Wheeee, this is fun!

Wheeee, this is fun!

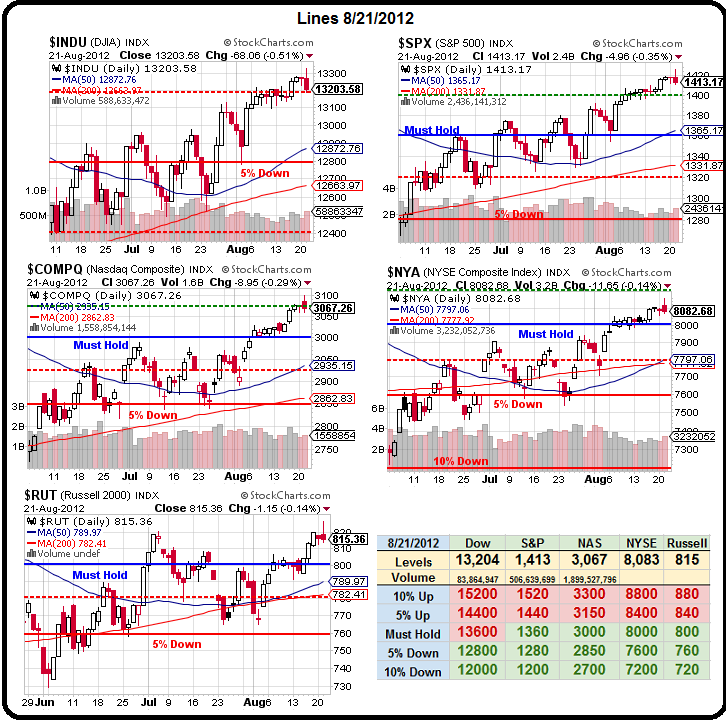

As you can see from our Big Chart, we flopped right back to support lines on the Dow (13,200) and the Nasdaq (3,075) with AAPL dragging the Nasdaq down for a change, all the way to 3,067 but our dollar-adjusted support (at 82.50) was 3,060 so still strong despite the sell-off.

Our other watch levels are Dow 13,464, S&P 1,428, NYSE 8,160 and Russell 816 and the NYSE and the Russell were both over our lines yesterday – morning – briefly – before crashing back down to Earth.

Of course we were EXTREMELY skeptical of the morning rally, something I noted in the morning post as well as my 9:31 chat note, where I urged Members not to let themselves get scared out of position by a currency-driven rally, saying:

Step one before capitulating is getting yourself neutral with the aggressive longs – then you can decide what to cash out and what to press without panicking. Often we have blow-off spikes at the tops and bottoms and this sure feels like one but we'll have to respect our levels if they break over – although I'm tempted to adjust again for this BS 0.5% drop in the Dollar but, so far – we still haven't had one whole day of even holding 3 of 5.

We followed up in Member Chat at 9:57 with aggressively bearish adjustments to our $25,000 Portfolio, which had been up to almost $40,000 on Friday but dropped back to just under $34,000 into the morning rally as we were poised about 70/30 bearish in our short-term positions. Although we did look at another 3 bullish plays that can make us 300% in the morning post – we were not moved to add any of them on that ridiculous morning pump job and we instead took the opportunity to press those bear bets.

