Here we go again (again)!

Here we go again (again)!

Yep, that's what I said last Tuesday and the Tuesday before that because Tuesday is a day they push the Futures higher and ditch the Dollar and tell you that this time it's different because of the same rumors they had the Tuesday before only this week – the data is getting worse and worse, as we know is better, right?

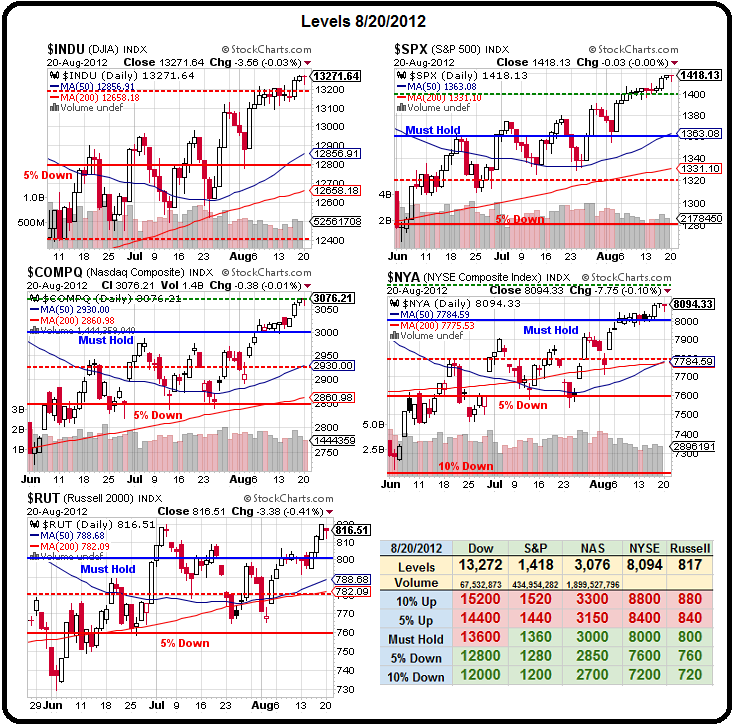

Last Tuesday we set levels to capitulate and go fully bullish at Dow 13,464, S&P 1,428, Nasdaq 3,060, NYSE 8,160 and Russell 816 and, as of yesterday's close we had the Nasdaq and the Russell over their marks needing just one confirmation to make it 3 of 5 and begin to flip our short-term portfolios (the $25KPs) bullish. We are soooo close but, so far – no cigar.

While we waited, we looked at some upside hedges that would do well if the market continued higher. Just as we get downside protection when we're bullish – we use upside protection when we're bearish and I suggested taking 5% or 10% positions in aggressive upside plays to help balance a bearish portfolio against – well against exactly what happened in the past 7 days. Our trade ideas were:

- 2 FAS Oct $105/115 bull call spread at $2, selling 1 BBY 2014 $18 puts for $3.25 for net .75, now $1.15 – up 53%

- 2014 SHLD $32.50 puts sold for $7.50, now $6.40 – up 15%

- 6 EWJ Jan $9 calls at .53, selling 1 BBY 2014 $18 put at $3.25 for a net .07 credit, still net .07 credit – even

- TNA Oct $55/61 bull call spread at $2.50, selling Oct $42 puts for $1.90 for net .60, now $1.80 – up 200%

The BBY puts jumped over 20% yesterday, from below $3 to $3.75 and that killed two of our trades (and worse today after earnings!), that were up significantly in Friday's update (which is why we take quick gains like that off the table). The good news is the EWJ play gives us a nice, new entry at the same net price so that one is still good and, of course, we are done with TNA after making 200% in a week and we'll find a fresh horse for that money.

The BBY puts jumped over 20% yesterday, from below $3 to $3.75 and that killed two of our trades (and worse today after earnings!), that were up significantly in Friday's update (which is why we take quick gains like that off the table). The good news is the EWJ play gives us a nice, new entry at the same net price so that one is still good and, of course, we are done with TNA after making 200% in a week and we'll find a fresh horse for that money.

Speaking of fresh horses – for our offsetting short puts today – let's take a look at our Twice in a Lifetime List, which were 16 blue-chip stocks we picked into the May market collapse that were approaching their 2009 panic lows.

BAC, for example, was $6.97 at the time and our trade idea was to sell the 2014 $7 puts for $1.75 each for a net $5.25 entry. BAC is now trading back at $8.15 and the 2014 $7 puts have dropped to $1.05 – up 40%. CCJ 2014 $17 puts were sold for $3.30 and are already down to $1.75 for a nice 47% gain, CHK is no surprise to people who heard me banging the table on them and, at the time, they were trading at a ridiculous $13.83 and we were able to aggressively sell the 2014 $13 puts for a whopping $5 (isn't panic great?) and those puts are already down to $2.15 with the stock back at $19.40 (up 57%). FTR is another one Members got sick of hearing me make bullish calls on and they were still $3.20 at the time (now $4.65) and the 2014 $3.50 puts (very aggressive sale) that sold for $1.30 are now .55 (up 54%).

While the list was generally like shooting fish in a barrel for our Members – the above trades are what we call "tired horses" that have already had a good run. We can ride them the next 17 months to the finish but, when you make 50% in 3 months and then have to wait 17 months for the next 50% – the thrill is kind of gone – don't you think?

While the list was generally like shooting fish in a barrel for our Members – the above trades are what we call "tired horses" that have already had a good run. We can ride them the next 17 months to the finish but, when you make 50% in 3 months and then have to wait 17 months for the next 50% – the thrill is kind of gone – don't you think?

Fortunately, we did have a few stocks on our list that are still pretty cheap but, the big question is – do we still believe in them?

