Pavlov's Dogs In The Stock Market

Courtesy of Karl Denninger, The Market Ticker

Courtesy of Karl Denninger, The Market Ticker

Today's rally can be "blamed" on the letter "released" (in a timely fashion) by Bernanke to Mr. Issa, and which was "conveniently" leaked to the WSJ.

I warned last night in my video (available to gold donors on my forum) that on short time-frames were were quite oversold and as such expecting a further big sell-down after the last two days' losses was a dangerous game to be playing. The Fed has a long and storied history of waiting for such conditions to release information that says nothing but sends bears running for the door, spiking markets.

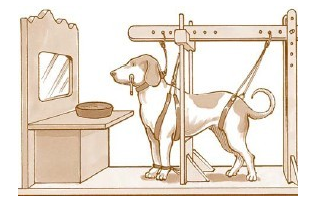

That such a gambit was inbound and was almost-certainly leaked to certain special insiders was also rather clear from other patterns. Specifically, the sell-off had a well-below normal TRIN the last couple of days for market conditions and in addition there's simply no big "fear position" in the VIX, in the internals, or for that matter in the A/D line. This morning on the little dump early on I bought it — I can play the Pavlov game too, but I'm not crazy enough to do anything other than make short-term plays on that predicate in such a so-called "market."

Of course all of this movement and response might be nothing more than the Pavlovian response — any time there's a dip one should accumulate into it, because Bernanke will come save the day.

Maybe.

Given our utter refusal to enforce anything approaching "the law" when it comes to big banks, however, my assumption is that I'm being traded against by people with inside information who will never be prosecuted for doing so.

This sort of casino mentality is nothing new. What's ugly, however, is that this is all the market is trading on nowdays.

There's been no material improvement in employment.

There is no grand new paradigm shift in the economy taking place that grossly boosts productivity.

There is no innovative new product or service that will drive broad-based gains in people's standard of living.

There has been no material drawdown in total systemic debt, and federal deficits haven't come in materially at all.

There are only two ways for equity (and other asset) prices to advance — either the common weal advances materially or there is more debt-based leverage added to the system.

One is good, the other disastrous as while the former is sustainable the latter never is.

And unfortunately the latter is all there is.

It's been a good ride and I'm making some nice money on long-side turnaround stories, including Sprint and Nokia. But those are beaten-into-the-dirt, still-have-a-business despite being written-off-for-dead companies.

When I look at the so-called "leaders" such as Amazon and Apple, what I see is a business model that either produces ridiculous P/Es and thin margins or worse, a fad-based business model predicated on margins that are sustainable only as long as people can keep refinancing their house and pulling out equity to blow on toys.

That set of predicates went kaboom four years ago.

Bernanke's hall of mirrors appears to be singularly focused on keeping the last mirage of "prosperity" — the equity markets — pumped up and "alive."

He will fail because the longer this continues the less bang he gets for each of his QE'd bucks.

We're in trouble folks, despite the S&P poking around 1,400.