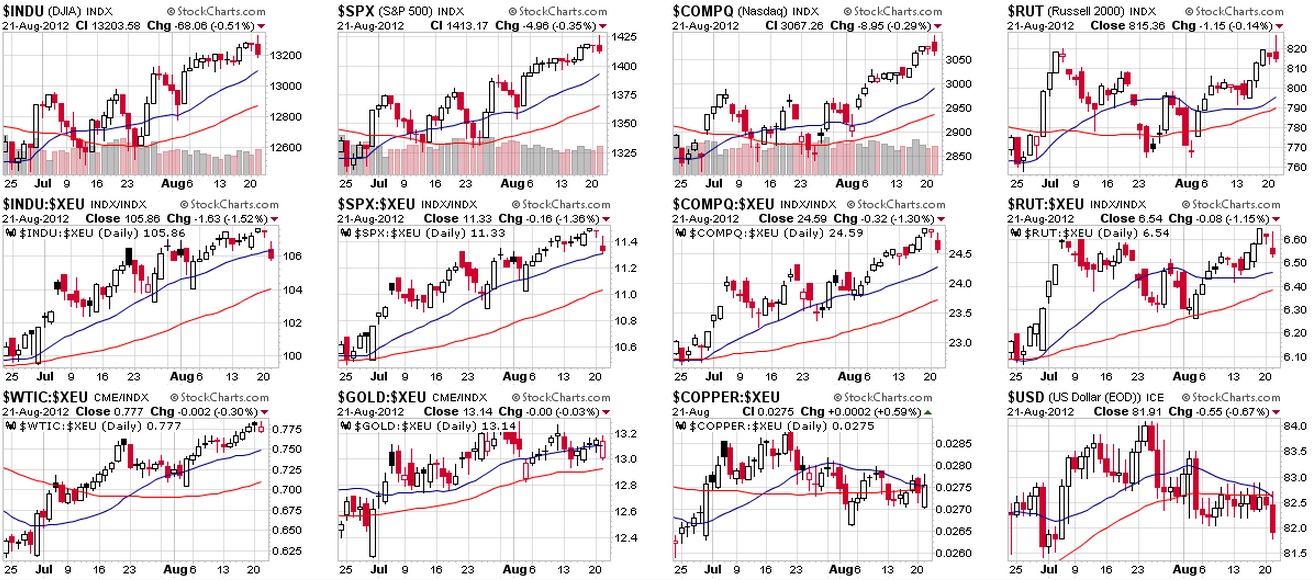

While we may be forced to capitulate if our levels do get broken and hold – the good news is those capitulation points are now so close that it will be a small loss to take if we do have to flip bullish. Also, looking at our index charts priced in Euros gives us some very different views of resistance indicating BIG TROUBLE for our markets if the Euro weakens and the Dollar rebounds:

Any way you slice it – that's a pretty toppy-looking pattern, supported by a 2.5% drop in the Dollar since July 26th and note the effect the rising Dollar had on the markets in the beginning of July – it's deja vu all over again if things start falling apart in Europe – again.

That brings us to our brief overview of the Global Recession that nobody seems to want to talk about:

- Greek PM Samaras says he needs an extension as the country can't hit budget targets – again.

- Spain will miss its targets for budget gaps of 6.3% of GDP this year and 4.5% in 2013 as the nation's recession worsens.

"As budget deficit targets look unachievable, the risk of a potential full bailout of the Spanish economy is still there," Jaime Becerril and Axel J. Finsterbusch, analysts at JPMorgan Chase & Co. in London, wrote in a note. "Further measures must be taken to restore market confidence."

- Japan posts an 8.1% drop in exports and a $6.5Bn trade deficit with exports to the EU down 25.1% and down 11.9% to China.

- BOJ Deputy Governor Nishimura says "China is now entering the danger Zone."

- China's 4 largest banks claim that just 0.56% of their loans are non-performing, possibly 1/10th of the true number – a discrepancy the size of Spain's entire debt.

- Iron ore output in China drops 8.1% in July, the steepest decline since July of 2008.

- Chinese steel prices drop back to 2009 lows on weak demand with profits at steelmakers down 96% from last year.

“The recent collapse in steel and iron ore prices suggests to us that we have reached the point in the cycle where a major destock is required,” Nomura said. “If production is not cut voluntarily, imbalances will continue to build, increasing the risk of a large, involuntary cut in steel production.”

- Rare Earth exports are off 50% from China, with some prices dropping over 80% from last year

- Cotton consumption is also down 11% this year.

“The Chinese economy is only at the beginning of a harsh winter,” Zhang Hongxia, chairman of China’s largest cotton- textile maker, said in an interview in Hong Kong on Aug. 20. “China now is facing a situation where everything from coal to steel inventories are piling up.”

- The US birth rate fell to the lowest level since WWII, cutting into consumption and spending totals and, of course, threatening to destabilize our SS system, which relies on young workers supporting retired ones.

- Mortgage applications fell 7.4% last week, continuing the summer downturn despite record-low rates.

There is, of course, more – but you get the idea. No one disputes that things are bad, what we have in the market is this fairly irrational concept that things are SO BAD that our Central Banksters have no choice but to ride to the rescue and shower us (the top 1%, not you little people) with MORE FREE MONEY that we can use to foreclose on more homes and businesses as the real economy collapses which will set us up to become phenomenally rich(er) when the cycle finally does turn around.

This should not come as a real surprise, it's the same game that has been played by the "job creators" since the Magna Carta was signed and we figured out we can make more money getting the peasants to buy our land from us at the top of the market and then buying it back from them at the bottom of the market than we ever could make by just taxing them.

This should not come as a real surprise, it's the same game that has been played by the "job creators" since the Magna Carta was signed and we figured out we can make more money getting the peasants to buy our land from us at the top of the market and then buying it back from them at the bottom of the market than we ever could make by just taxing them.

Even better, by letting the peasants in the bottom 99% own property, we get to lend them money (even if we have to print it ourselves) to buy our land from us and then charge them interest that causes them to pay $432,000 over 30 years on a $200,000 loan. Should they, at any point during that 30 years, default on their payments – we get our land back and sell it to the next sucker. If too many peasants are making their payments – we crash the markets, put them underwater, take away their jobs, retirement savings, raise the price of necessities – whatever it takes until we push them under and we get our land back!

AFTER that, then we "fix" the economy and re-inflate the property prices so we can create a new batch of wage slaves who are willing to indenture themselves for life in order to get that piece of that "American Dream" we drum into their heads via the various propaganda outlets we control.

As a top 1%'er, giving my market outlook to other top 1%'ers – I think the question we have to ask ourselves is: "Are we done yet?" Don't be confused by the suffering of the masses – they still have more to give us! Housing prices could go lower, unemployment can go higher – no one is revolting yet. While we may be near the end game for this cycle – this isn't it yet. Don't fall for our own hype – the markets are still very dangerous, the economy is still very shaky and we make A LOT more money swooping in and deploying our ample capital after a collapse than chasing a hyped up market now.

The top 1% play a long game – patience is key.