- The ALU ($1.20) 2014 $2 puts are still $1 and we do like ALU long-term and this is a net $1 entry on the stock.

- BTU ($22.82) 2014 $20 puts are now $3.60 (up just 12% from our $4.10 entry) and, if you believe in China (or the Koch brothers), then coal still has a future.

- HPQ ($20.10) is down about 10% from our original pick ($22.04, now $20.20) and the 2014 $23 puts are one of two losers on our list as they have gone up from $5 to $5.65 (down 13%). While I still like that target for HPQ, now you can sell the 2014 $20 puts for $3.80 and that's net $16.20 vs net $17.35 on the other sale so it depends what you think you will be comfortable with as an entry if things go downhill.

- SVU ($2.30) is our other loser and our biggest with the 2014 $5 puts jumping from $1.85 to $3.10 (down 40%). Our play was to roll them down to 2x the $3 puts at $1.50 for a net $2.12 entry on 2x with SVU now at $2.30 so no real tragedy and we do still like selling the 2014 $2.50 puts for $1.10 as that's a net $1.40 entry, which is a 39% discount to the current stock price.

- X ($22.66) 2014 $20 puts are up 20% from our $5 entry at $4 but gosh, I still like them! Even better are the 2014 $18 puts at $3.10 for a net $14.90 entry if put to you, which is 34% below the current price.

As we like to teach our Members, if you take your initial entries into stocks at 34% below the current price – you stand an excellent chance of staying ahead of the market AND you have a built-in cushion to fend off all but the worst market corrections.

As we like to teach our Members, if you take your initial entries into stocks at 34% below the current price – you stand an excellent chance of staying ahead of the market AND you have a built-in cushion to fend off all but the worst market corrections.

BEFORE we talk about making money in a breakout rally – it's important to make it clear that I still do not believe in this rally at all. IF we get stimulus, THEN I will believe for the 6-12 months it will last us but, until there is actual money on the table from the EU and the Fed – this "rally" is nothing but a house of cards that a breeze (or a negative statement) can blow right over. In fact, this morning I sent out a special pre-market Alert to Members at 5:46 am where we decided to short the Futures on Oil (/CL) at $97, Gold (/YG) at $1,627 and the Nasdaq (/NQ) at 2,786 so those are aggressively short day-trades as we're not buying the morning pump job. We got a quick dip but now we're waiting to see if those levels cross again (note Dave Fry's chart) – and we'd like to see the Dollar get back over 82.20 (now 82.10).

Our short-term portfolios are still very bearish and down 6% for the week as we hang on until that 3rd level finally breaks (and holds for a full day) while our long-term Income Portfolio remains very bullish. Of course, to some extent, it's prudent to have a small, aggressive, short-term $25,000 Portfolio act more bearish when it's protecting a bullish $500,000 Portfolio that's poised bullish but most of our Income Portfolio positions are the same kind of long-term short puts as we had on our Twice in a Lifetime List and they don't need a whole lot of protection – just time to mature. Now, for the upside trade ideas:

Our short-term portfolios are still very bearish and down 6% for the week as we hang on until that 3rd level finally breaks (and holds for a full day) while our long-term Income Portfolio remains very bullish. Of course, to some extent, it's prudent to have a small, aggressive, short-term $25,000 Portfolio act more bearish when it's protecting a bullish $500,000 Portfolio that's poised bullish but most of our Income Portfolio positions are the same kind of long-term short puts as we had on our Twice in a Lifetime List and they don't need a whole lot of protection – just time to mature. Now, for the upside trade ideas:

- FAS is still my favorite long. Look how well our last FAS play did and all XLF did was move up .20. We're looking for $16.50 on any kind of stimulus/bailout news and that's up 8.5% from here on XLF and that should pop FAS about 25%, from $96 to $120 and we can still pick up the Oct $107/117 bull call spread for $2.05 and offset 2 of those ($4.10) with the sale of one BBY 2014 $15 puts at $3.75 for a net .35 entry on $20 worth of spreads. That's a potential upside of 5,614% if we hit our targets – that can certainly take the sting out of losing a few bearish bets!

- I said last week I did not like gold but silver had possibilities. AGQ is is an ultra-ETF that tracks silver at 2x the move and silver may beak over $29 and has a clear shot to $31 if it does and that's going to be good enough to take AGQ up to $45 but we're betting on QE and a big rally so how about the Oct $38/45 bull call spread at $3.10, which can be nicely offset by another materials position in BTU, selling the 2014 $20 puts for $3.60, which is a net .50 credit on the $8 spread for a very nice 4,100% return if both sides hit their target and the worst case here is we end up owning BTU at net $19.50, which is another 14% off from here.

- If we are going to break up from here, the Dow has a bit of catching up to do. DIA follows the Dow and is now $132.38 and the Oct $135 calls are just $1.35 and we can buy 3 of those for $4.05 and sell just one (per unit) HPQ (a Dow component) 2014 $20 put for $3.80 for a net .25 with no limit to the upside Dr. Bernanke and Mr. Draghi can give us in September. Dow 13,600 is only 2% away and, while 13,600 seems ridiculously overvalued to us – that's just our brain talking and we'll have to stop listening to that long before we get that high…. A 5% move up in the Dow to 13,933 (so ridiculous to write that down!) would make those 3 calls worth about $12 on the net .25 investment so, if the HPQ puts also expire worthless, we're looking at a gain on cash of 4,800%.

Don't forget, our goal on these trades is to make 300% and move on and if, like the last batch, we make over 100% in less than a week – that's also a good reason to take them off the table. We are NOT bullish yet, these are hedges to our bearish positions but, like any good boy scouts – we do like to be prepared.