Courtesy of Lee Adler of the Wall Street Examiner

The report is an excerpt from the Employment Charts permanent page, updated when new data is reported. Bookmark it for future reference.

The Labor Department reported today that seasonally adjusted (SA) first time claims for unemployment were down by 35,000 to 353,000. As usual, both the total and the change are categorically and demonstrably false, just like every week. The seasonal adjustment process applied to weekly data is the problem (False Claims and Absurdities of Mainstream Media Reports On Initial Unemployment Claims).

On a not seasonally adjusted basis (NSA)– in other words, the actual count–the year to year change from the same week last year was a decline of 7.6%. Applying that to the SA claims number of 402,000 for the same week in 2011, the current SA number would be 371,000, not 353,000, significantly larger than reported. It’s all very confusing, largely a product of the large variance in the SA adjustment for the same week in any given year (see this post).

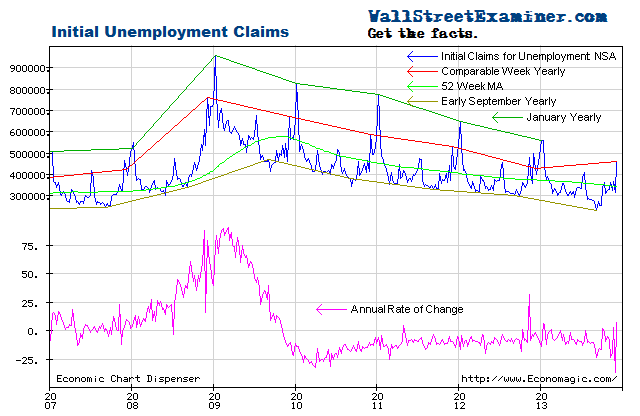

To avoid the confusion, I take the simple approach. Ignore the fictitious SA data and analyze the actual numbers of claims as counted. Extract the trend from the actual data (NSA) and compare the latest week’s actual performance to the trend, to last year, and to the average performance for the week over the prior 10 years. Looking at that graphically it’s easy to see whether the trend is accelerating, decelerating, or about the same. This week’s data is absolutely consistent with the improving trend of the past two years. Last week, the annual rate of change was near the weaker side of the trend. This week it’s near the middle. This is entirely consistent with the normal week to week fluctuations that have occurred since mid 2010.

In the advance report for the week ended July 21, actual claims (NSA) were 341,000 (rounded) including the addition of 4,000 claims to adjust for incomplete state counts that do not include interstate claims at the time of the advance release. This week was better than the week ended July 23, 2011 when new claims totaled 370,000. Total new claims were also better than the average of the last 10 years’ claims for this week of 380,000. Approximately 28,000 (7.6%) fewer people filed first time claims this year than in the same week in 2011.

Seasonal adjustment factors for this week have varied widely. Over the last 10 years, the factor applied to the actual NSA number for this week has ranged from .939 to 1.111. The range of variance was 19%, which is absurd. We’re talking about the same week every year! This week’s factor was 1.047.

Given the actual year to year percentage change in claims versus this week last year, the correct seasonally adjusted claims number should be 371,000. The SA factor should have been 1.088. The difference of .41 is the error in the reported data. Yet, the conomic establishment and the media treat the SA data as if it were real, and then it twists and turns with all kinds of explanations and excuses as to why it was so much better than the consensus estimate. For the past couple of weeks the excuse with the constant huge misses of the consensus estimate has been some absolute nonsense about the timing of auto plant shutdowns. It’s ridiculous. The reason for the constantly missed estimates is that they are based on bad data week in and week out. The whole process of seasonally adjusting volatile weekly data like this is deeply flawed. It’s bogus.

Looking back 10 years, the current week has always shown a huge decline in claims. The current week to week decline was 114,000 (rounded). That compares with a prior 10 year average of -92,000 for the week. Last year claims fell by 101.000, and in 2010 they fell by 89,000 during the same week. By these measures, the current numbers are good. They indicate a continuing downtrend in unemployment.

