Courtesy of Lee Adler of the Wall Street Examiner

This report is an excerpt from the permanent employment charts page, which is updated whenever new data becomes available.

The Labor Department reported Thursday that seasonally adjusted (SA) first time claims for unemployment were unchanged at 374,000 in the advance report for the week ended August 25 after an upward revision of 2,000 for the previous week. That missed the consensus estimate of 370,000.

Actual claims, Not Seasonally Adjusted (NSA-the actual total of individual state counts submitted to the Department of Labor) were 311,000 (rounded) including the addition of 1,500 claims to adjust for incomplete state counts that do not include interstate claims at the time of the advance release. This week was better than the week ended August 27, 2011 when new claims totaled 337,000. The current week was also better than the average of the last 10 years’ claims for this week of 320,000. Approximately 25,000 (7.5%) fewer people filed first time claims this year than in the same week in 2011. On a week to week basis, claims were essentially unchanged, falling by less than 1,000.

To avoid the confusion inherent in the fictitious SA data, I ignore it and analyze the actual numbers of claims filed that week as counted by the 50 states and submitted to the Department of Labor. It is a simple matter to extract the trend from the actual data (NSA) and compare the latest week’s actual performance to the trend, to last year, and to the average performance for the week over the prior 10 years. It’s easy to see graphically whether the trend is accelerating, decelerating, or about the same. This week it’s about the same.

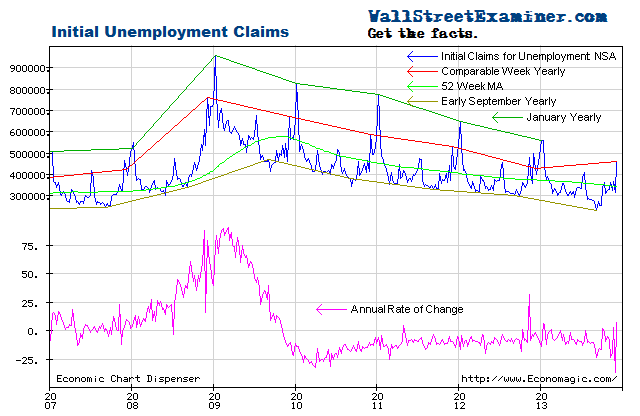

This week’s data continues to be consistent with the improving trend of the past two years. It is entirely consistent with the normal weekly fluctuations in the rate of change from -3% to -20% that have occurred since mid 2010. Since mid 2011, in most weeks the annual rate of change has been within a couple of percent of -10%. The trend has been remarkably consistent.

Looking back 10 years, the current week has consistently shown little change in claims, with small increases in some years and small declines in others. The current week to week change was probably a decline of several hundred, depending on how close my adjusted figure is to the final number to be reported next week. That compares with a prior 10 year average of an increase of a few hundred for the week. Last year claims fell by 8,000. That was an outlier compared to the 10 year period. In 2010 when the economy was rebounding from the worst part of the recession, they fell by 1,800 during the same week. The current numbers are not as strong as the past 2 years, but consistent with or slightly better than the 10 year average. It is not a great number but it is consistent with the trend.

As plotted on a chart, this week’s data shows that the trend is still improving (chart below). The rate of improvement is slightly slower than from August 2010 to August 2011, but the slope of the year to year line for this week is declining at approximately the same rate than the slower 52 week moving average, suggesting no shift in the rate of change over the past year.

The consistency is clear in the annual rate of change graph. The rate of decrease in new claims continues to hover near the -10% axis. The current year to year decline of 7.5% remains near the middle of the range of the rate of change over the past 2 years. So far, the Fed has no reason for additional QE (more in depth analysis in the Professional Edition Fed Report). Only if the rate of decrease shrinks to less than 2.8% would the Fed have greater impetus to move.

As the number of workers eligible for unemployment compensation has trended up since 2009, the percentage of workers filing first time claims has continued to decline. Comparing the yearly line for the current week to the 52 week moving average, the trend of improvement continues to track at a steady rate. The current level is near the level of 2004, the last non-bubble, “normal” year. By this standard, the current level of claims is “normal.”

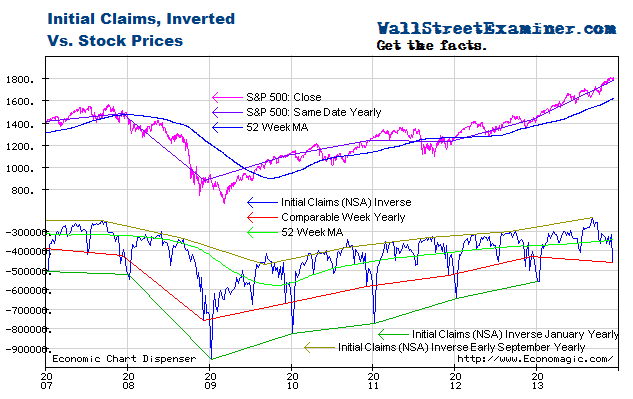

Plotted on an inverse scale, the correlation of the trend of claims with the trend of stock prices over the longer term is strong, while allowing for wide intermediate term swings in stock prices. Both trends are largely driven by the Fed’s operations with Primary Dealers (covered weekly in the Professional Edition Fed Report; See also The Conomy Game, a free report.) This chart suggests that as long as this trend in claims is intact, the S&P would be overbought at approximately 1450, and oversold at roughly 1200. The market got very close to the overbought parameter over the past couple of weeks. Barring a much stronger improvement in the claims data, the market will be at greater risk of a correction in the next few months. [I cover the technical side of the market in the Professional Edition Daily Market Updates.]

For long term charts and other measures of initial claims and other employment measures visit the permanent Employment Charts page, updated whenever new data becomes available.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.