Courtesy of Pam Martens.

According to news reports yesterday, New York State Attorney General Eric Schneiderman has been cranking out the subpoenas to Wall Street’s largest banks over allegations of an international bank cartel rigging Libor interest rates.

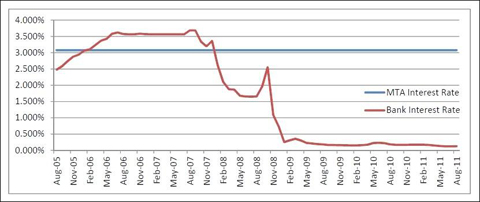

Libor is the benchmark rate used to set many consumer loans, like credit card, student loans, and adjustable rate mortgages. It is also the primary rate used by Wall Street banks in setting rates on interest rate swaps. Both New York State and New York City have a boatload of those deals that are bleeding red ink. (Read how other municipalities around the country are being drained by these deals.)

According to a December 2011 report by Michael Stewart of United NY, JPMorgan Chase is the counterparty to most of the interest rate swaps for New York City; the MTA currently has sixteen active swap agreements with JPMorgan Chase, Citigroup/Citibank, UBS, AIG, Morgan Stanley and Ambac.

Below are just a sampling of the issues from Michael Stewart’s report that Schneiderman is certain to have on his mind:

Since January 2000, the Metropolitan Transportation Authority (MTA) has already paid out a net $658 million to banks under these swap agreements.

…