with our game plan as we trade the channel until the channel betrays us. To that end – we will be looking for some bottom-fishing opportunities this morning but we also have to be aware that we expect AT LEAST weak bounces (20% retraces) off our 200 dmas but anything less than a strong bounce (40% retrace) means nothing and will keep us bearish.

Fundamentally, as we discussed in SWW and in Member Chat this weekend, it's DEPRESSING – as in looking like the Great Depression depressing – right down to the GOP running Herbert Hoover Junior to promise the downtrodden masses a chicken in every pot if they just get out of rich folks way and let them foreclose on the homes and farms without all that annoying paperwork that they never legally filed.

Hoover promoted "economic partnerships" between Government and Business to boost the economy of 1928, arguing that the "job creators" should be allowed to work unfettered by regulations. Hoover championed the "Efficiency Movement," claiming that the Government and the Economy were riddled with inefficiency and waste but, when push came to shove in the great crash of 1929 – his response was to blow off all his campaign promises and RAISE taxes in the top bracket from 25% to 63%, along with an increase in Corporate Taxes that guaranteed Hoover a one-term Presidency and led the way to 40 years of Democratic Rule along with the greatest period of prosperity (after a 10-year depression) this country had ever known.

Like Romney, Hoover was a very successful businessman who made his fortune in mining and, in fact, donated his entire Presidential salary to charity so, like Romney, he wasn't evil per se – just an arrogant wealthy jackass who was nothing more than a tool of the top 1% who was set up to placate the masses while the carpet-baggers looted what was left of the Treasury. Sound familiar?

Like Romney, Hoover was a very successful businessman who made his fortune in mining and, in fact, donated his entire Presidential salary to charity so, like Romney, he wasn't evil per se – just an arrogant wealthy jackass who was nothing more than a tool of the top 1% who was set up to placate the masses while the carpet-baggers looted what was left of the Treasury. Sound familiar?

Jobs, jobs, JOBS!!! That's what this country (as well as the rest of the planet) needs to turn the economy around. You can give Zillions of Dollars to the banks but how does that help out the families the banks confiscate homes from? There are still over 4M properties in the US in the foreclosure process and our housing turnover is running just over 1M per year.

As Robert Reich said on Friday: "The prosperity of Big Business has become disconnected from the well-being of most Americans." I am anti-Republican (as opposed to being pro-Democrat) for the same reason I am bearish on the market – the long-term fundamentals of their economic policies are BAD for the market. Why would I vote for people who are going to destroy the economy of this country?

We NEED Socialism (I know, a word that immediately inflames half the readers) at this stage in the economic cycle – just like we needed it in 1928 and to pretend that more Capitalism coupled with harsh austerity measures will make things better sets us on the same dire path this country, and the whole World, followed into 10 years of misery in the 1930s. It's as simple as that. This country is DOOMED if we back Romney and the GOP in what is going to be the most important decision made by American voters since Bush "won" in 2000 (and boy did we blow that one!).

We NEED Socialism (I know, a word that immediately inflames half the readers) at this stage in the economic cycle – just like we needed it in 1928 and to pretend that more Capitalism coupled with harsh austerity measures will make things better sets us on the same dire path this country, and the whole World, followed into 10 years of misery in the 1930s. It's as simple as that. This country is DOOMED if we back Romney and the GOP in what is going to be the most important decision made by American voters since Bush "won" in 2000 (and boy did we blow that one!).

Unfortunately, our fate is not completely in our hands. The Euro dropped to an 11-year low versus the Yen this morning and near that against the Dollar as well ahead of Spain's 7.5% bond auction which is, of course, disastrous. Both Japan and the IMF are lowering their Global outlook – pointing to slowing economies in China and India now dragging the Global economy where previously it had been hoped they would provide leadership.

Sales at S&P companies are up just 2.9% in Q2 among the 119 companies that have reported so far and that's the worst performance since the third quarter of 2009. Just 42% of the reporting companies have beat sales estimates but 73% have beaten very low profit estimates as a result of stock buybacks and accounting changes we had outlined earlier in the month that mask the underlying weakness in the reports.

Overall, US Poverty is on track to reach it's highest level since the 1960s as the "war on poverty" has somehow morphed into a war against the middle class, waged by the "job creators" of the top 1%. The official poverty rate is heading towards 15.7% of our population, just 0.1% shy of the worst recorded back in 1965. Poverty is spreading at record levels across many groups (see chart), from underemployed workers and suburban families to the poorest poor. More discouraged workers are giving up on the job market, leaving them vulnerable as unemployment aid begins to run out.

Overall, US Poverty is on track to reach it's highest level since the 1960s as the "war on poverty" has somehow morphed into a war against the middle class, waged by the "job creators" of the top 1%. The official poverty rate is heading towards 15.7% of our population, just 0.1% shy of the worst recorded back in 1965. Poverty is spreading at record levels across many groups (see chart), from underemployed workers and suburban families to the poorest poor. More discouraged workers are giving up on the job market, leaving them vulnerable as unemployment aid begins to run out.

The 2010 poverty level was $22,314 for a family of four, and $11,139 for an individual, based on an official government calculation that includes only cash income, before tax deductions. It excludes capital gains or accumulated wealth, such as home ownership, as well as noncash aid such as food stamps and tax credits, which were expanded substantially under President Barack Obama's stimulus package. An additional 9 million people in 2010 would have been counted above the poverty line if food stamps and tax credits were taken into account. Outside of Medicaid, federal spending on major low-income assistance programs such as food stamps, disability aid and tax credits have been mostly flat at roughly 1.5 percent of the gross domestic product from 1975 to the 1990s.

This IS our economy folks – empty promises and Congressional filibusters are NOT going to make it any better and ignoring the plight of the bottom 99% will NOT let you enjoy your dividends because, ultimately, these are your customers – believe it or not you have an obligation to take care of them or, surprise, they won't be there anymore to buy your goods and services. That's not politics – that's economics!