Tut, tut, it does not look like rain.

Tut, tut, it does not look like rain.

You would think the worst drought in 80 years would merit more than the occasional mention in the Financial media – I've seen CNBC do one-hour specials on the marijuana crops so you'd think actual FOOD would maybe make it a little higher on the list of concerns for the MSM – especially when we are experiencing the worst drought of the past 80 years and the last one that was this bad led to a Global Depression (along with, of course, National Debt Crises and Financial Failures but mission accomplished there already).

You would think the drought has somehow fallen into a Somebody Else's Problem Field, where individuals/populations of individuals choose to decentralize themselves from an issue that may be in critical need of recognition. Such issues may be of large concern to the population as a whole but can easily be a choice of ignorance at an individualistic level. As Douglas Adams explains in The Hitchiker's Guide to the Galaxy:

An SEP is something we can't see, or don't see, or our brain doesn't let us see, because we think that it's somebody else's problem…. The brain just edits it out, it's like a blind spot. If you look at it directly you won't see it unless you know precisely what it is. Your only hope is to catch it by surprise out of the corner of your eye.The technology involved in making something properly invisible is so mind-bogglingly complex that 999,999,999 times out of a billion it's simpler just to take the thing away and do without it……. The "Somebody Else's Problem field" is much simpler, more effective, and "can be run for over a hundred years on a single torch battery.This is because it relies on people's natural predisposition not to see anything they don't want to, weren't expecting, or can't explain.

Various areas of psychology and philosophy of perception are concerned with the reasons why individuals often ignore issues that are of relative or critical importance. Optimism bias tends to reduce issues of subjectivity due to the tendency to have thought processes that are overly positive- "Overly positive assumptions can lead to disastrous miscalculations — make us less likely to get health checkups, apply sunscreen or open a savings account, and more likely to bet the farm on a bad investment."

Betting the farm is an apropos expression here as the bulls are betting that crops withering on the vine in America's bread basket are not going to have a long-term detrimental affect on the Global economy. This is despite seeing food riots in Asia in 2009 and 2010 and last year's Arab Spring – all sparked by runaway food prices (see David Fry's grain chart, left).

Betting the farm is an apropos expression here as the bulls are betting that crops withering on the vine in America's bread basket are not going to have a long-term detrimental affect on the Global economy. This is despite seeing food riots in Asia in 2009 and 2010 and last year's Arab Spring – all sparked by runaway food prices (see David Fry's grain chart, left).

How is it possible to ignore such a major macro issue? With the MSM, it's obvious – they don't want to worry people because worried people don't give their money to the sponsors who can whittle their accounts down with endless fees – some of which find their way back to the "news" station in the form of more advertising money.

To some extent, with ALL the other problems facing us, investors seem to have no room on their plate for something else to worry about but the markets do not appear quite ready to "ignore and soar" either. We truly stand at a very major inflection point as we hit the point on our charts we predicted two weeks ago – pretty much right on schedule. Now, two weeks ago, we were not too worried about the drought and, two weeks later, we are still worried about Greece and Spain and Italy and earnings and the Euro and China and India, etc. – so you can see why people hear "record drought" and just sigh at this point.

I think, in the least, that we have another bit of data (and a pretty big one) that simply tips the scales a bit more bearish and we need to watch that $65 line on JJG, which was only ever crossed in 2008 on the Bush stimulus plan – right before the entire Global market collapsed under the weight of crushing commodity prices. If you consider $40 to be a baseline cost of food – then $60 on JJG represents a 50% increase in the food budget. This is not so tragic in the US, where we spend less than 15% of our monthly income on food but, in Asia, where it's more like 30% and up to 50% in poorer areas – a 50% increase in food costs pretty much precludes any kind of discretionary spending on other things.