The net change for the past two weeks was a decline of 101,000. That compares with the prior 10 year average of an decrease of 82,000 for the same 2 week period. Last year, the 2 week decrease was 105,000. Therefore on the basis of the change over 1 and 2 weeks, this year shows some strengthening.

This week’s data shows that the trend is still improving (chart below), but that the rate of improvement may have slowed slightly versus last year. The slope of the year to year line for this week is also declining at a slightly slower rate than the slower 52 week moving average. Such variances are normal.

The annual rate of decrease in new claims continues to oscillate around the -10% axis. The latest data was down by 7.6% which is near the middle of the rate of change over the past 2 years. Anything between a decline of approximately 3% and 20% year to year suggests that the improving trend is on track. So far, the Fed has no reason for additional QE (more in depth analysis in the Professional Edition Fed Report). Only if the rate of decrease drops to less than 2.8%, then the Fed would have greater impetus to move .

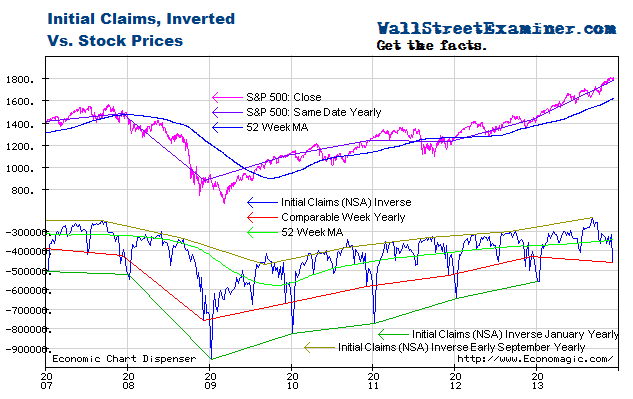

Plotted on an inverse scale, the correlation of the trend of claims with the trend of stock prices over the longer term is strong, while allowing for wide intermediate term swings in stock prices. Both trends are driven by the Fed’s operations with Primary Dealers (covered weekly in the Professional Edition Fed Report; See also The Conomy Game, a free report.) This chart suggests that the as long as this trend in claims is intact, the S&P would be overbought at approximately 1425-50, and oversold at roughly 1200. The market is approaching the overbought parameter. I cover the technical side of the market in the Professional Edition Daily Market Updates.

As the number of workers eligible for unemployment compensation has trended up since 2009, the percentage of workers filing first time claims has continued to decline. Comparing the current week yearly line to the 52 week moving average, the trend of improvement continues to track at a steady rate, just minimally slower than in 2011.

The chart below gives a longer term perspective on claims. The trend has been improving while remaining above the bubble years with their 10 million fake jobs taking orders for new and unneeded condos and houses, building them, permitting and inspecting them, and taking and processing mortgage applications.

Lately, conomists have been arguing about the “natural” unemployment rate. I think we’re at it now. If we recognize that the bubble period with its millions of fake jobs was abnormal, then the low level of claims during those years was also abnormal. Where we are today is probably normal and the expectation that the US will ever get back to 6% unemployment is a false hope.

The problem the conomists have is that they think the bubble rates with their 10 million fake jobs were normal. That was abnormal. Today is normal.

The following chart is a picture of reality versus the the Impressionist art of seasonal adjustments. Sometimes the SA data represents reality to some degree, and sometimes it doesn’t. If you are following only that data, at any given time you have no way of knowing which it is. One thing is certain– it is not photo-realism.

There are ways to measure trends using actual data. One way is shown on this chart, which is to show the year to year line as of the current and corresponding date. Another is to view the annual rate of change as shown in the first chart above.

The arbitrary seasonal adjustment process has raised a couple of false alarms over the past 2 years with big counter trend pops early in the second half of 2010 and in the second quarter last year. But in the July 7 week it gave a false positive reading, which conomists furiously tried to explain away, when the explanation was mundane. The SA data was just wrong.

The trend of the SA data often goes off track for months at a time, giving a false picture. As of the July 21 week, it was still not as strong as the actual trend, giving the overall impression that the improving trend is weaker than it actually is.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.