America is screwed!

America is screwed!

That's what I learned watching the GOP convention last night. About 5 minutes into Paul Ryan's speech I had to go outside to check to see if my neighborhood was in flames but, apparently, the seniors in my town haven't yet started rioting for their Medicare (which Ryan claims he's trying to protect) funds that Obama is stealing.

Well, saving, stealing – same thing, right?

As Romney's pollster, Neil Newhouse said on ABC yesterday – "We're not going to let our campaign be dictated by fact-checkers." and that was the perfect prelude to the BS festival that was held yesterday at the GOP convention.

“Right there at that plant, candidate Obama said: ‘I believe that if our government is there to support you … this plant will be here for another hundred years.’ That’s what he said in 2008. Well, as it turned out, that plant didn’t last another year. It is locked up and empty to this day.” – Ryan

OK folks, this isn't a guy misspeaking, this is what Paul Ryan, Mitt Romney and 20 of the country's best speechwriters (well, best Conservative speech-writers – which is, I admit, a terrible mental handicap to overcome) decided to say to America in THE most important speech of their lives. Opening with suck a blatant lie pretty much sets the tone for this campaign, don't you think? Obama was not at the plant October of 2008, it was February, he did not say anything of the sort AND the plant closed in December of 2008 – NOT when Obama was President.

OK folks, this isn't a guy misspeaking, this is what Paul Ryan, Mitt Romney and 20 of the country's best speechwriters (well, best Conservative speech-writers – which is, I admit, a terrible mental handicap to overcome) decided to say to America in THE most important speech of their lives. Opening with suck a blatant lie pretty much sets the tone for this campaign, don't you think? Obama was not at the plant October of 2008, it was February, he did not say anything of the sort AND the plant closed in December of 2008 – NOT when Obama was President.

Interestingly, Ryan test-drove this statement on August 16th in Ohio and was blasted for it by fact-checkers at the time but, as Nazi propagandist Joseph Goebbels used to say: "If you tell a lie big enough and keep repeating it, people will eventually come to believe it." It's nice to see the GOP embracing the classics. Goebbels said: “The most brilliant propagandist technique will yield no success unless one fundamental principle is borne in mind constantly – it must confine itself to a few points and repeat them over and over” like "Drill Baby Drill," "Job Creators" or "Obamacare."

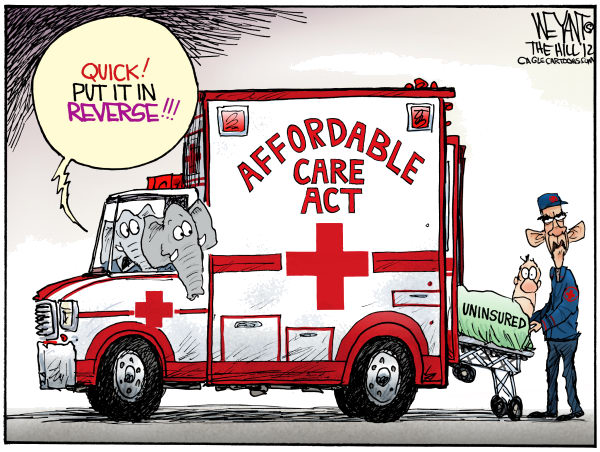

Ryan slammed the president for not supporting a deficit commission report the same one that he himself, as a member of the committee, had voted against – killing it. He also made a cornerstone of his argument the claim that Obama "funneled" $716 billion out of Medicare to pay for Obamacare. But he didn't mention that his own budget plan relies on those very same savings or that Obama's plan SAVES the $716Bn (over 10 years) through the Affordable Care Act while Ryan's plan uses the same money Obama is SAVING to give tax breaks to people who earn over $250,000 a year while killing the Affordable Care Act (job 1 for Romney/Ryan apparently) – truly leaving Medicare recipients with nothing to fall back on.

Ryan slammed the president for not supporting a deficit commission report the same one that he himself, as a member of the committee, had voted against – killing it. He also made a cornerstone of his argument the claim that Obama "funneled" $716 billion out of Medicare to pay for Obamacare. But he didn't mention that his own budget plan relies on those very same savings or that Obama's plan SAVES the $716Bn (over 10 years) through the Affordable Care Act while Ryan's plan uses the same money Obama is SAVING to give tax breaks to people who earn over $250,000 a year while killing the Affordable Care Act (job 1 for Romney/Ryan apparently) – truly leaving Medicare recipients with nothing to fall back on.

Ryan also put responsibility for Standard & Poor's downgrade of U.S. government debt at Obama's doorstep. But he didn't mention that S&P itself, in explaining its downgrade, referred to the debt ceiling standoff. That process of raising the debt ceiling was only politicized in the last Congress, driven by House Republicans, led in the charge by – Paul Ryan. The credit rater also said it worried that Republicans would never agree to tax increases. “We have changed our assumption on [revenue] because the majority of Republicans in Congress continue to resist any measure that would raise revenues,” S&P wrote.

I really liked the touching story of how Paul Ryan's mother used, as did her son, Paul Senior's Social Security death benefits and ongoing checks to attend a state-funded college and, as Paul says, his mom took the public transportation every day to go 40 miles back and forth to Madison, where there were better opportunities, because they couldn't afford a car, but her business in Madison became a success AND THEY DID IT WITHOUT ANY GOVERNMENT HELP! How does the guy even stand there and say things like that? Does he not understand what he's saying or does he not care?

Needless to say, this was not a market booster and Asia was down 1% last night and Europe is down another half a point this morning and the US futures are down about half a point as we all wait to see if Mitt can inspire us this evening. Of course it's Ben Bernanke that really needs to come through tomorrow morning, as he delivers his opening remarks at the Fed's Jackson Hole conference. Whatever Chairman Bernanke is planning to do – he'd better do it quick because Romney has vowed to remove him from his post so the clock is ticking.

Needless to say, this was not a market booster and Asia was down 1% last night and Europe is down another half a point this morning and the US futures are down about half a point as we all wait to see if Mitt can inspire us this evening. Of course it's Ben Bernanke that really needs to come through tomorrow morning, as he delivers his opening remarks at the Fed's Jackson Hole conference. Whatever Chairman Bernanke is planning to do – he'd better do it quick because Romney has vowed to remove him from his post so the clock is ticking.

Those waiting for Draghi to save us may be disappointed as well. "The ECB can't unpack the big bazooka. It doesn't have such a mandate," says Lars Feld, an economic adviser to Angela Merkel. He instead expects the central bank to buy peripheral debt "bit by bit," but not have much impact on bond yields.

Copper jumped 2% off yesterday's low and is now (9:05) testing the $3.50 mark and that's an excellent spot to take a short position in the Futures (/HG). We went long on the Russell (/TF) off the 810 line and the S&P (/ES) off the 1,400 line earlier this morning but we already got a nice pop and made our Egg McMuffin money and we're not long into the open but we will be watching those lines very closely to see if they hold up.

Oil should hold $95 into the Natural Gas Inventories at 10:30 but, unless there is a big draw, it's doubtful they hold it. Unfortunately, it's too close to the weekend and then next week's very bullish inventory report (because production is shut down and the shipping channels are blocked from the storm) so it's a little too dangerous to take chances in the Petroleum pits today.

Personal Spending was up a disappointing 0.3%, matching the Growth in Personal Income but, adjusting for inflation – both were a zero. Nonetheless, retail numbers are coming in strong as back to school shopping kicks in and, of course, last month's comps were TERRIBLE but we ignored them because Ben was going to give us Trillions of Dollar tomorrow – I can't wait – it's like Christmas!