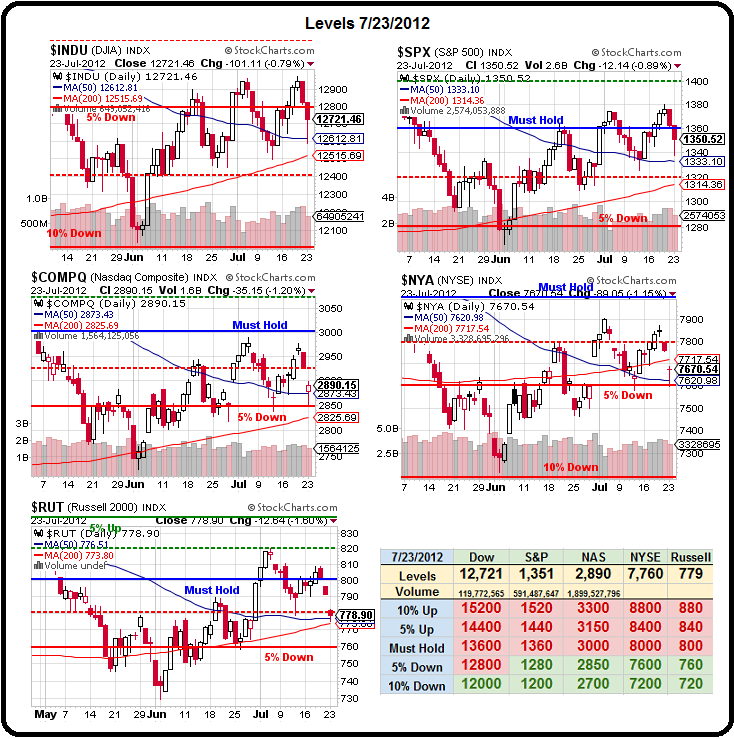

As you can see from our Big Chart above – we are right on track with my Friday's prediction that we'd be down on Monday, recover through Tuesday and then a big down day tomorrow when people once again realize not enough is being done to address our problems. As I said to Members in Chat this morning:

Nas and RUT recovered just enough to sit on top of their 50s while Dow, S&P an NYSE ALL tested theirs and sit about a point above – ALL – like a coordinated ballet. What we have discovered is there is no support between here and the 50 dma and we're not even sure that 50 dma support is real. If the Nas and/or RUT fail their 50s (anything red at this point), then I think it's a pretty safe bet to aggressively play the others to join them so we're looking for a 100-point Dow drop to 12,600 and S&P back to 1,333 if the Nas fails to hold 2,875 (with 2,850 and 2,825 both acting as strong support) or the RUT fails to hold 775 (and those are all the supports it has so nice TZA play below that line).

As to the "death cross" on the RUT – keep in mind that, as long as the RUT is over the 50 dma, then the 50 DMA will curve up at a faster rate than the 200 dma and, if they can get the RUT back to 800 – you'll have a very impressive-looking floor of the 200 dma that is SO STRONG that even the falling 50 dma bounces off it. So there is still room to print a bullish technical picture but time is running out if they are going to pull it off.

After a very bearish turn on Thursday, when we went with our first Long Put List of the year, we were already taking our first set of profits at 10:29 am yesterday, when we cashed in some gains and even picked up a bullish quickie on the Qs (already gone with a quick gain). The puts we mentioned in yesterday morning's post did very well on the morning drop and finished up with very nice 48-hour gains that were featured on BNN yesterday afternoon:

- AMZN Oct $180 puts at $2.75, out at $3.50 – up 27%

- CMG Sept $350 puts at $5, out at $35 – up 600%

- DIA Dec $117 puts at $2.50, out at $3.60 – up 44%

- ISRG Jan $350 puts at $1.70, out at $5 – up 194%

- MA Jan $290 puts at $2.85, out at $4 – up 40%

- SPY Oct $120 puts at $1, out at $1.70 – up 70%

- V Jan $100 puts at $2, out at $2.60 – up 30%

- XRT Jan $53 puts at $2, now $2.50 – up 25%

With AMZN, we switched to the Oct $185 puts at $3.50 and the rest we are done with for the moment but all will still be on our radar for re-entries if they get back to our strikes because, really, what's changed in 48 hours to change our premise? In that same Alert to Members, I laid out our targets for strong and weak bounces and we got our weak bounces yesterday (12,660, 1,346, 2,875, 7,650 and 781) and today we look for the strong ones but, most likely, they will be the rejection points at which we begin to layer back in with our shorts at Dow 12,720, S&P 1,354, Nasdaq 2,900, NYSE 7,700 and Russell 787 – anything less than that will be very disappointing and failure to hold our weak bounce lines will be very bearish indeed.